Stem SPAC Presentation Deck

stem Operational Benchmarking

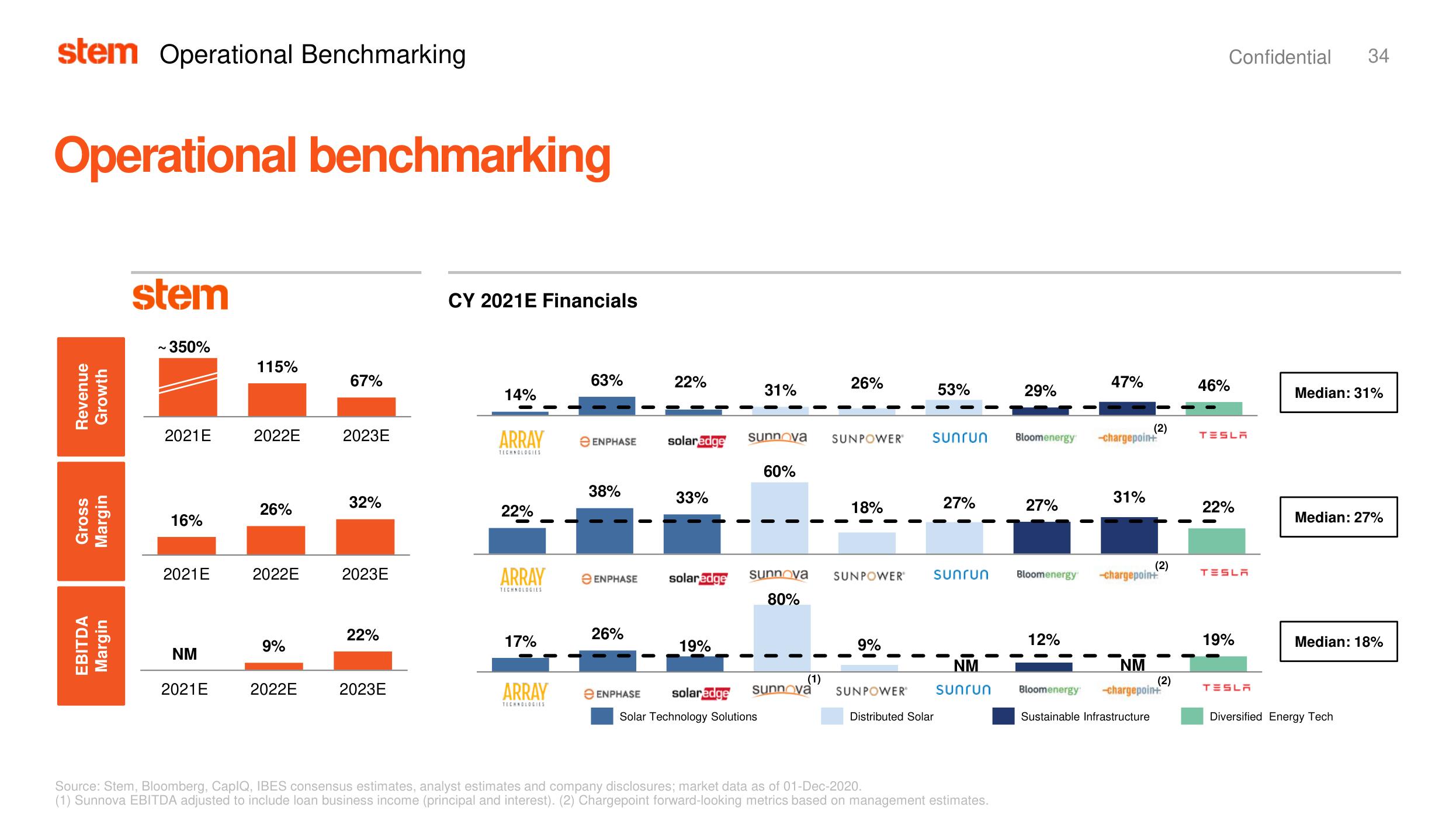

Operational benchmarking

Revenue

Growth

Gross

Margin

EBITDA

Margin

stem

~ 350%

2021E

16%

2021 E

NM

2021E

115%

2022E

26%

2022E

9%

2022E

67%

2023E

32%

2023E

22%

2023E

CY 2021E Financials

14%

ARRAY

TECHNOLOGIES

22%

ARRAY

TECHNOLOGIES

17%

ARRAY

TECHNOLOGIES

63%

e ENPHASE

38%

22%

26%

solaredge

33%

e ENPHASE solaredge

19%

31%

sunnova

solaredge

e ENPHASE

Solar Technology Solutions

60%

sunnova

80%

(1)

sunnova

26%

SUNPOWER®

18%

SUNPOWER

9%

53%

SUNPOWER®

Distributed Solar

27%

sunrun

sunrun Bloomenergy -chargepoin+

NM

sunrun

29%

Source: Stem, Bloomberg, CapIQ, IBES consensus estimates, analyst estimates and company disclosures; market data as of 01-Dec-2020.

(1) Sunnova EBITDA adjusted to include loan business income (principal and interest). (2) Chargepoint forward-looking metrics based on management estimates.

27%

47%

12%

(2)

31%

(2)

Bloomenergy -chargepoint

NM

Bloomenergy -chargepoin+

Sustainable Infrastructure

(2)

46%

Confidential 34

TESLA

22%

TESLA

19%

TESLA

Median: 31%

Median: 27%

Median: 18%

Diversified Energy TechView entire presentation