dLocal Results Presentation Deck

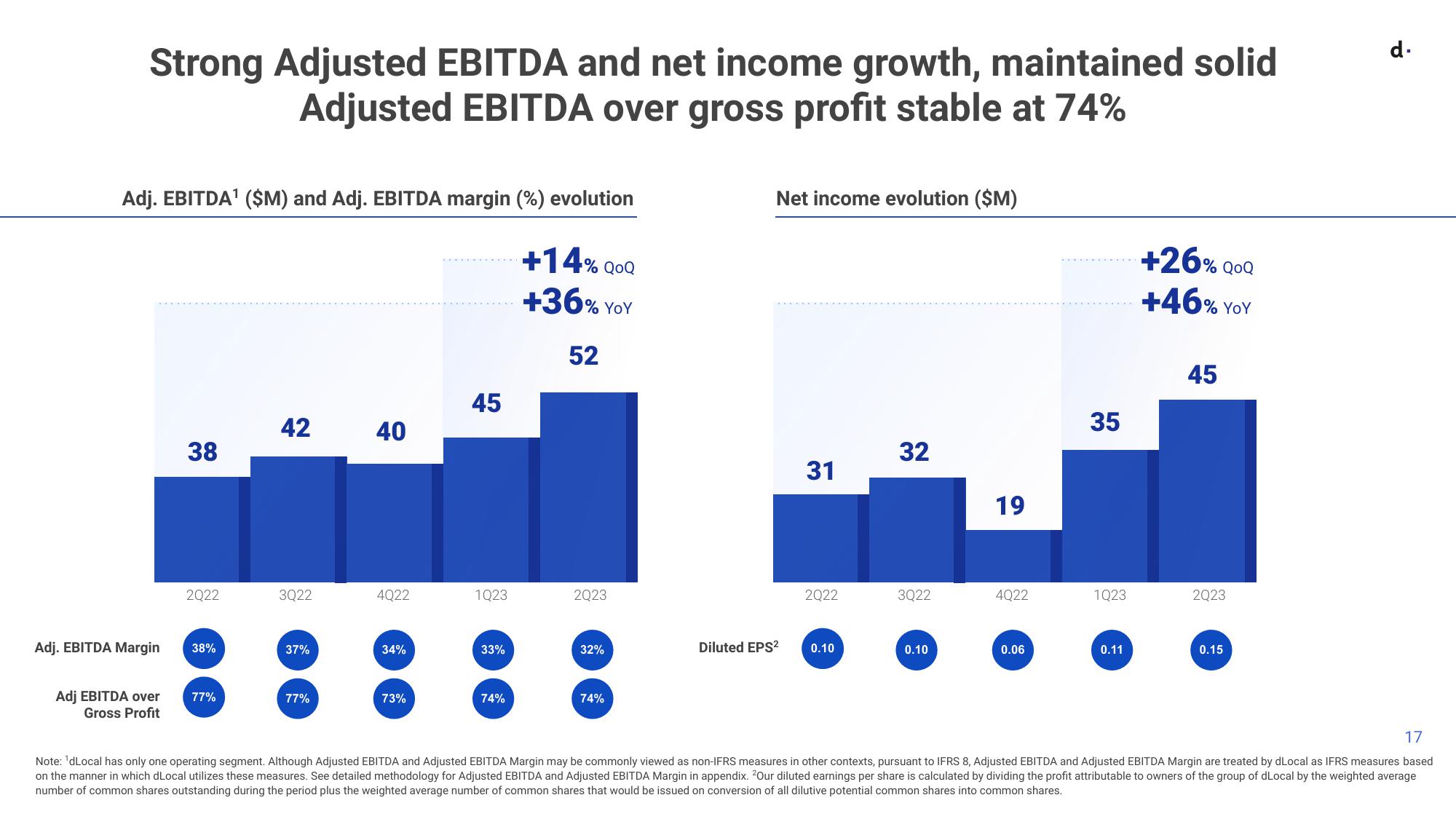

Strong Adjusted EBITDA and net income growth, maintained solid

Adjusted EBITDA over gross profit stable at 74%

Adj. EBITDA¹ ($M) and Adj. EBITDA margin (%) evolution

Adj. EBITDA Margin

Adj EBITDA over

Gross Profit

38

2Q22

38%

77%

42

3Q22

37%

77%

40

4022

34%

73%

45

1Q23

33%

74%

+14% QOQ

+36% YOY

52

2023

32%

74%

Net income evolution ($M)

31

2Q22

Diluted EPS² 0.10

32

3Q22

0.10

19

4Q22

0.06

35

1Q23

0.11

+26% QOQ

+46% YOY

45

2Q23

0.15

d.

17

Note: 'dLocal has only one operating segment. Although Adjusted EBITDA and Adjusted EBITDA Margin may be commonly viewed as non-IFRS measures in other contexts, pursuant to IFRS 8, Adjusted EBITDA and Adjusted EBITDA Margin are treated by dLocal as IFRS measures based

on the manner in which dLocal utilizes these measures. See detailed methodology for Adjusted EBITDA and Adjusted EBITDA Margin in appendix. 2Our diluted earnings per share is calculated by dividing the profit attributable to owners of the group of dLocal by the weighted average

number of common shares outstanding during the period plus the weighted average number of common shares that would be issued on conversion of all dilutive potential common shares into common shares.View entire presentation