Melrose Mergers and Acquisitions Presentation Deck

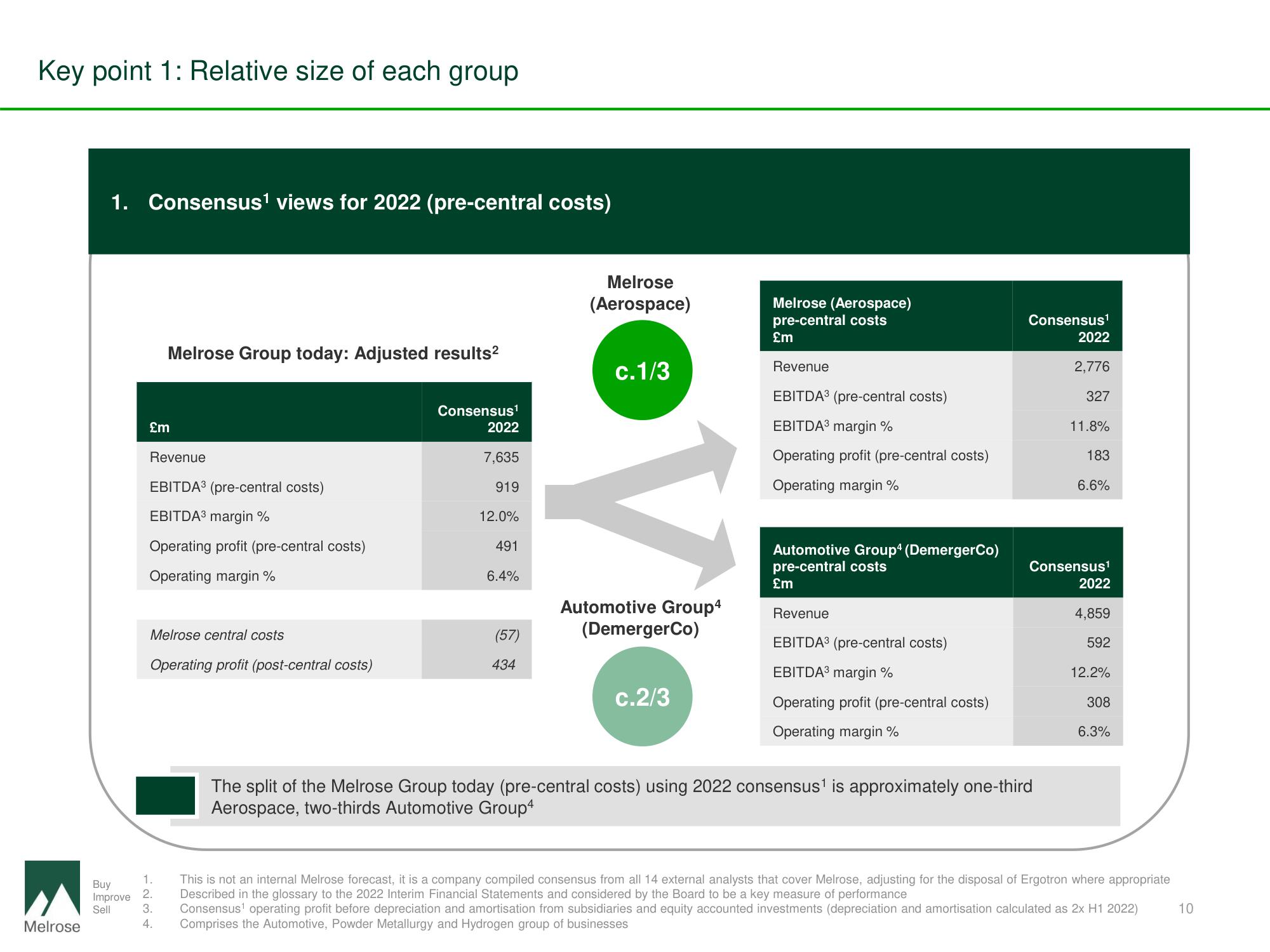

Key point 1: Relative size of each group

Melrose

1. Consensus¹ views for 2022 (pre-central costs)

Buy

Improve

Sell

Melrose Group today: Adjusted results²

£m

Revenue

EBITDA³ (pre-central costs)

EBITDA³ margin %

Operating profit (pre-central costs)

Operating margin %

Melrose central costs

Operating profit (post-central costs)

1234

Consensus¹

2022

7,635

919

12.0%

491

6.4%

(57)

434

Melrose

(Aerospace)

c.1/3

VI

Automotive Group4

(DemergerCo)

c.2/3

Melrose (Aerospace)

pre-central costs

£m

Revenue

EBITDA³ (pre-central costs)

EBITDA³ margin %

Operating profit (pre-central costs)

Operating margin %

Automotive Group4 (DemergerCo)

pre-central costs

£m

Revenue

EBITDA³ (pre-central costs)

EBITDA³ margin %

Operating profit (pre-central costs)

Operating margin %

Consensus1¹

2022

The split of the Melrose Group today (pre-central costs) using 2022 consensus¹ is approximately one-third

Aerospace, two-thirds Automotive Group4

2,776

327

11.8%

183

6.6%

Consensus¹

2022

4,859

592

12.2%

308

6.3%

1. This is not an internal Melrose forecast, it is a company compiled consensus from all 14 external analysts that cover Melrose, adjusting for the disposal of Ergotron where appropriate

Described in the glossary to the 2022 Interim Financial Statements and considered by the Board to be a key measure of performance

H1 2022)

3. Consensus¹ operating profit before depreciation and amortisation from subsidiaries and equity accounted investments (depreciation and amortisation calculated as

4. Comprises the Automotive, Powder Metallurgy and Hydrogen group of businesses

10View entire presentation