Third Quarter Fiscal 2023 Earnings Conference Call

4

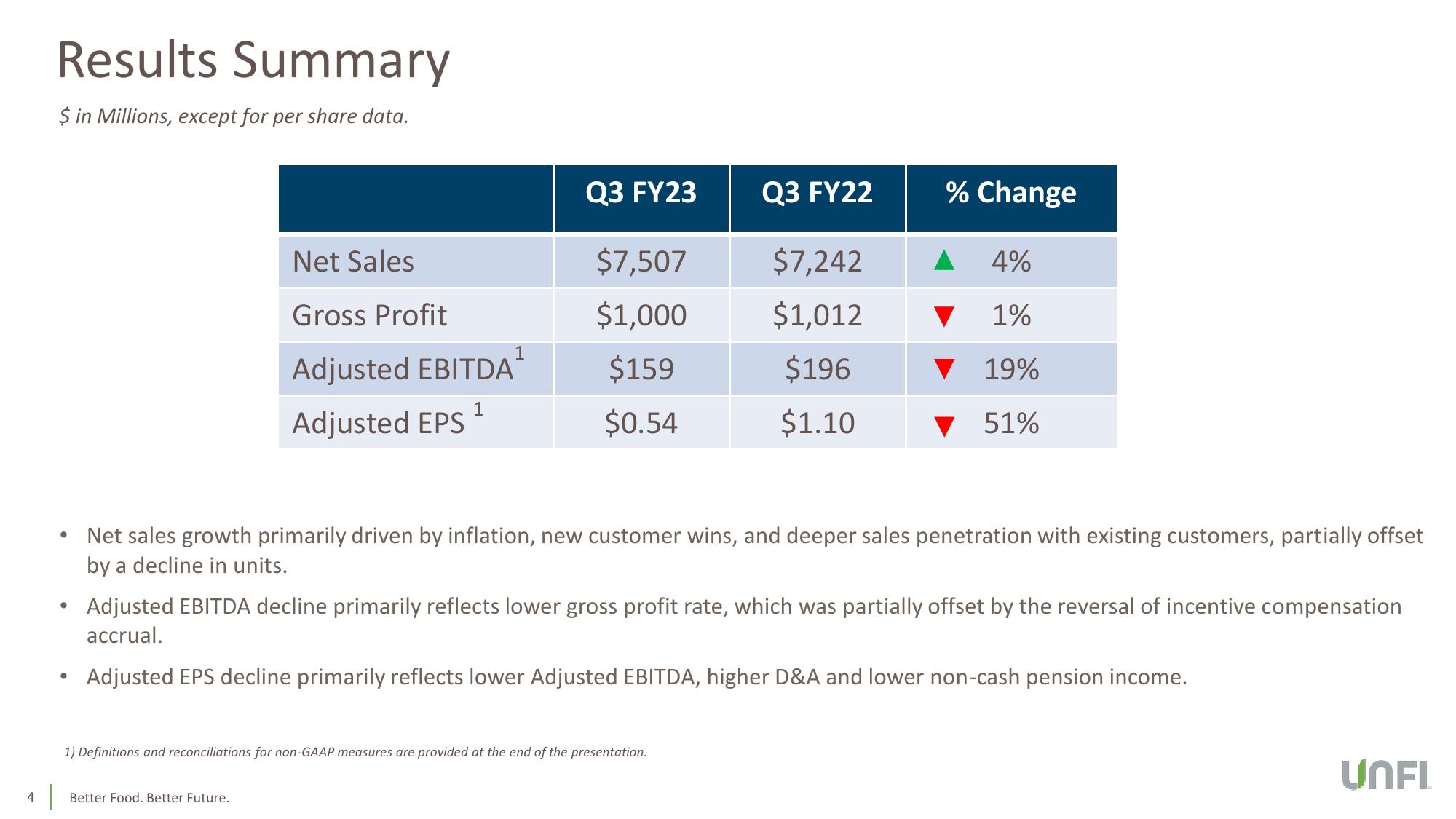

Results Summary

$ in Millions, except for per share data.

●

●

Net Sales

Gross Profit

Adjusted EBITDA

1

Adjusted EPS

Q3 FY23

Better Food. Better Future.

$7,507

$1,000

$159

$0.54

Q3 FY22

1) Definitions and reconciliations for non-GAAP measures are provided at the end of the presentation.

$7,242

$1,012

$196

$1.10

% Change

Net sales growth primarily driven by inflation, new customer wins, and deeper sales penetration with existing customers, partially offset

by a decline in units.

4%

1%

19%

51%

Adjusted EBITDA decline primarily reflects lower gross profit rate, which was partially offset by the reversal of incentive compensation

accrual.

Adjusted EPS decline primarily reflects lower Adjusted EBITDA, higher D&A and lower non-cash pension income.

UNFLView entire presentation