Bright Machines SPAC

EV / Revenue

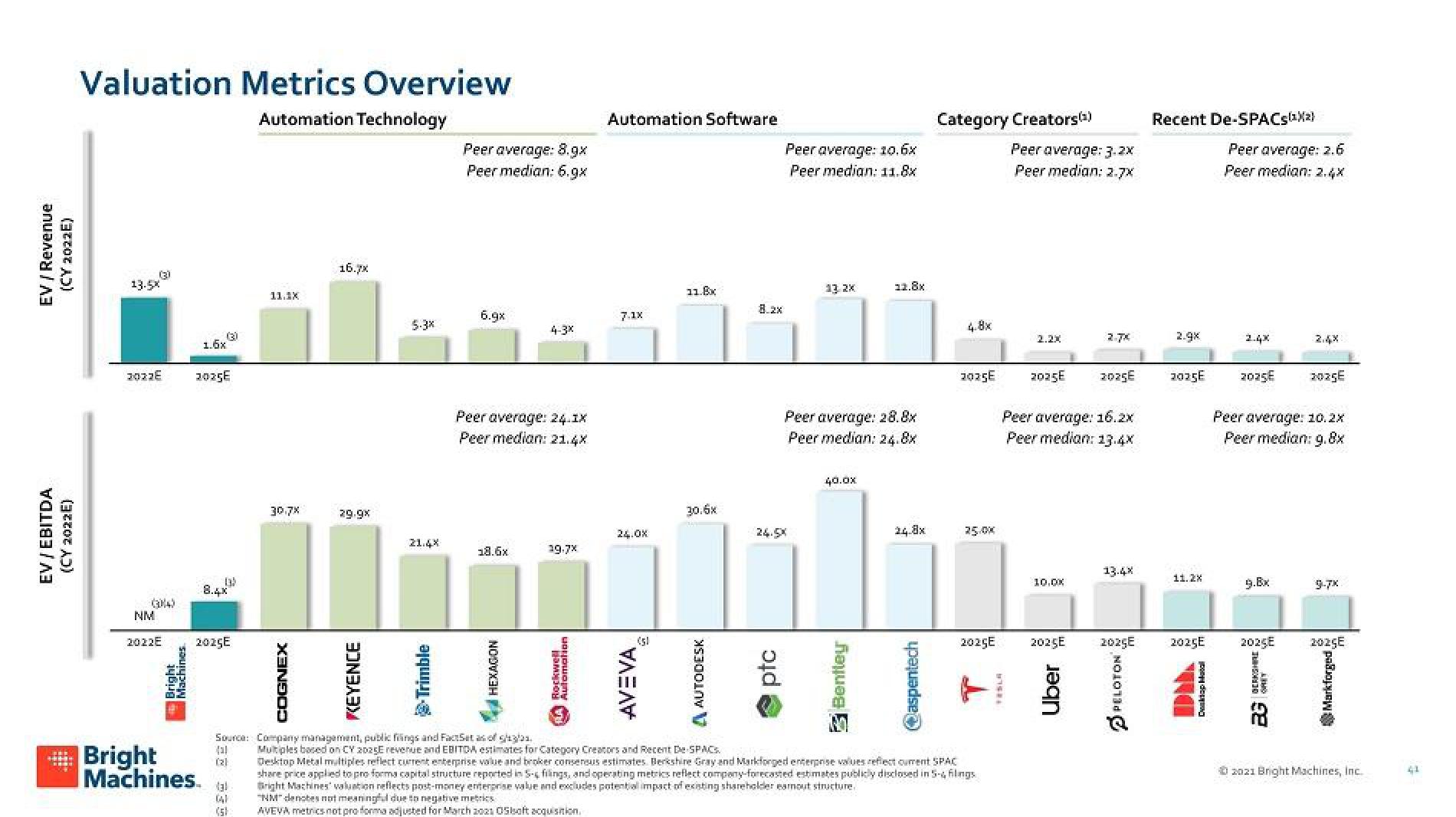

(CY 2022E)

EV / EBITDA

(CY 2022E)

Valuation Metrics Overview

Automation Technology

(3)

13.58

(3)

2022E 2025E

jybug a

1.5x

Bright

Machines.

(3)

NM

2022E 2025E

8.4x

Source:

tal

(2)

(al

(41

11.1X

30.7x

COGNEX

16.7x

29.9x

KEYENCE

5.3x

21.4X

> Trimble

Peer average: 8.9x

Peer median: 6.9x

6.9x

Peer average: 24.1X

Peer median: 21.4X

18.6x

4-3X

HEXAGON

39.7x

RA Rockwell

Automation Software

7.1X

24.0x

AVEVA

(5)

11.8x

30.6x

A AUTODESK

Company management, public filings and FactSet as of s/13/1

Multiples based on CY 2025E revenue and EBITDA estimates for Category Creators and Recent De-SPACS.

8.2x

Peer average: 10.6x

Peer median: 11.8x

ptc

24.5%

13,2x

Peer average: 28.8x

Peer median: 24.8x

40.0x

12.8x

3 Bentley

24.8x

@aspentech

Category Creators(1)

4.8x

2025E

25/0x

Desktop Metal multiples reflect current enterprise value and broker consensus estimates. Berkshire Gray and Markforged enterprise values reflect cument SPAC

share price applied to pro forma capital structure reported in 5-filings, and operating metrics reflect company-forecasted estimates publicly disclosed in 5-4 filings

Bright Machines' valuation reflects post-money enterprise value and excludes potential impact of existing shareholder earnout structure.

"NM" denotes not meaningful due to negative metrics

AVEVA metrics not pro forma adjusted for March 2021 Osloft acquisition.

Peer average: 3.2x

Peer median: 2.7x

2025E

TESLA

Peer average: 16.2x

Peer median: 13.4X

10.00

2025E

Uber

13.4%

Recent De-SPACs(¹₂)

PELOTON

2.9x

3025E

11.2X

2025E 2025E 2025E 2025E 2025E 2025E

Peer average: 2.6

Peer median: 2.4x

DI

2025€ 2025E

Peer average: 10.2x

Peer median: 9.8x

9.Bx

BERKSHIRE

KUMO

9-7X

23

Markforged

2021 Bright Machines, Inc.

41View entire presentation