Evercore Investment Banking Pitch Book

Confidential - Preliminary and Subject to Change

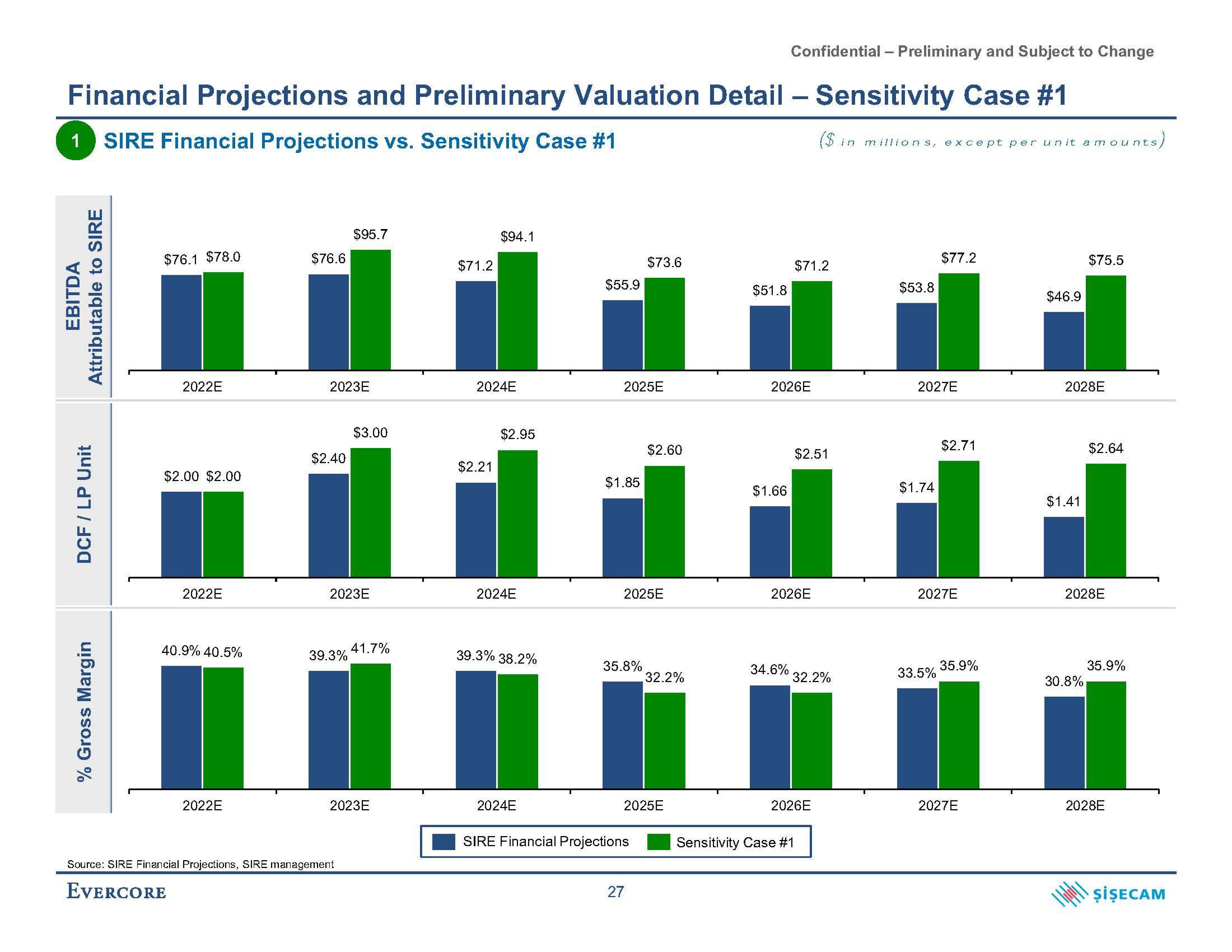

Financial Projections and Preliminary Valuation Detail - Sensitivity Case #1

1 SIRE Financial Projections vs. Sensitivity Case #1

($ in millions, except per unit amounts,

EBITDA

Attributable to SIRE

DCF / LP Unit

% Gross Margin

$76.1 $78.0

2022E

$2.00 $2.00

2022E

40.9% 40.5%

2022E

$76.6

2023E

$2.40

$95.7

39.3%

2023E

$3.00

Source: SIRE Financial Projections, SIRE management

EVERCORE

41.7%

2023E

$71.2

$94.1

2024E

$2.21

$2.95

2024E

39.3% 38.2%

2024E

$55.9

2025E

$1.85

35.8%

$73.6

2025E

SIRE Financial Projections

$2.60

27

2025E

32.2%

$51.8

2026E

$1.66

$71.2

34.6%

2026E

$2.51

32.2%

Sensitivity Case #1

2026E

$53.8

2027E

$1.74

$77.2

33.5%

$2.71

2027E

35.9%

2027E

$46.9

2028E

$1.41

$75.5

30.8%

$2.64

2028E

35.9%

2028E

ŞİŞECAMView entire presentation