DraftKings Investor Day Presentation Deck

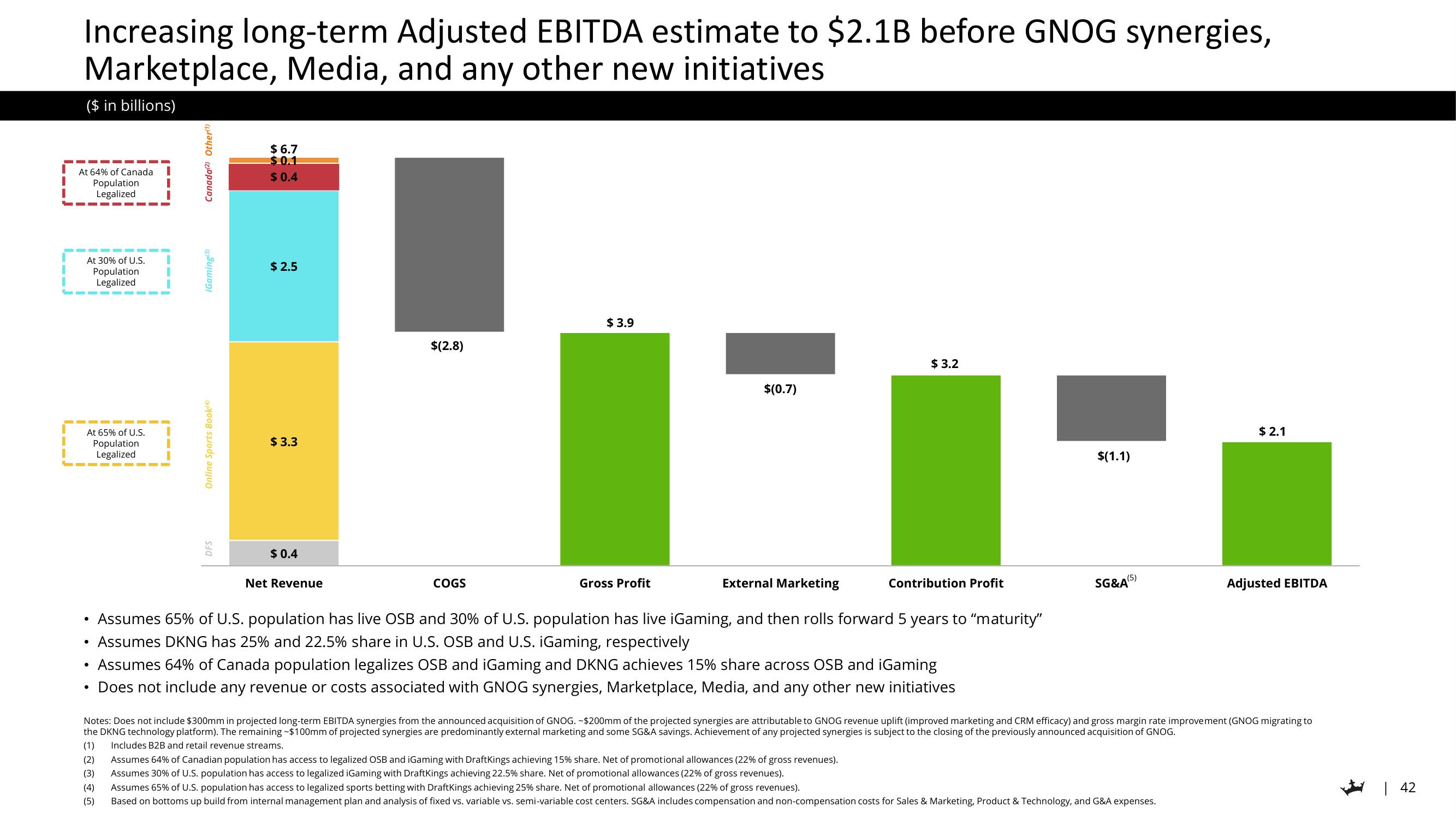

Increasing long-term Adjusted EBITDA estimate to $2.1B before GNOG synergies,

Marketplace, Media, and any other new initiatives

($ in billions)

At 64% of Canada

Population

Legalized

At 30% of U.S.

Population

Legalized

At 65% of U.S.

Population

Legalized

Canada(2) Other(¹)

●

iGaming(3)

Online Sports Book(4)

DFS

$6.7

$0.1

$ 0.4

$ 2.5

$3.3

$0.4

$(2.8)

Net Revenue

$3.9

COGS

External Marketing

Assumes 65% of U.S. population has live OSB and 30% of U.S. population has live iGaming, and then rolls forward 5 years to “maturity"

• Assumes DKNG has 25% and 22.5% share in U.S. OSB and U.S. iGaming, respectively

Assumes 64% of Canada population legalizes OSB and iGaming and DKNG achieves 15% share across OSB and iGaming

• Does not include any revenue or costs associated with GNOG synergies, Marketplace, Media, and any other new initiatives

$(0.7)

Gross Profit

$3.2

Assumes 64% of Canadian population has access to legalized OSB and iGaming with DraftKings achieving 15% share. Net of promotional allowances (22% of gross revenues).

Assumes 30% of U.S. population has access to legalized iGaming with DraftKings achieving 22.5% share. Net of promotional allowances (22% of gross revenues).

Contribution Profit

$(1.1)

SG&A(5

$ 2.1

Notes: Does not include $300mm in projected long-term EBITDA synergies from the announced acquisition of GNOG. -$200mm of the projected synergies are attributable to GNOG revenue uplift (improved marketing and CRM efficacy) and gross margin rate improvement (GNOG migrating to

the DKNG technology platform). The remaining -$100mm of projected synergies are predominantly external marketing and some SG&A savings. Achievement of any projected synergies is subject to the closing of the previously announced acquisition of GNOG.

(1) Includes B2B and retail revenue streams.

(2)

(3)

(4)

(5)

Assumes 65% of U.S. population has access to legalized sports betting with DraftKings achieving 25% share. Net of promotional allowances (22% of gross revenues).

Based on bottoms up build from internal management plan and analysis of fixed vs. variable vs. semi-variable cost centers. SG&A includes compensation and non-compensation costs for Sales & Marketing, Product & Technology, and G&A expenses.

Adjusted EBITDA

| 42View entire presentation