Embark SPAC Presentation Deck

Transaction

Overview

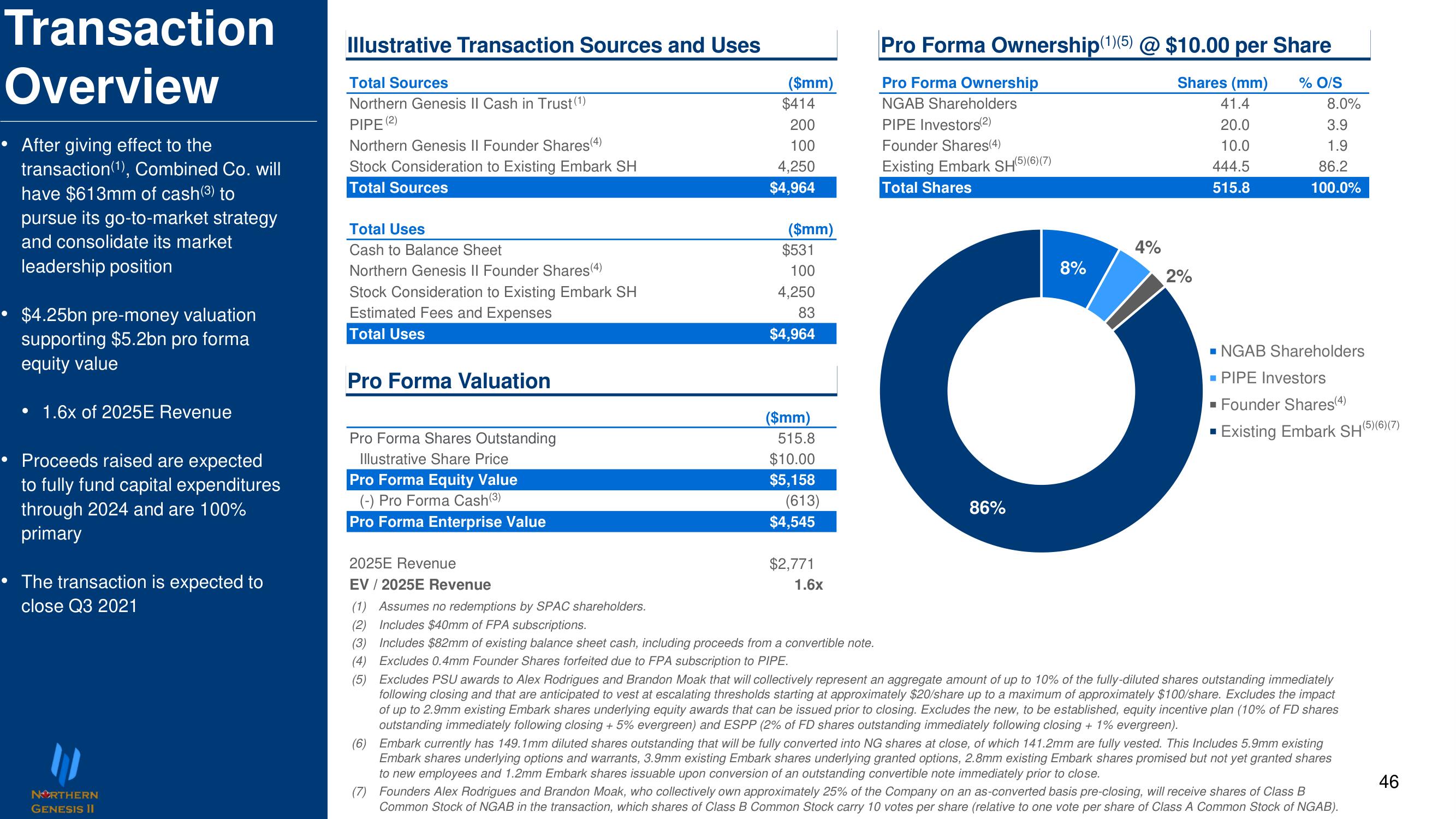

• After giving effect to the

transaction (1), Combined Co. will

have $613mm of cash (³) to

pursue its go-to-market strategy

and consolidate its market

leadership position

$4.25bn pre-money valuation

supporting $5.2bn pro forma

equity value

● 1.6x of 2025E Revenue

• Proceeds raised are expected

to fully fund capital expenditures

through 2024 and are 100%

primary

• The transaction is expected to

close Q3 2021

11

NORTHERN

GENESIS II

Illustrative Transaction Sources and Uses

Total Sources

Northern Genesis II Cash in Trust (1)

PIPE (2)

Northern Genesis II Founder Shares (4)

Stock Consideration to Existing Embark SH

Total Sources

Total Uses

Cash to Balance Sheet

Northern Genesis II Founder Shares(4)

Stock Consideration to Existing Embark SH

Estimated Fees and Expenses

Total Uses

Pro Forma Valuation

Pro Forma Shares Outstanding

Illustrative Share Price

Pro Forma Equity Value

(-) Pro Forma Cash (³)

Pro Forma Enterprise Value

($mm)

$414

200

100

4,250

$4,964

($mm)

$531

100

4,250

83

$4,964

($mm)

515.8

$10.00

$5,158

(613)

$4,545

$2,771

1.6x

Pro Forma Ownership(1)(5) @ $10.00 per Share

Pro Forma Ownership

Shares (mm)

41.4

NGAB Shareholders

PIPE Investors(2)

20.0

10.0

444.5

515.8

Founder Shares(4)

Existing Embark SH(5) (6) (7)

Total Shares

86%

8%

4%

2%

% O/S

■

8.0%

3.9

1.9

86.2

100.0%

▪ NGAB Shareholders

PIPE Investors

▪ Founder Shares(4)

Existing Embark SH (5)(6)(7)

2025E Revenue

EV / 2025E Revenue

(1) Assumes no redemptions by SPAC shareholders.

(2) Includes $40mm of FPA subscriptions.

(3) Includes $82mm of existing balance sheet cash, including proceeds from a convertible note.

(4) Excludes 0.4mm Founder Shares forfeited due to FPA subscription to PIPE.

(5)

Excludes PSU awards to Alex Rodrigues and Brandon Moak that will collectively represent an aggregate amount of up to 10% of the fully-diluted shares outstanding immediately

following closing and that are anticipated to vest at escalating thresholds starting at approximately $20/share up to a maximum of approximately $100/share. Excludes the impact

of up to 2.9mm existing Embark shares underlying equity awards that can be issued prior to closing. Excludes the new, to be established, equity incentive plan (10% of FD shares

outstanding immediately following closing + 5% evergreen) and ESPP (2% of FD shares outstanding immediately following closing + 1% evergreen).

(6) Embark currently has 149.1mm diluted shares outstanding that will be fully converted into NG shares at close, of which 141.2mm are fully vested. This Includes 5.9mm existing

Embark shares underlying options and warrants, 3.9mm existing Embark shares underlying granted options, 2.8mm existing Embark shares promised but not yet granted shares

to new employees and 1.2mm Embark shares issuable upon conversion of an outstanding convertible note immediately prior to close.

(7) Founders Alex Rodrigues and Brandon Moak, who collectively own approximately 25% of the Company on an as-converted basis pre-closing, will receive shares of Class B

Common Stock of NGAB in the transaction, which shares of Class B Common Stock carry 10 votes per share (relative to one vote per share of Class A Common Stock of NGAB).

46View entire presentation