Grab SPAC Presentation Deck

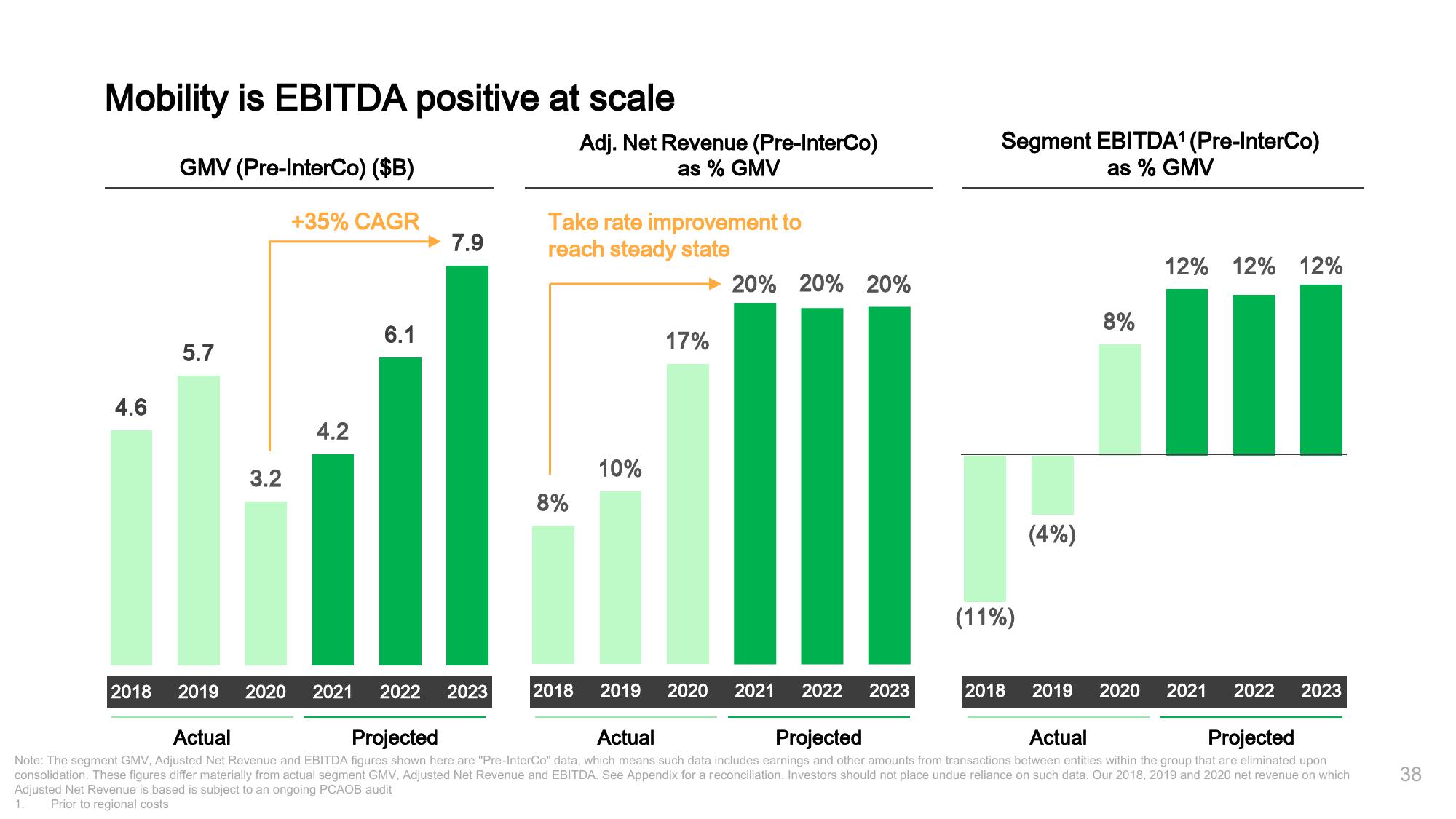

Mobility is EBITDA positive at scale

4.6

GMV (Pre-InterCo) ($B)

+35% CAGR

2018

5.7

3.2

4.2

6.1

7.9

2022 2023

Take rate improvement to

reach steady state

8%

Adj. Net Revenue (Pre-InterCo)

as % GMV

2018

10%

17%

2019

20% 20% 20%

2020 2021

Segment EBITDA¹ (Pre-InterCo)

as % GMV

2019 2020 2021

Projected

Actual

Projected

Actual

Projected

Actual

Note: The segment GMV, Adjusted Net Revenue and EBITDA figures shown here are "Pre-InterCo" data, which means such data includes earnings and other amounts from transactions between entities within the group that are eliminated upon

consolidation. These figures differ materially from actual segment GMV, Adjusted Net Revenue and EBITDA. See Appendix for a reconciliation. Investors should not place undue reliance on such data. Our 2018, 2019 and 2020 net revenue on which

Adjusted Net Revenue is based is subject to an ongoing PCAOB audit

1. Prior to regional costs

2022 2023

(11%)

(4%)

2018

8%

12% 12% 12%

2019 2020 2021

2022 2023

38View entire presentation