Maersk Results Presentation Deck

A.P. Moller Maersk Group

- Interim Report 02 2015

MAERSK

DRILLING

Contents

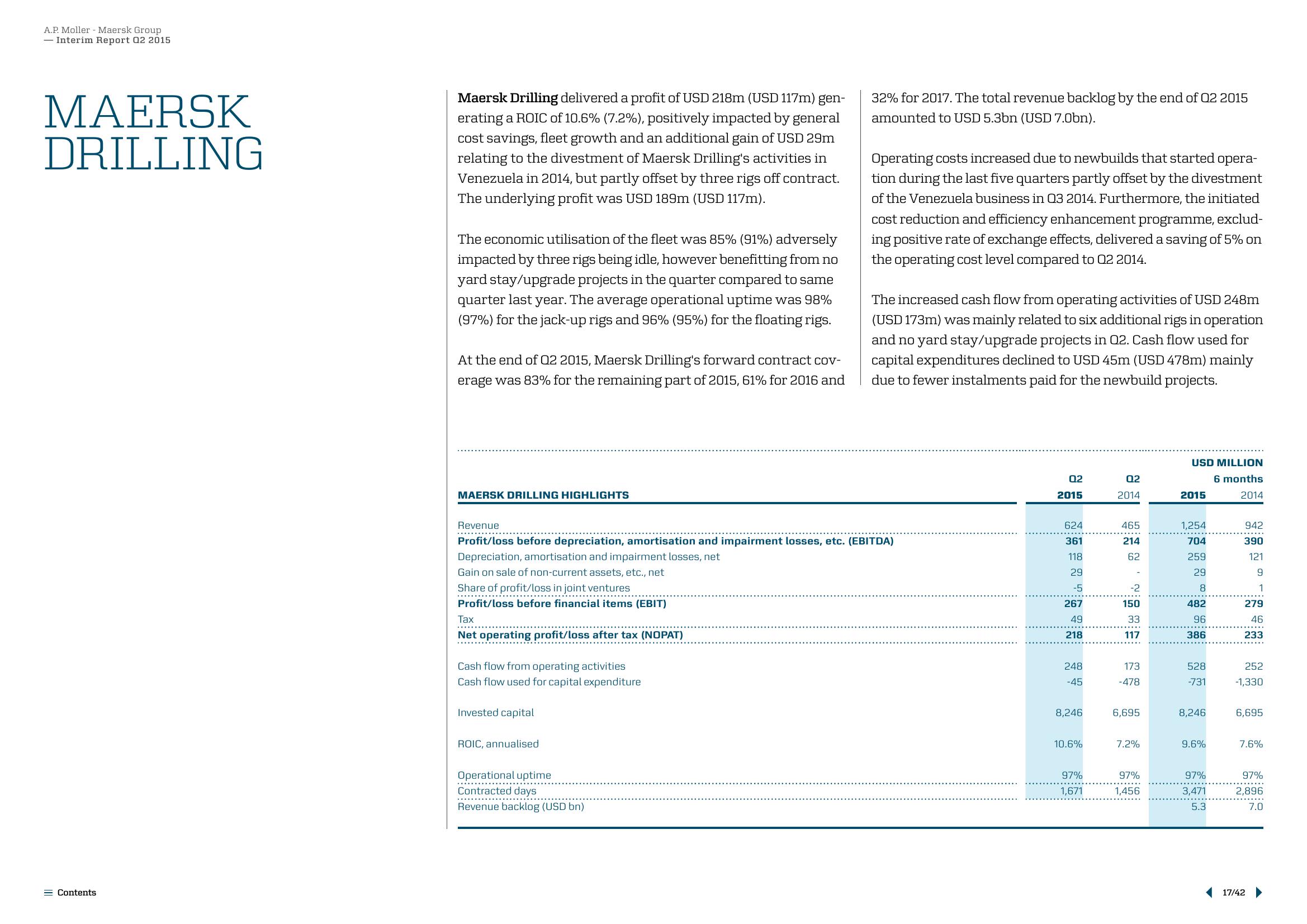

Maersk Drilling delivered a profit of USD 218m (USD 117m) gen-

erating a ROIC of 10.6% (7.2%), positively impacted by general

cost savings, fleet growth and an additional gain of USD 29m

relating to the divestment of Maersk Drilling's activities in

Venezuela in 2014, but partly offset by three rigs off contract.

The underlying profit was USD 189m (USD 117m).

The economic utilisation of the fleet was 85% (91%) adversely

impacted by three rigs being idle, however benefitting from no

yard stay/upgrade projects in the quarter compared to same

quarter last year. The average operational uptime was 98%

(97%) for the jack-up rigs and 96% (95%) for the floating rigs.

At the end of 02 2015, Maersk Drilling's forward contract cov-

erage was 83% for the remaining part of 2015, 61% for 2016 and

MAERSK DRILLING HIGHLIGHTS

Revenue

**********

Tax

Net operating profit/loss after tax (NOPAT)

Cash flow from operating activities

Cash flow used for capital expenditure

Profit/loss before depreciation, amortisation and impairment losses, etc. (EBITDA)

Depreciation, amortisation and impairment losses, net

Gain on sale of non-current assets, etc., net

Share of profit/loss in joint ventures

Profit/loss before financial items (EBIT)

Invested capital

ROIC, annualised

32% for 2017. The total revenue backlog by the end of 02 2015

amounted to USD 5.3bn (USD 7.0bn).

Operational uptime

....…....

Contracted days

Revenue backlog (USD bn)

Operating costs increased due to newbuilds that started opera-

tion during the last five quarters partly offset by the divestment

of the Venezuela business in Q3 2014. Furthermore, the initiated

cost reduction and efficiency enhancement programme, exclud-

ing positive rate of exchange effects, delivered a saving of 5% on

the operating cost level compared to 02 2014.

The increased cash flow from operating activities of USD 248m

(USD 173m) was mainly related to six additional rigs in operation

and no yard stay/upgrade projects in Q2. Cash flow used for

capital expenditures declined to USD 45m (USD 478m) mainly

due to fewer instalments paid for the newbuild projects.

02

2015

624

361

118

29

-5

267

49

218

248

-45

8,246

10.6%

97%

1,671

02

2014

465

214

62

-2

150

33

117

173

-478

6,695

7.2%

97%

1,456

USD MILLION

6 months

2014

2015

1,254

704

259

29

8

482

96

386

528

-731

8,246

9.6%

97%

3,471

5.3

942

390

121

9

1

279

46

233

252

-1,330

6,695

7.6%

97%

2,896

7.0

17/42 ▶View entire presentation