Cheesecake Factory Investor Presentation Deck

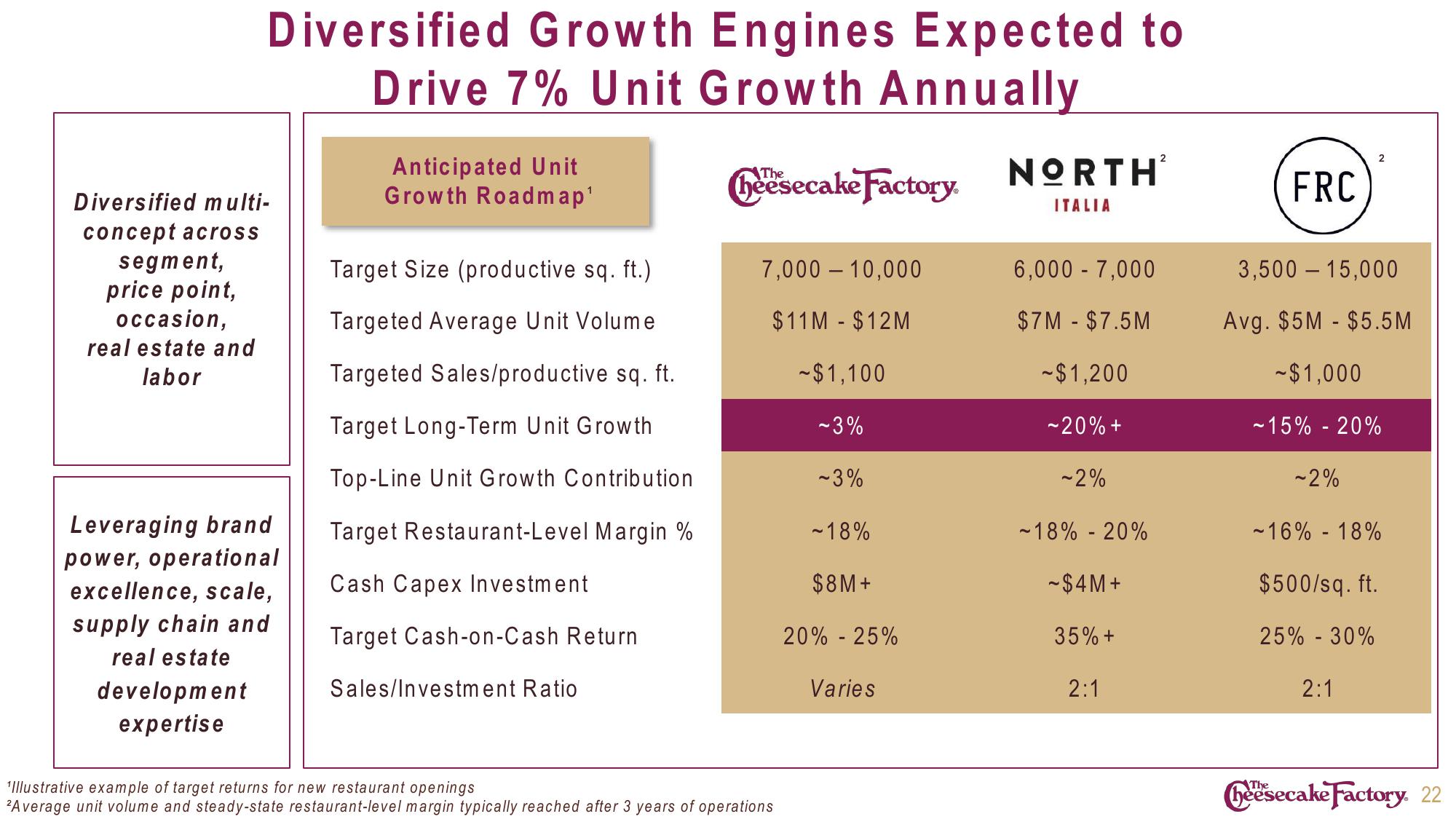

Diversified Growth Engines Expected to

Drive 7% Unit Growth Annually

Diversified multi-

concept across

segment,

price point,

occasion,

real estate and

labor

Leveraging brand

power, operational

excellence, scale,

supply chain and

real estate

development

expertise

Anticipated Unit

Growth Roadmap¹

Target Size (productive sq. ft.)

Targeted Average Unit Volume

Targeted Sales/productive sq. ft.

Target Long-Term Unit Growth

Top-Line Unit Growth Contribution

Target Restaurant-Level Margin %

Cash Capex Investment

Target Cash-on-Cash Return

Sales/Investment Ratio

heesecake Factory.

7,000 - 10,000

$11M - $12M

~$1,100

~3%

'Illustrative example of target returns for new restaurant openings

²Average unit volume and steady-state restaurant-level margin typically reached after 3 years of operations

-3%

~ 18%

$8M+

20% - 25%

Varies

NORTH

ITALIA

6,000 - 7,000

$7M - $7.5M

- $1,200

~20% +

~2%

-18% - 20%

~$4M+

35% +

2:1

FRC

2

3,500 - 15,000

Avg. $5M - $5.5M

~$1,000

-15% - 20%

~2%

-16% - 18%

$500/sq. ft.

25% - 30%

2:1

Cheesecake Factory. 22View entire presentation