Nerdy Investor Presentation Deck

1.

2.

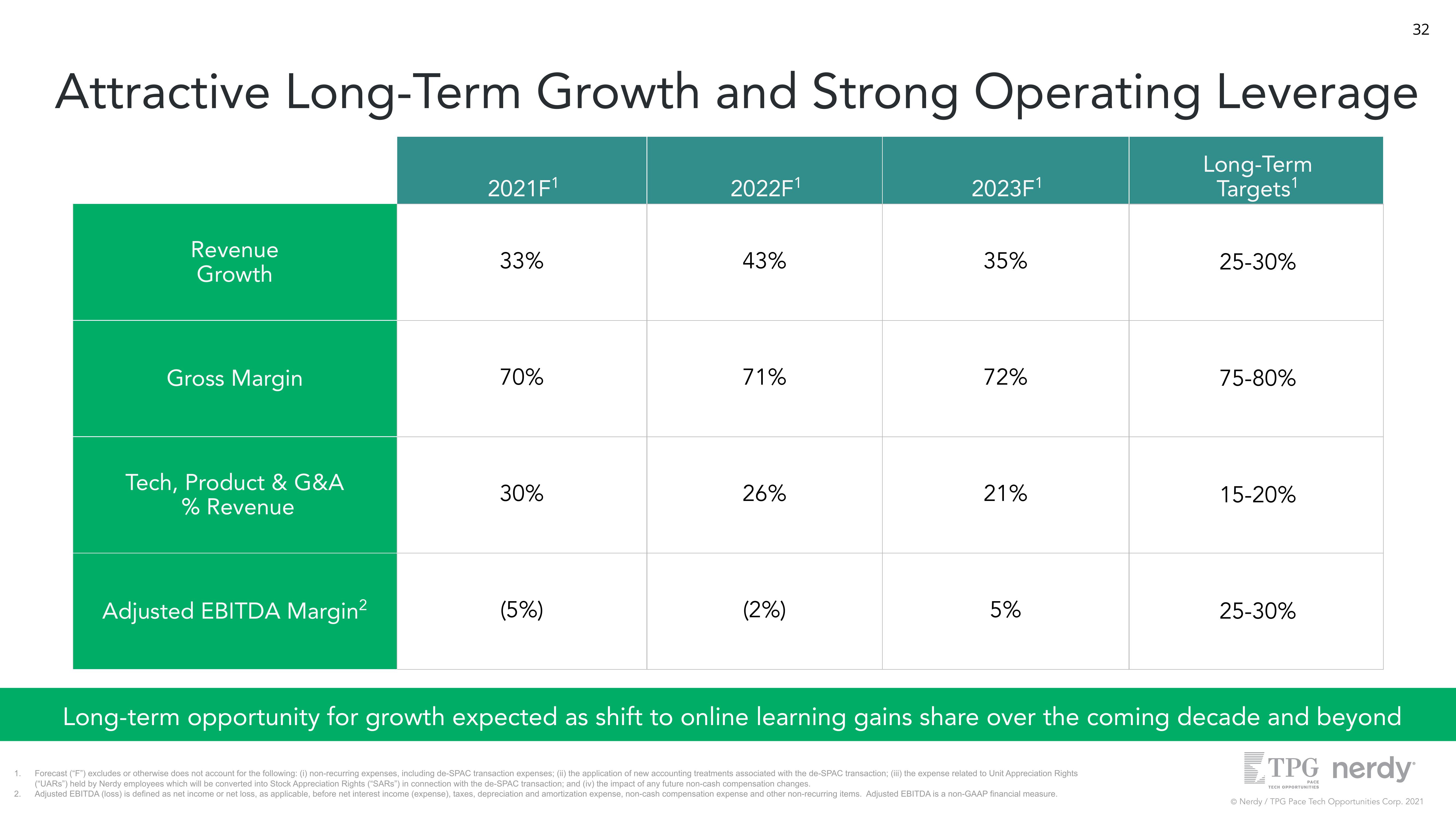

Attractive Long-Term Growth and Strong Operating Leverage

Long-Term

Targets¹

Revenue

Growth

Gross Margin

Tech, Product & G&A

% Revenue

Adjusted EBITDA Margin²

2021F¹

33%

70%

30%

(5%)

2022F¹

43%

71%

26%

(2%)

2023F¹

35%

72%

21%

5%

25-30%

Forecast ("F") excludes or otherwise does not account for the following: (i) non-recurring expenses, including de-SPAC transaction expenses; (ii) the application of new accounting treatments associated with the de-SPAC transaction; (iii) the expense related to Unit Appreciation Rights

("UARS") held by Nerdy employees which will be converted into Stock Appreciation Rights ("SARS") in connection with the de-SPAC transaction; and (iv) the impact of any future non-cash compensation changes.

Adjusted EBITDA (loss) is defined as net income or net loss, as applicable, before net interest income (expense), taxes, depreciation and amortization expense, non-cash compensation expense and other non-recurring items. Adjusted EBITDA is a non-GAAP financial measure.

75-80%

15-20%

32

25-30%

Long-term opportunity for growth expected as shift to online learning gains share over the coming decade and beyond

STPG nerdy

TECH OPPORTUNITIES

Ⓒ Nerdy / TPG Pace Tech Opportunities Corp. 2021View entire presentation