Centrica Results Presentation Deck

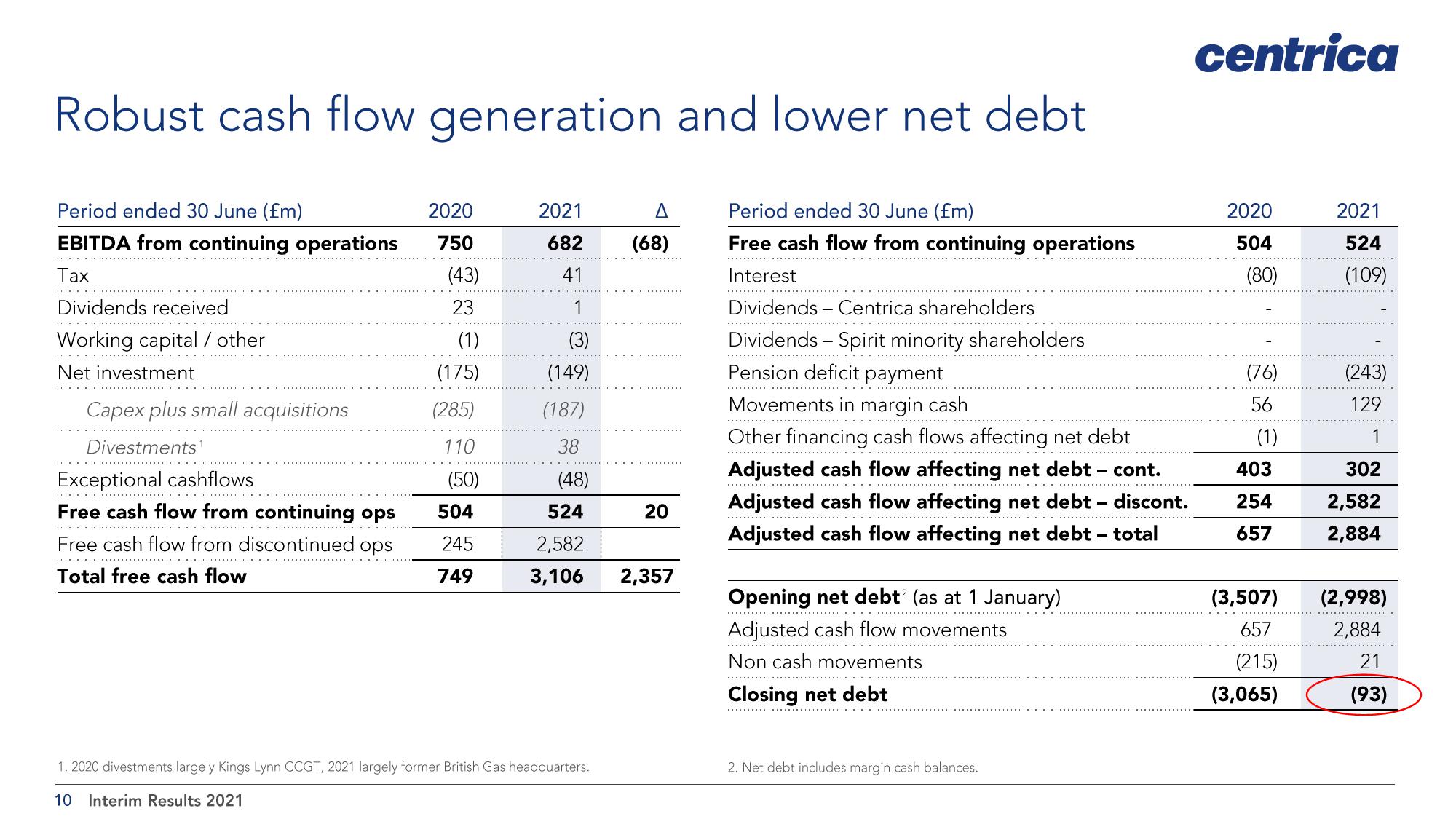

Robust cash flow generation and lower net debt

Period ended 30 June (fm)

EBITDA from continuing operations

Tax

Dividends received

Working capital / other

Net investment

Capex plus small acquisitions

Divestments

Exceptional cashflows

Free cash flow from continuing ops

Free cash flow from discontinued ops

Total free cash flow

2020

750

(43)

23

(1)

(175)

(285)

110

(50)

504

245

749

2021

682

41

1

(3)

(149)

(187)

38

(48)

524

(68)

1. 2020 divestments largely Kings Lynn CCGT, 2021 largely former British Gas headquarters.

10 Interim Results 2021

20

2,582

3,106 2,357

Period ended 30 June (fm)

Free cash flow from continuing operations

Interest

Dividends Centrica shareholders

Dividends - Spirit minority shareholders

Pension deficit payment

Movements in margin cash

Other financing cash flows affecting net debt

Adjusted cash flow affecting net debt cont.

Adjusted cash flow affecting net debt - discont.

Adjusted cash flow affecting net debt - total

Opening net debt2 (as at 1 January)

Adjusted cash flow movements

Non cash movements

Closing net debt

2. Net debt includes margin cash balances.

centrica

2020

504

(80)

(76)

56

(1)

403

254

657

(3,507)

657

(215)

(3,065)

2021

524

(109)

(243)

129

1

302

2,582

2,884

(2,998)

2,884

21

(93)View entire presentation