TPG Results Presentation Deck

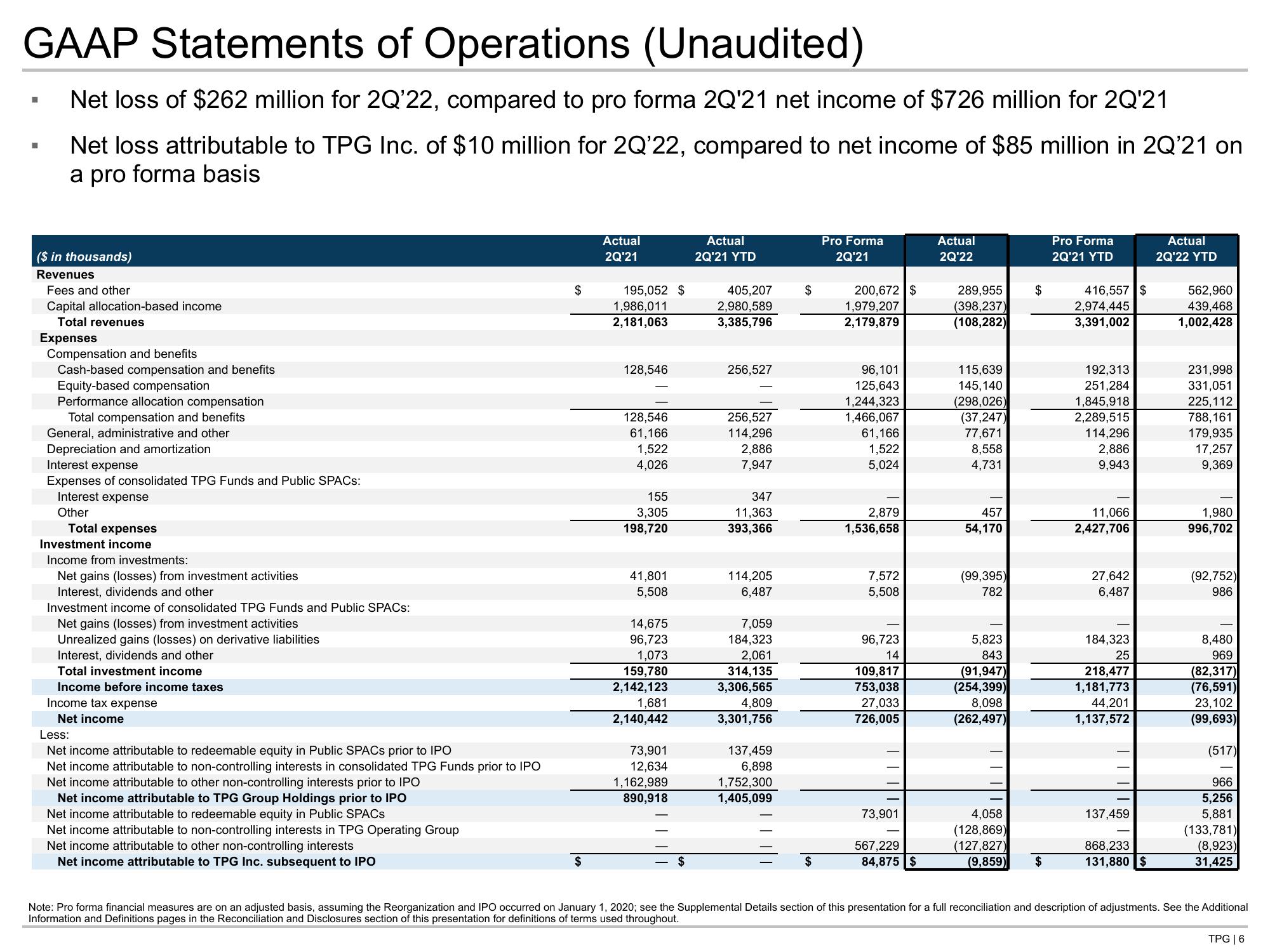

GAAP Statements of Operations (Unaudited)

Net loss of $262 million for 2Q'22, compared to pro forma 2Q'21 net income of $726 million for 2Q'21

Net loss attributable to TPG Inc. of $10 million for 2Q'22, compared to net income of $85 million in 2Q'21 on

a pro forma basis

■

■

($ in thousands)

Revenues

Fees and other

Capital allocation-based income

Total revenues

Expenses

Compensation and benefits

Cash-based compensation and benefits

Equity-based compensation

Performance allocation compensation

Total compensation and benefits

General, administrative and other

Depreciation and amortization

Interest expense

Expenses of consolidated TPG Funds and Public SPACs:

Interest expense

Other

Total expenses

Investment income

Income from investments:

Net gains (losses) from investment activities

Interest, dividends and other

Investment income of consolidated TPG Funds and Public SPACs:

Net gains (losses) from investment activities

Unrealized gains (losses) on derivative liabilities

Interest, dividends and other

Total investment income

Income before income taxes

Income tax expense

Net income

Less:

Net income attributable to redeemable equity in Public SPACs prior to IPO

Net income attributable to non-controlling interests in consolidated TPG Funds prior to IPO

Net income attributable to other non-controlling interests prior to IPO

Net income attributable to TPG Group Holdings prior to IPO

Net income attributable to redeemable equity in Public SPACS

Net income attributable to non-controlling interests in TPG Operating Group

Net income attributable to other non-controlling interests

Net income attributable to TPG Inc. subsequent to IPO

$

$

Actual

2Q'21

195,052 $

1,986,011

2,181,063

128,546

128,546

61,166

1,522

4,026

155

3,305

198,720

41,801

5,508

14,675

96,723

1,073

159,780

2,142,123

1,681

2,140,442

73,901

12,634

1,162,989

890,918

Actual

2Q'21 YTD

405,207

2,980,589

3,385,796

256,527

256,527

114,296

2,886

7,947

347

11,363

393,366

114,205

6,487

7,059

184,323

2,061

314,135

3,306,565

4,809

3,301,756

137,459

6,898

1,752,300

1,405,099

$

Pro Forma

2Q'21

200,672 $

1,979,207

2,179,879

96,101

125,643

1,244,323

1,466,067

61,166

1,522

5,024

2,879

1,536,658

7,572

5,508

96,723

14

109,817

753,038

27,033

726,005

73,901

567,229

84,875 $

Actual

2Q'22

289,955

(398,237)

(108,282)

115,639

145, 140

(298,026)

(37,247)

77,671

8,558

4,731

457

54,170

(99,395)

782

5,823

843

(91,947)

(254,399)

8,098

(262,497)

$

4,058

(128,869)

(127,827)

(9,859) $

Pro Forma

2Q'21 YTD

416,557 $

2,974,445

3,391,002

192,313

251,284

1,845,918

2,289,515

114,296

2,886

9,943

11,066

2,427,706

27,642

6,487

184,323

25

218,477

1,181,773

44,201

1,137,572

137,459

868,233

131,880 $

Actual

2Q'22 YTD

562,960

439,468

1,002,428

231,998

331,051

225,112

788,161

179,935

17,257

9,369

1,980

996,702

(92,752)

986

8,480

969

(82,317)

(76,591)

23,102

(99,693)

(517)

966

5,256

5,881

(133,781)

(8,923)

31,425

Note: Pro forma financial measures are on an adjusted basis, assuming the Reorganization and IPO occurred on January 1, 2020; see the Supplemental Details section of this presentation for a full reconciliation and description of adjustments. See the Additional

Information and Definitions pages in the Reconciliation and Disclosures section of this presentation for definitions of terms used throughout.

TPG | 6View entire presentation