Silicon Valley Bank Results Presentation Deck

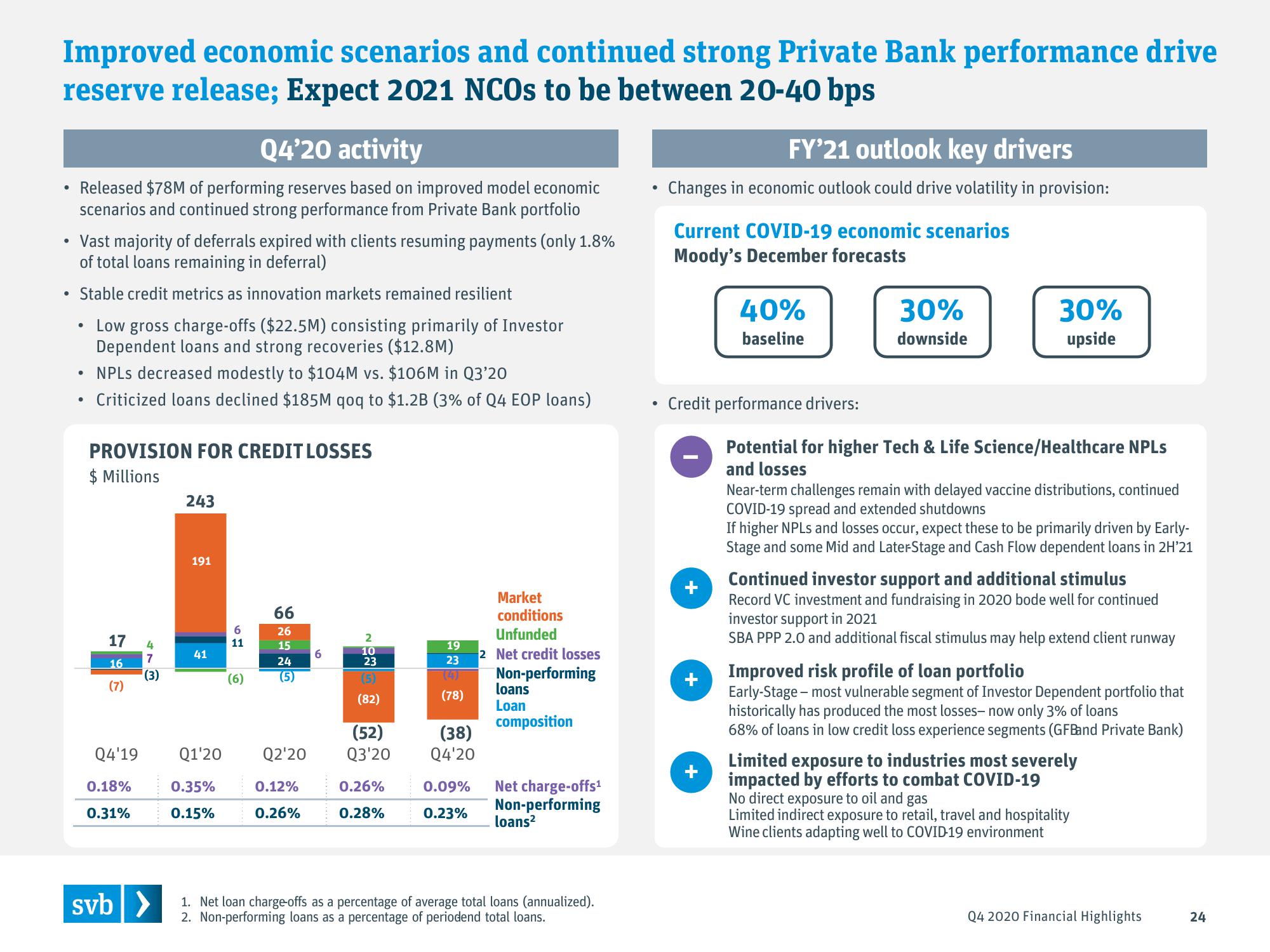

Improved economic scenarios and continued strong Private Bank performance drive

reserve release; Expect 2021 NCOs to be between 20-40 bps

Q4'20 activity

• Released $78M of performing reserves based on improved model economic

scenarios and continued strong performance from Private Bank portfolio

• Vast majority of deferrals expired with clients resuming payments (only 1.8%

of total loans remaining in deferral)

Stable credit metrics as innovation markets remained resilient

Low gross charge-offs ($22.5M) consisting primarily of Investor

Dependent loans and strong recoveries ($12.8M)

• NPLs decreased modestly to $104M vs. $106M in Q3'20

Criticized loans declined $185M qoq to $1.2B (3% of Q4 EOP loans)

●

●

●

PROVISION FOR CREDIT LOSSES

$ Millions

17

16

(7)

Q4'19

0.18%

0.31%

47

(3)

svb >

243

191

41

Q1'20

0.35%

0.15%

6

11

(6)

66

26

15

24

(5)

Q2'20

0.12%

0.26%

6

2

10

23

(5)

(82)

19

23

(78)

(52)

(38)

Q3'20 Q4'20

0.26%

0.28%

0.09%

0.23%

Market

conditions

Unfunded

2 Net credit losses

Non-performing

loans

Loan

composition

Net charge-offs¹

Non-performing

loans²

1. Net loan charge-offs as a percentage of average total loans (annualized).

2. Non-performing loans as a percentage of periodend total loans.

●

FY'21 outlook key drivers

Changes in economic outlook could drive volatility in provision:

Current COVID-19 economic scenarios

Moody's December forecasts

Credit performance drivers:

+

+

40%

baseline

+

30%

downside

30%

upside

Potential for higher Tech & Life Science/Healthcare NPLs

and losses

Near-term challenges remain with delayed vaccine distributions, continued

COVID-19 spread and extended shutdowns

If higher NPLs and losses occur, expect these to be primarily driven by Early-

Stage and some Mid and LaterStage and Cash Flow dependent loans in 2H'21

Continued investor support and additional stimulus

Record VC investment and fundraising in 2020 bode well for continued

investor support in 2021

SBA PPP 2.0 and additional fiscal stimulus may help extend client runway

Improved risk profile of loan portfolio

Early-Stage - most vulnerable segment of Investor Dependent portfolio that

historically has produced the most losses- now only 3% of loans

68% of loans in low credit loss experience segments (GFBand Private Bank)

Limited exposure to industries most severely

impacted by efforts to combat COVID-19

No direct exposure to oil and gas

Limited indirect exposure to retail, travel and hospitality

Wine clients adapting well to COVID-19 environment

Q4 2020 Financial Highlights

24View entire presentation