Bed Bath & Beyond Results Presentation Deck

Q4 BUSINESS & FINANCIAL RESULTS

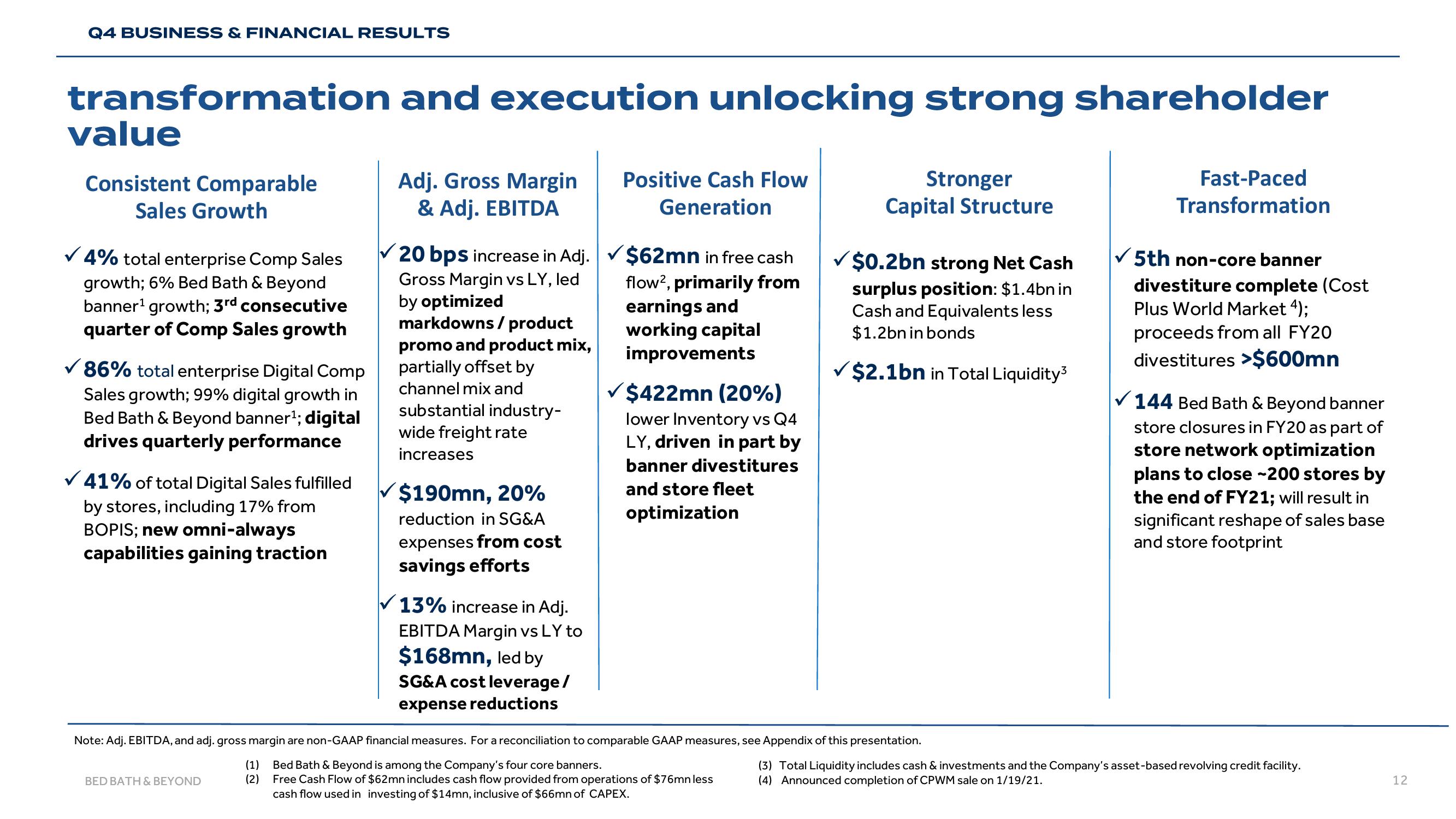

transformation and execution unlocking strong shareholder

value

Consistent Comparable

Sales Growth

✓ 4% total enterprise Comp Sales

growth; 6% Bed Bath & Beyond

banner¹ growth; 3rd consecutive

quarter of Comp Sales growth

✓86% total enterprise Digital Comp

Sales growth; 99% digital growth in

Bed Bath & Beyond banner¹; digital

drives quarterly performance

✓ 41% of total Digital Sales fulfilled

by stores, including 17% from

BOPIS; new omni-always

capabilities gaining traction

Adj. Gross Margin

& Adj. EBITDA

BED BATH & BEYOND

✓20 bps increase in Adj.

Gross Margin vs LY, led

by optimized

markdowns/product

promo and product mix,

partially offset by

channel mix and

substantial industry-

wide freight rate

increases

$190mn, 20%

reduction in SG&A

expenses from cost

savings efforts

13% increase in Adj.

EBITDA Margin vs LY to

$168mn, led by

SG&A cost leverage/

expense reductions

Positive Cash Flow

Generation

✔$62mn in free cash

flow², primarily from

earnings and

working capital

improvements

✓ $422mn (20%)

lower Inventory vs Q4

LY, driven in part by

banner divestitures

and store fleet

optimization

Stronger

Capital Structure

✓$0.2bn strong Net Cash

surplus position: $1.4bn in

Cash and Equivalents less

$1.2bn in bonds

✓$2.1bn in Total Liquidity³

Note: Adj. EBITDA, and adj. gross margin are non-GAAP financial measures. For a reconciliation to comparable GAAP measures, see Appendix of this presentation.

(1) Bed Bath & Beyond is among the Company's four core banners.

(2)

Free Cash Flow of $62mn includes cash flow provided from operations of $76mn less

cash flow used in investing of $14mn, inclusive of $66mn of CAPEX.

Fast-paced

Transformation

✓5th non-core banner

divestiture complete (Cost

Plus World Market 4);

proceeds from all FY20

divestitures >$600mn

✓144 Bed Bath & Beyond banner

store closures in FY20 as part of

store network optimization

plans to close ~200 stores by

the end of FY21; will result in

significant reshape of sales base

and store footprint

(3) Total Liquidity includes cash & investments and the Company's asset-based revolving credit facility.

(4) Announced completion of CPWM sale on 1/19/21.

12View entire presentation