Baird Investment Banking Pitch Book

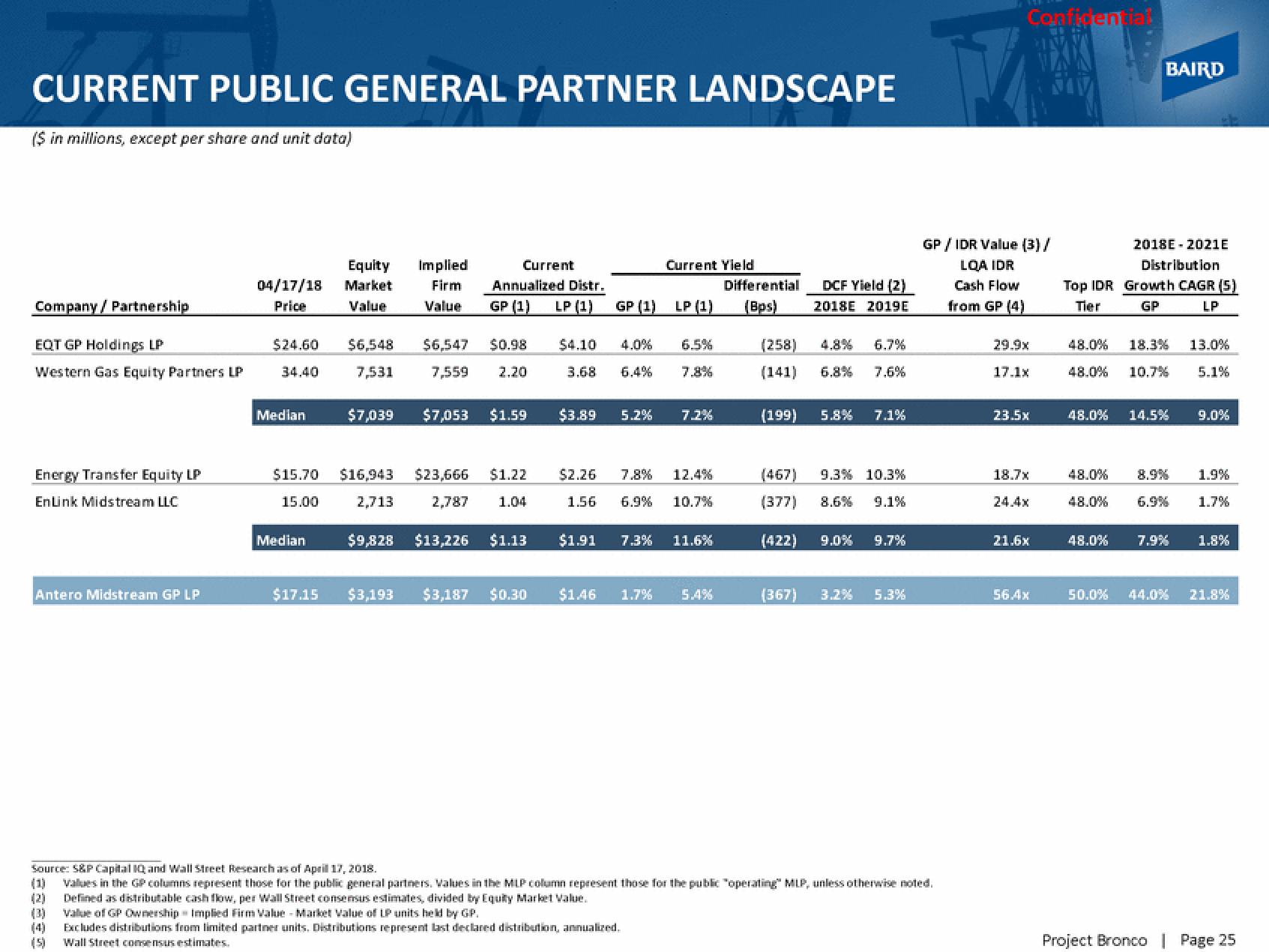

CURRENT PUBLIC GENERAL PARTNER LANDSCAPE

($ in millions, except per share and unit data)

Company / Partnership

EQT GP Holdings LP

Western Gas Equity Partners LP

Energy Transfer Equity LP

EnLink Midstream LLC

Antero Midstream GP LP

3333

04/17/18 Market

Price

Value

Equity Implied

Firm

Value

$24.60 $6,548

34.40 7,531

Median

Median

Current

Annualized Distr.

GP (1) LP (1)

$6,547 $0.98

7,559 2.20

$7,039 $7,053 $1.59

$15.70 $16,943 $23,666 $1.22

15.00 2,713 2,787 1.04

Current Yield

GP (1) LP (1)

$4.10 4.0%

6.5%

3.68 6.4% 7.8%

$3.89 5.2%

7.2%

$2.26 7.8% 12.4%

1.56 6.9% 10.7%

$9,828 $13,226 $1.13 $1.91 7.3% 11.6%

$17.15 $3,193 $3,187 $0.30 $1.46 1.7% 5.4%

Differential

(Bps)

DCF Yield (2)

2018E 2019E

(258) 4.8% 6.7%

(141) 6.8% 7.6%

(199)

5.8% 7.1%

(467) 9.3 % 10.3 %

(377) 8.6% 9.1%

(422) 9.0% 9.7%

(367) 3.2% 5.3%

Source: S&P Capital IQ and Wall Street Research as of April 17, 2018.

(1) Values in the GP columns represent those for the public general partners. Values in the MLP column represent those for the public "operating MLP, unless otherwise noted.

Defined as distributable cash flow, per Wall Street consensus estimates, divided by Equity Market Value.

Value of GP Ownership Implied Firm Value - Market Value of LP units held by GP.

Excludes distributions from limited partner units. Distributions represent last declared distribution, annualized.

(5) Wall Street consensus estimates.

Confidential

GP / IDR Value (3) /

LOA IDR

Cash Flow

from GP (4)

29.9x

17.1x

11.5x

18.7x

24.4x

21.6x

56.4x

Top IDR

Tier

BAIRD

48.0%

2018E-2021E

Distribution

Growth CAGR (5)

GP

LP

48.0% 18.3%

48.0% 10.7%

14.5%

48.0%

48.0% 6.9%

13.0%

5.1%

9.0%

1.9%

1.7%

48.0% 7.9% 1.8%

50.0% 44.0% 21.8%

Project Bronco | Page 25View entire presentation