Hypebeast SPAC Presentation Deck

Proposed Transaction Summary

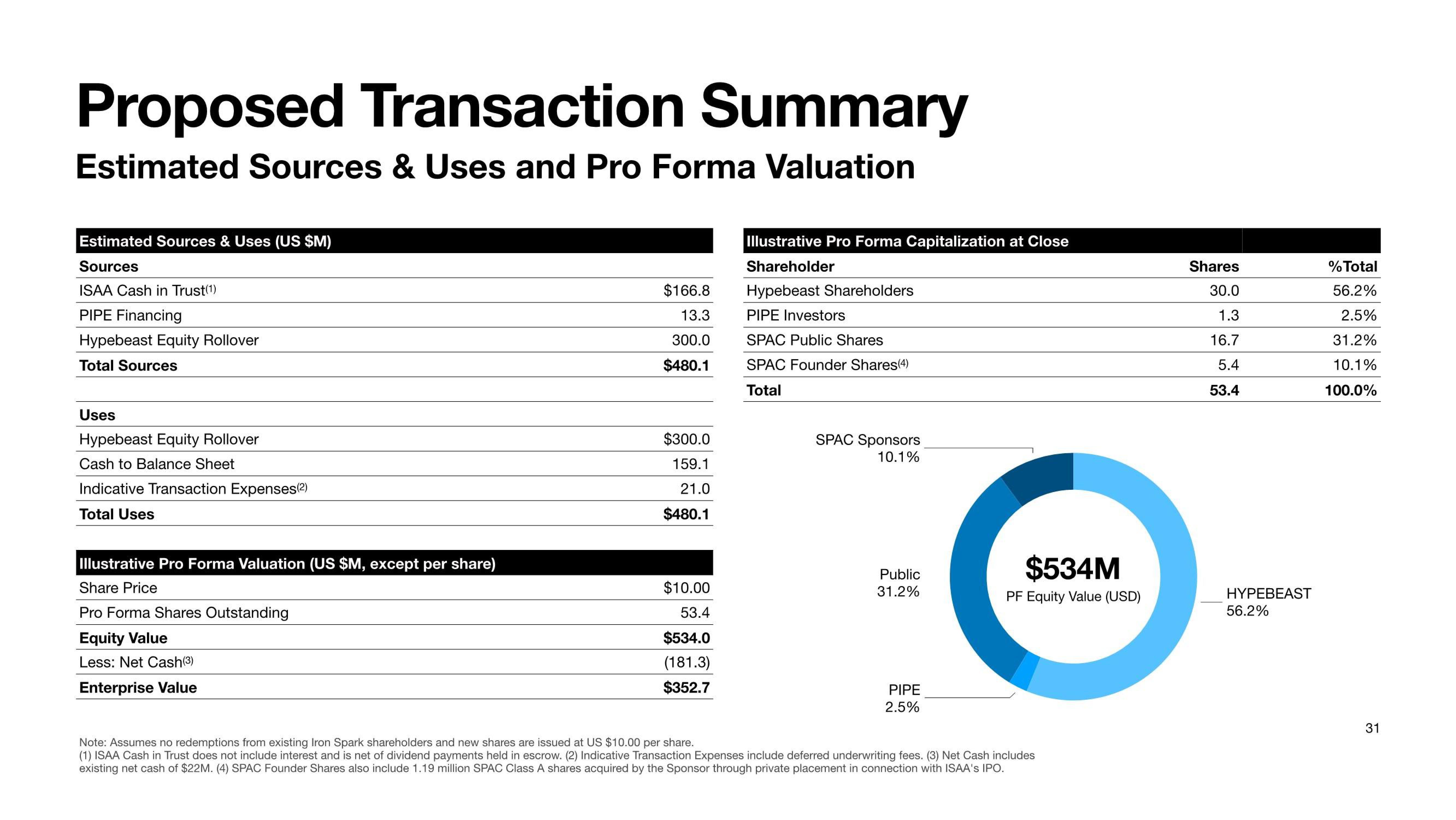

Estimated Sources & Uses and Pro Forma Valuation

Estimated Sources & Uses (US $M)

Sources

ISAA Cash in Trust(1)

PIPE Financing

Hypebeast Equity Rollover

Total Sources

Uses

Hypebeast Equity Rollover

Cash to Balance Sheet

Indicative Transaction Expenses(2)

Total Uses

Illustrative Pro Forma Valuation (US $M, except per share)

Share Price

Pro Forma Shares Outstanding

Equity Value

Less: Net Cash (3)

Enterprise Value

$166.8

13.3

300.0

$480.1

$300.0

159.1

21.0

$480.1

$10.00

53.4

$534.0

(181.3)

$352.7

Illustrative Pro Forma Capitalization at Close

Shareholder

Hypebeast Shareholders

PIPE Investors

SPAC Public Shares

SPAC Founder Shares(4)

Total

SPAC Sponsors

10.1%

Public

31.2%

PIPE

2.5%

$534M

PF Equity Value (USD)

Note: Assumes no redemptions from existing Iron Spark shareholders and new shares are issued at US $10.00 per share.

(1) ISAA Cash in Trust does not include interest and is net of dividend payments held in escrow. (2) Indicative Transaction Expenses include deferred underwriting fees. (3) Net Cash includes

existing net cash of $22M. (4) SPAC Founder Shares also include 1.19 million SPAC Class A shares acquired by the Sponsor through private placement in connection with ISAA's IPO.

Shares

30.0

1.3

16.7

5.4

53.4

HYPEBEAST

56.2%

% Total

56.2%

2.5%

31.2%

10.1%

100.0%

31View entire presentation