SoftBank Results Presentation Deck

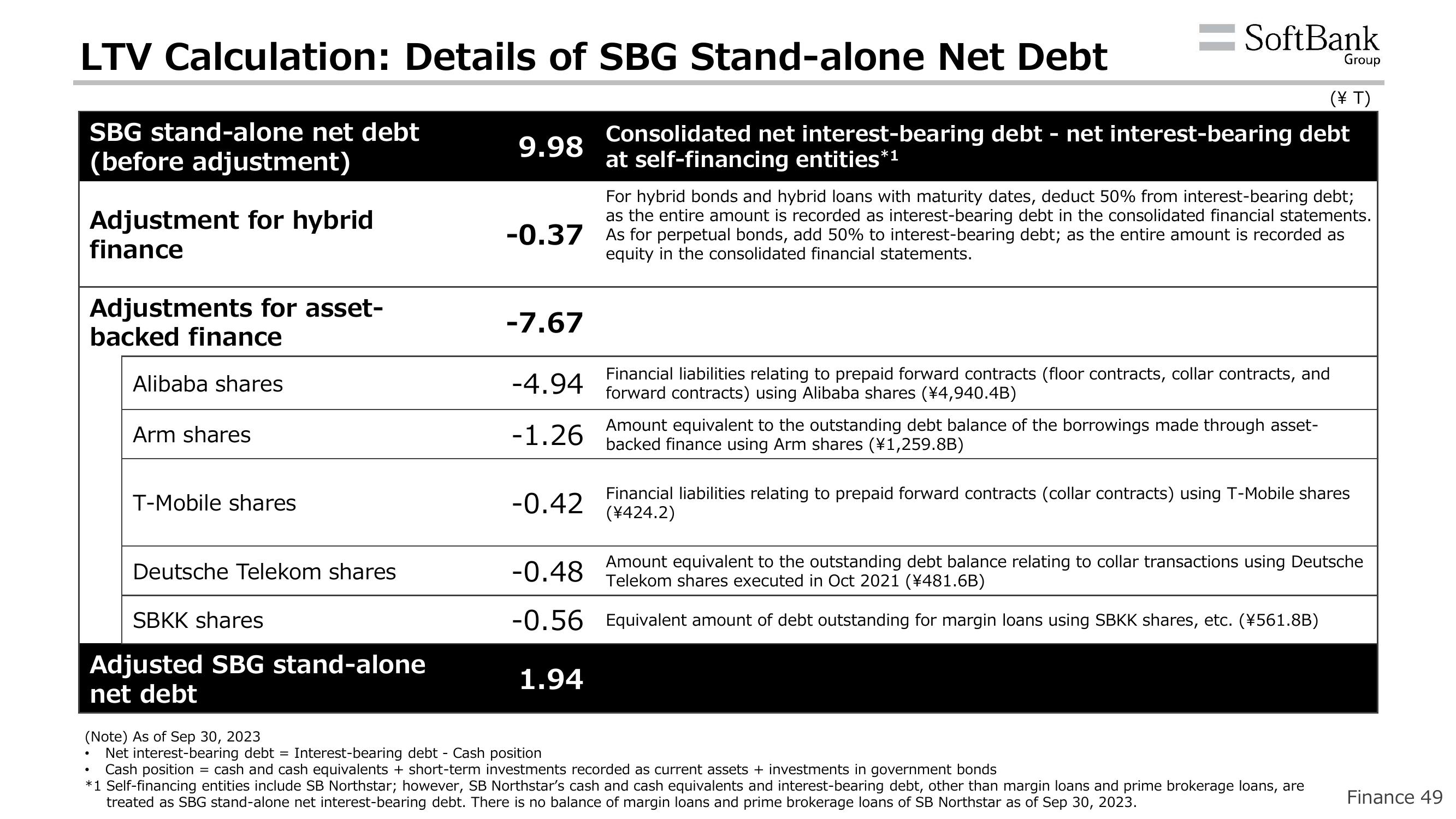

LTV Calculation: Details of SBG Stand-alone Net Debt

SBG stand-alone net debt

(before adjustment)

Adjustment for hybrid

finance

Adjustments for asset-

backed finance

Alibaba shares

Arm shares

T-Mobile shares

●

Deutsche Telekom shares

SBKK shares

Adjusted SBG stand-alone

net debt

9.98

(\ T)

Consolidated net interest-bearing debt - net interest-bearing debt

at self-financing entities*¹

For hybrid bonds and hybrid loans with maturity dates, deduct 50% from interest-bearing debt;

as the entire amount is recorded as interest-bearing debt in the consolidated financial statements.

-0.37 As for perpetual bonds, add 50% to interest-bearing debt; as the entire amount is recorded as

equity in the consolidated financial statements.

-7.67

-4.94

-1.26

-0.42

-0.48

-0.56

1.94

(Note) As of Sep 30, 2023

Net interest-bearing debt = Interest-bearing debt - Cash position

Cash position

=SoftBank

Financial liabilities relating to prepaid forward contracts (floor contracts, collar contracts, and

forward contracts) using Alibaba shares (¥4,940.4B)

Amount equivalent to the outstanding debt balance of the borrowings made through asset-

backed finance using Arm shares (¥1,259.8B)

Group

Financial liabilities relating to prepaid forward contracts (collar contracts) using T-Mobile shares

(¥424.2)

= cash and cash equivalents + short-term investments recorded as current assets + investments in government bonds

Amount equivalent to the outstanding debt balance relating to collar transactions using Deutsche

Telekom shares executed in Oct 2021 (¥481.6B)

Equivalent amount of debt outstanding for margin loans using SBKK shares, etc. (¥561.8B)

*1 Self-financing entities include SB Northstar; however, SB Northstar's cash and cash equivalents and interest-bearing debt, other than margin loans and prime brokerage loans, are

treated as SBG stand-alone net interest-bearing debt. There is no balance of margin loans and prime brokerage loans of SB Northstar as of Sep 30, 2023.

Finance 49View entire presentation