AMD Investor Day Presentation Deck

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

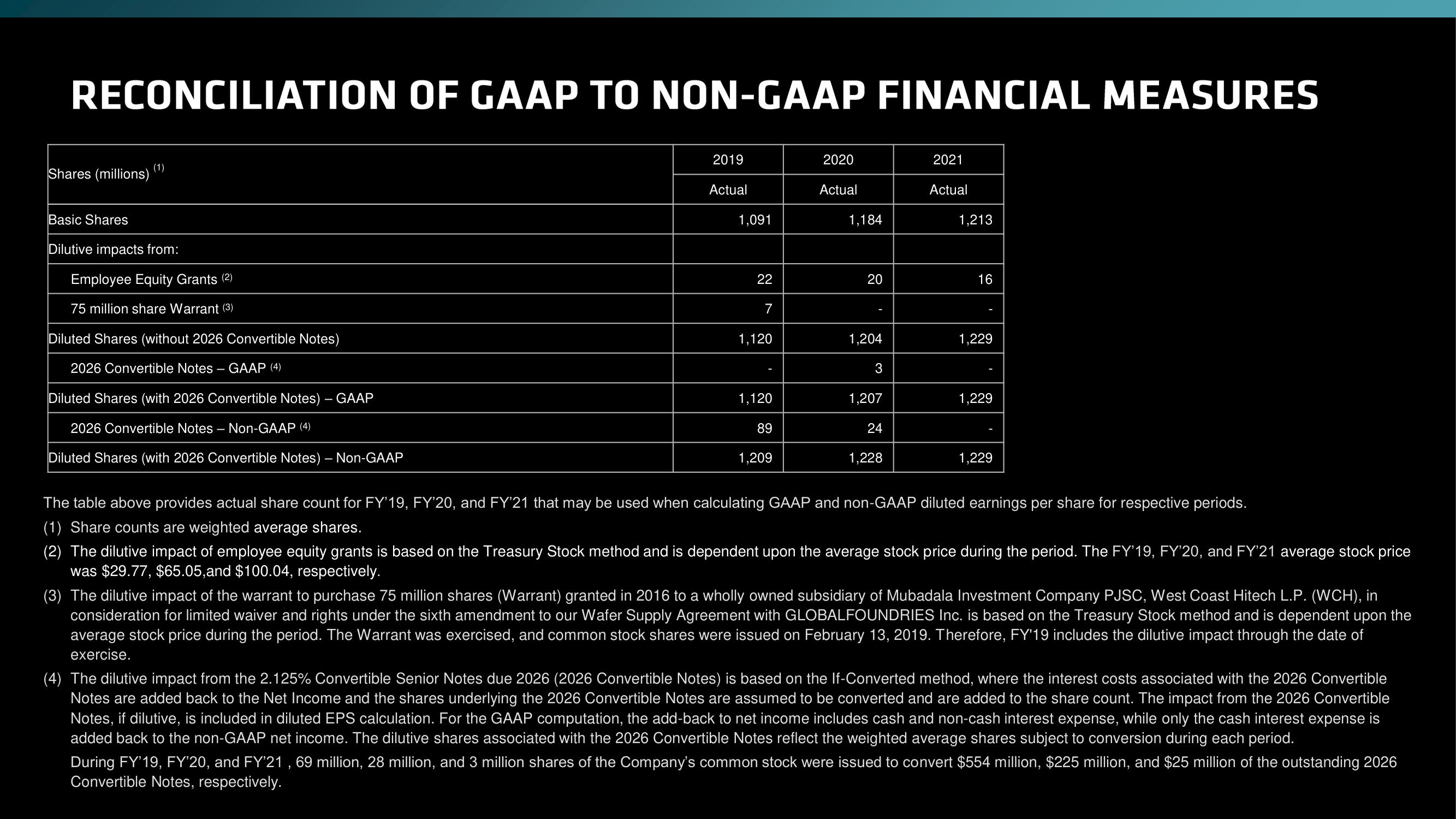

Shares (millions) (¹)

Basic Shares

Dilutive impacts from:

Employee Equity Grants (2)

75 million share Warrant (3)

Diluted Shares (without 2026 Convertible Notes)

2026 Convertible Notes - GAAP (4)

Diluted Shares (with 2026 Convertible Notes) - GAAP

2026 Convertible Notes - Non-GAAP (4)

Diluted Shares (with 2026 Convertible Notes) - Non-GAAP

2019

Actual

1,091

22

7

1,120

1,120

89

1,209

2020

Actual

1,184

20

I

1,204

3

1,207

24

1,228

2021

Actual

1,213

16

1,229

1,229

1,229

based on the Treasury Stock method and is dependent upon the average stock price during the period. The FY'19, FY'20, and FY'21 average stock price

The table above provides actual share count for FY'19, FY'20, and FY'21 that may be used when calculating GAAP and non-GAAP diluted earnings per share for respective periods.

(1) Share counts are weighted average shares.

(2) The dilutive impact of employee equity grants

was $29.77, $65.05,and $100.04, respectively.

(3) The dilutive impact of the warrant to purchase 75 million shares (Warrant) granted in 2016 to a wholly owned subsidiary of Mubadala Investment Company PJSC, West Coast Hitech L.P. (WCH), in

consideration for limited waiver and rights under the sixth amendment to our Wafer Supply Agreement with GLOBALFOUNDRIES Inc. is based on the Treasury Stock method and is dependent upon the

average stock price during the period. The Warrant was exercised, and common stock shares were issued on February 13, 2019. Therefore, FY'19 includes the dilutive impact through the date of

exercise.

(4) The dilutive impact from the 2.125% Convertible Senior Notes due 2026 (2026 Convertible Notes) is based on the If-Converted method, where the interest costs associated with the 2026 Convertible

Notes are added back to the Net Income and the shares underlying the 2026 Convertible Notes are assumed to be converted and are added to the share count. The impact from the 2026 Convertible

Notes, if dilutive, is included in diluted EPS calculation. For the GAAP computation, the add-back to net income includes cash and non-cash interest expense, while only the cash interest expense is

added back to the non-GAAP net income. The dilutive shares associated with the 2026 Convertible Notes reflect the weighted average shares subject to conversion during each period.

During FY'19, FY'20, and FY'21, 69 million, 28 million, and 3 million shares of the Company's common stock were issued to convert $554 million, $225 million, and $25 million of the outstanding 2026

Convertible Notes, respectively.View entire presentation