WeWork Investor Presentation Deck

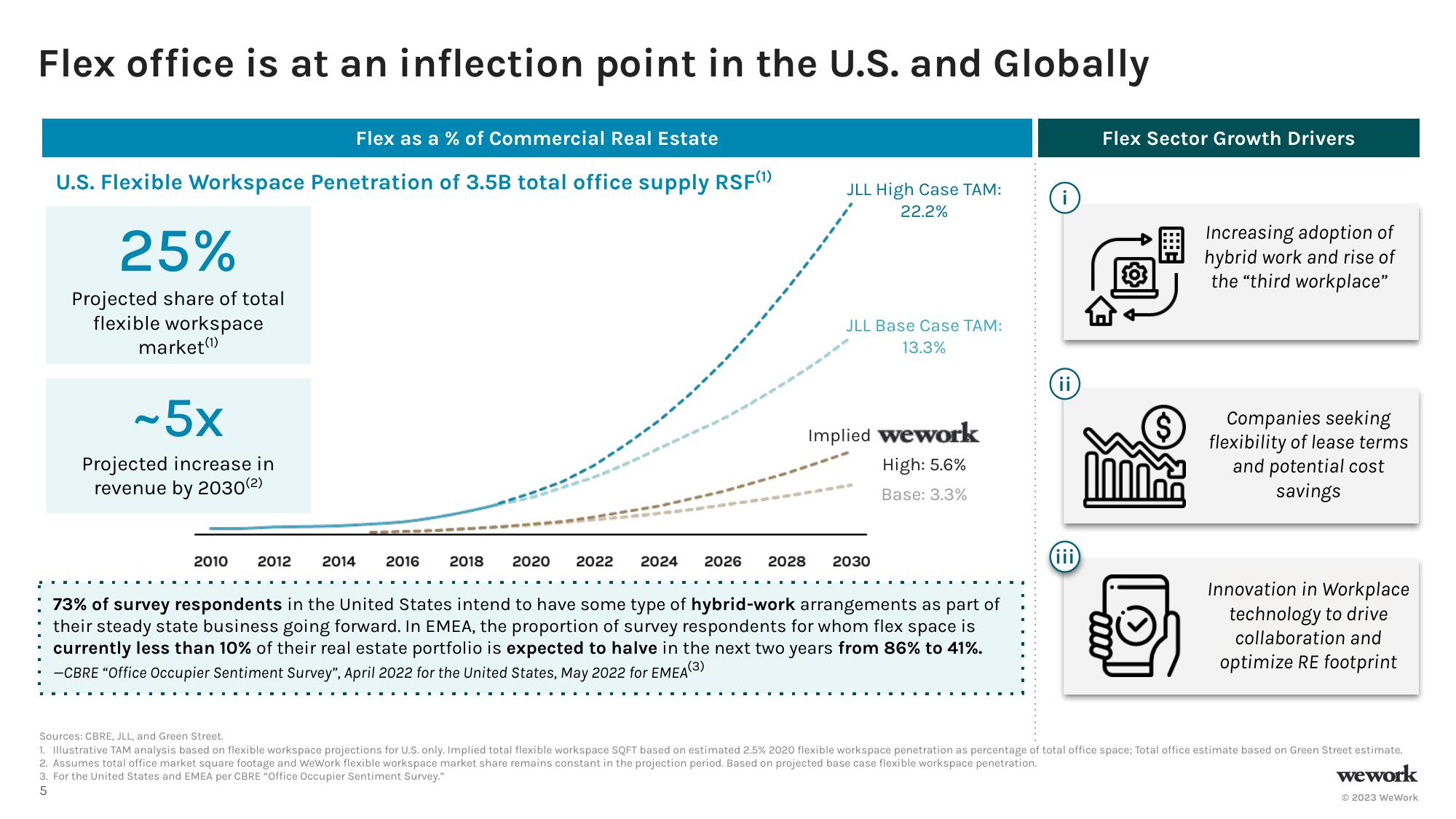

Flex office is at an inflection point in the U.S. and Globally

Flex as a % of Commercial Real Estate

U.S. Flexible Workspace Penetration of 3.5B total office supply RSF (1)

25%

Projected share of total

flexible workspace

market (¹)

~5x

Projected increase in

revenue by 2030 (²)

2010 2012 2014 2016 2018

JLL High Case TAM:

22.2%

2020 2022 2024 2026 2028

JLL Base Case TAM:

13.3%

Implied wework

High: 5.6%

Base: 3.3%

2030

▪▪▪▪

73% of survey respondents in the United States intend to have some type of hybrid-work arrangements as part of

their steady state business going forward. In EMEA, the proportion of survey respondents for whom flex space is

currently less than 10% of their real estate portfolio is expected to halve in the next two years from 86% to 41%.

-CBRE "Office Occupier Sentiment Survey", April 2022 for the United States, May 2022 for EMEA(3)

(ii)

(iii)

Flex Sector Growth Drivers

($

Increasing adoption of

hybrid work and rise of

the "third workplace"

Companies seeking

flexibility of lease terms

and potential cost

savings

Innovation in Workplace

technology to drive

collaboration and

optimize RE footprint

Sources: CBRE, JLL, and Green Street.

1. Illustrative TAM analysis based on flexible workspace projections for U.S. only. Implied total flexible workspace SQFT based on estimated 2.5% 2020 flexible workspace penetration as percentage of total office space; Total office estimate based on Green Street estimate.

2. Assumes total office market square footage and WeWork flexible workspace market share remains constant in the projection period. Based on projected base case flexible workspace penetration.

3. For the United States and EMEA per CBRE "Office Occupier Sentiment Survey."

wework

5

© 2023 WeWorkView entire presentation