Kinnevik Results Presentation Deck

Intro

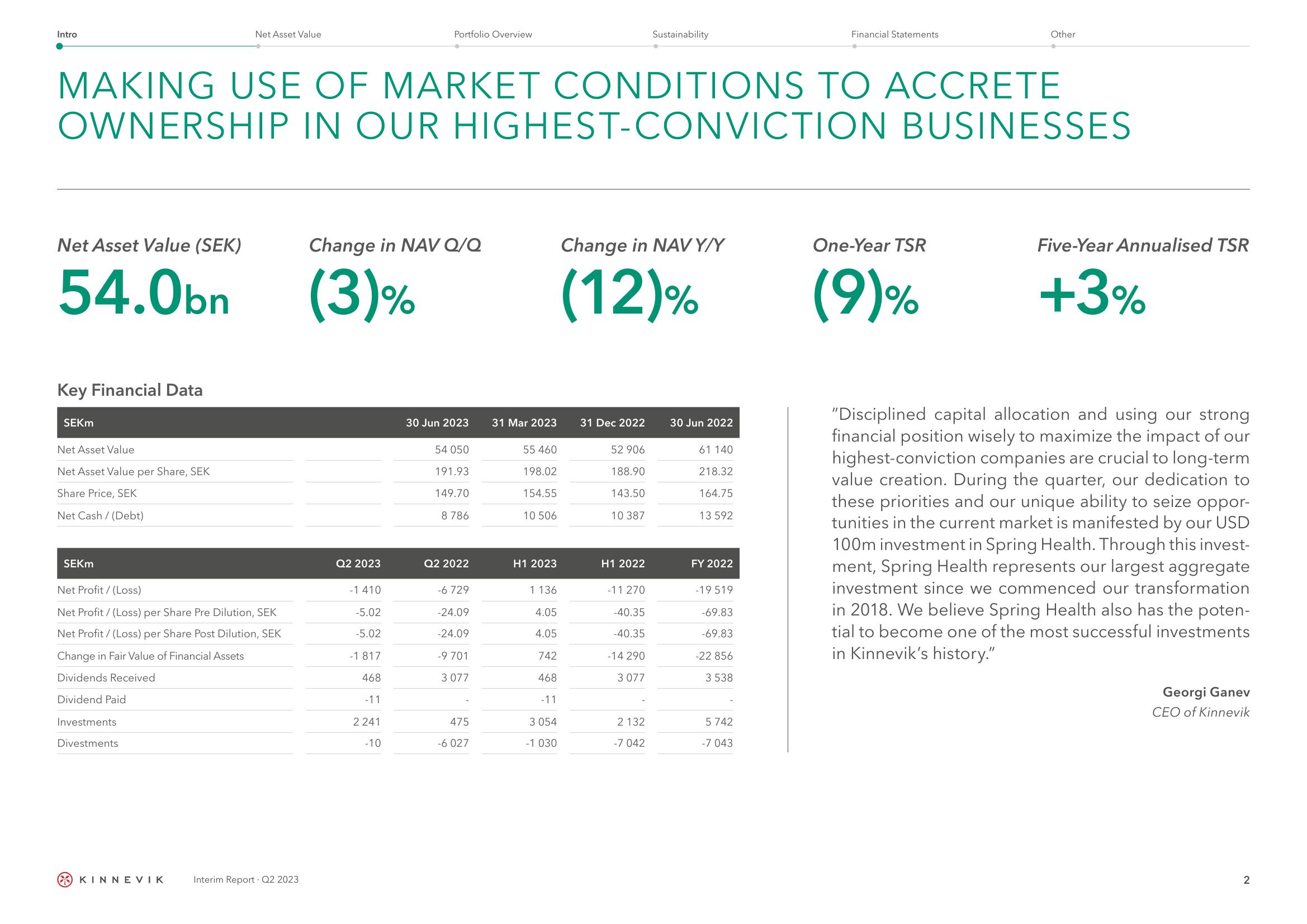

Net Asset Value (SEK)

54.0bn

Key Financial Data

SEKM

Net Asset Value

Net Asset Value per Share, SEK

Share Price, SEK

Net Cash/ (Debt)

MAKING USE OF MARKET CONDITIONS TO ACCRETE

OWNERSHIP IN OUR

HIGHEST-CONVICTION BUSINESSES

SEKM

Net Asset Value

Net Profit/(Loss)

Net Profit /(Loss) per Share Pre Dilution, SEK

Net Profit / (Loss) per Share Post Dilution, SEK

Change in Fair Value of Financial Assets

Dividends Received

Dividend Paid

Investments

Divestments

KINNEVIK

Interim Report Q2 2023

Change in NAV Q/Q

(3)%

Q2 2023

-1 410

-5.02

-5.02

Portfolio Overview

-1 817

468

-11

2241

-10

30 Jun 2023

54 050

191.93

149.70

8 786

Q2 2022

-6 729

-24.09

-24.09

-9 701

3 077

475

-6 027

31 Mar 2023

55 460

198.02

154.55

10 506

H1 2023

1 136

4.05

4.05

742

468

-11

Change in NAVY/Y

(12)%

3 054

-1 030

31 Dec 2022

52 906

188.90

143.50

10 387

H1 2022

-11 270

-40.35

-40.35

-14 290

Sustainability

3 077

2 132

-7 042

30 Jun 2022

61 140

218.32

164.75

13 592

FY 2022

-19 519

-69.83

-69.83

-22 856

3 538

Financial Statements

5 742

-7 043

Other

One-Year TSR

(9)%

Five-Year Annualised TSR

+3%

"Disciplined capital allocation and using our strong

financial position wisely to maximize the impact of our

highest-conviction companies are crucial to long-term

value creation. During the quarter, our dedication to

these priorities and our unique ability to seize oppor-

tunities in the current market is manifested by our USD

100m investment in Spring Health. Through this invest-

ment, Spring Health represents our largest aggregate

investment since we commenced our transformation

in 2018. We believe Spring Health also has the poten-

tial to become one of the most successful investments

in Kinnevik's history."

Georgi Ganev

CEO of Kinnevik

2View entire presentation