Credit Suisse Investment Banking Pitch Book

Preliminary illustrative Maine royalty per share

sensitivity analysis

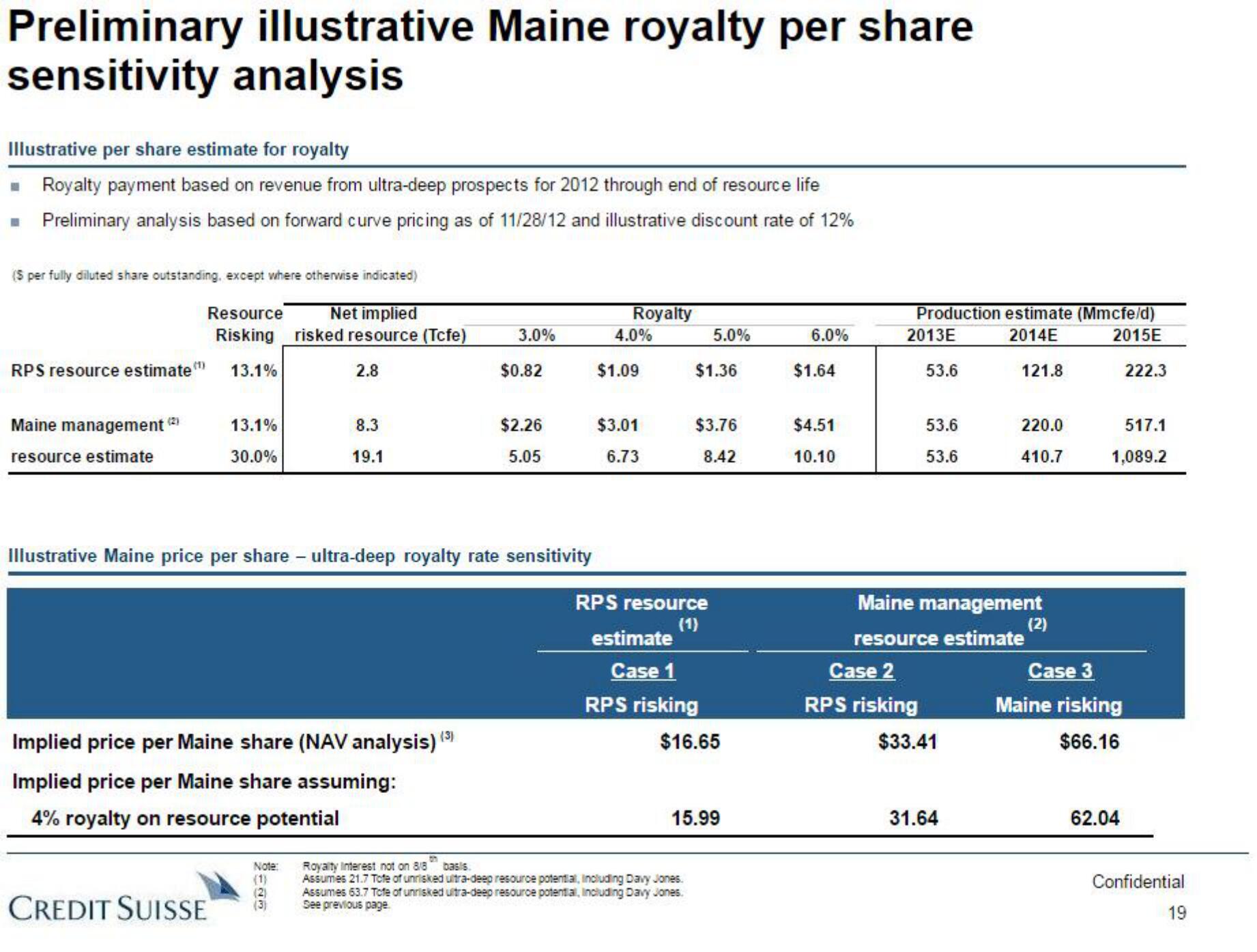

Illustrative per share estimate for royalty

Royalty payment based on revenue from ultra-deep prospects for 2012 through end of resource life

■ Preliminary analysis based on forward curve pricing as of 11/28/12 and illustrative discount rate of 12%

($ per fully diluted share outstanding, except where otherwise indicated)

Net implied

risked resource (Tcfe)

RPS resource estimate

Maine management

resource estimate

(1)

Resource

Risking

13.1%

13.1%

30.0%

CREDIT SUISSE

2.8

8.3

19.1

Implied price per Maine share (NAV analysis) (3)

Implied price per Maine share assuming:

4% royalty on resource potential

Note:

(1)

(2)

(3)

3.0%

Illustrative Maine price per share - ultra-deep royalty rate sensitivity

$0.82

$2.26

5.05

Royalty

4.0%

$1.09

$3.01

6.73

$1.36

RPS resource

(1)

5.0%

$3.76

8.42

estimate

Case 1

RPS risking

on

Royalty Interest not on 8/8

basis.

Assumes 21.7 Tote of unrisked ultra-deep resource potential, including Davy Jones.

Assumes 63.7 Tote of unrisked ultra-deep resource potential, Including Davy Jones.

See previous page.

$16.65

15.99

6.0%

$1.64

$4.51

10.10

Production estimate (Mmcfe/d)

2013E

2014E

2015E

222.3

53.6

Case 2

RPS risking

53.6

53.6

Maine management

resource estimate

$33.41

121.8

31.64

220.0

410.7

(2)

517.1

1,089.2

Case 3

Maine risking

$66.16

62.04

Confidential

19View entire presentation