Bank of America Investment Banking Pitch Book

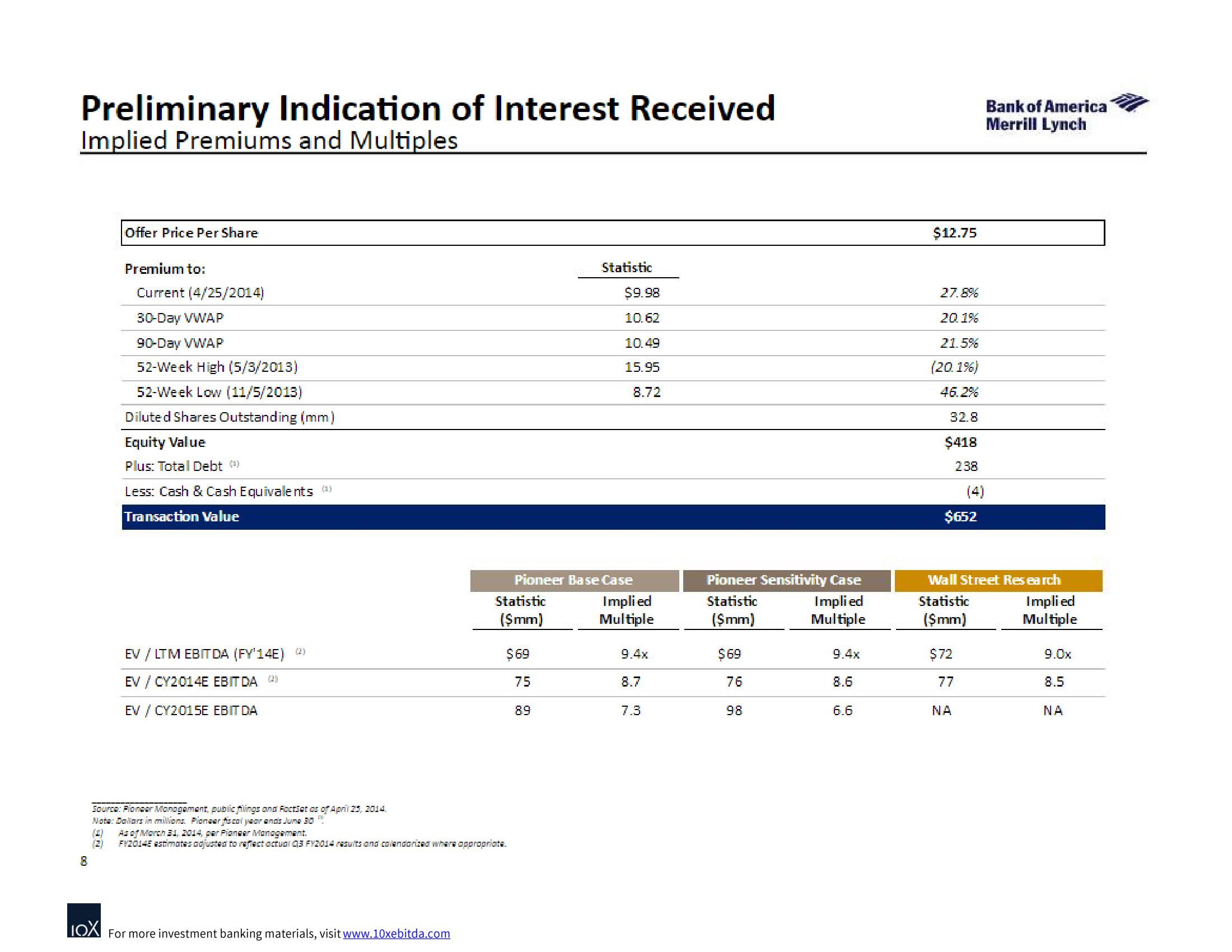

Preliminary Indication of Interest Received

Implied Premiums and Multiples

8

Offer Price Per Share

Premium to:

Current (4/25/2014)

30-Day VWAP

90-Day VWAP

52-Week High (5/3/2013)

52-Week Low (11/5/2013)

Diluted Shares Outstanding (mm)

Equity Value

Plus: Total Debt #¹)

Less: Cash & Cash Equivalents (²)

Transaction Value

EV / LTM EBITDA (FY'14E) (2)

EV / CY2014E EBITDA (2)

EV / CY2015E EBITDA

Source: Pioneer Management, publicfilings and FoctSet os of April 25, 2014.

Note: Dollars in millions. Pioneer fiscal year ands June 30

LOX For more investment banking materials, visit www.10xebitda.com

Statistic

($mm)

As of March 31, 2014, par Fionaer Management.

FY2014E estimates adjusted to reflect actual q3 FY2014 results and colandorized where appropriate.

$69

75

89

Statistic

Pioneer Base Case

$9.98

10.62

10.49

15.95

8.72

Implied

Multiple

9.4x

8.7

7.3

Pioneer Sensitivity Case

Statistic

Implied

($mm)

Multiple

$69

76

98

9.4x

8.6

6.6

$12.75

27.8%

20.1%

21.5%

(20.1%)

46.2%

32.8

$418

238

$652

Wall Street Research

Statistic

($mm)

$72

77

Bank of America

Merrill Lynch

NA

Implied

Multiple

9.0x

8.5

NAView entire presentation