SoftBank Results Presentation Deck

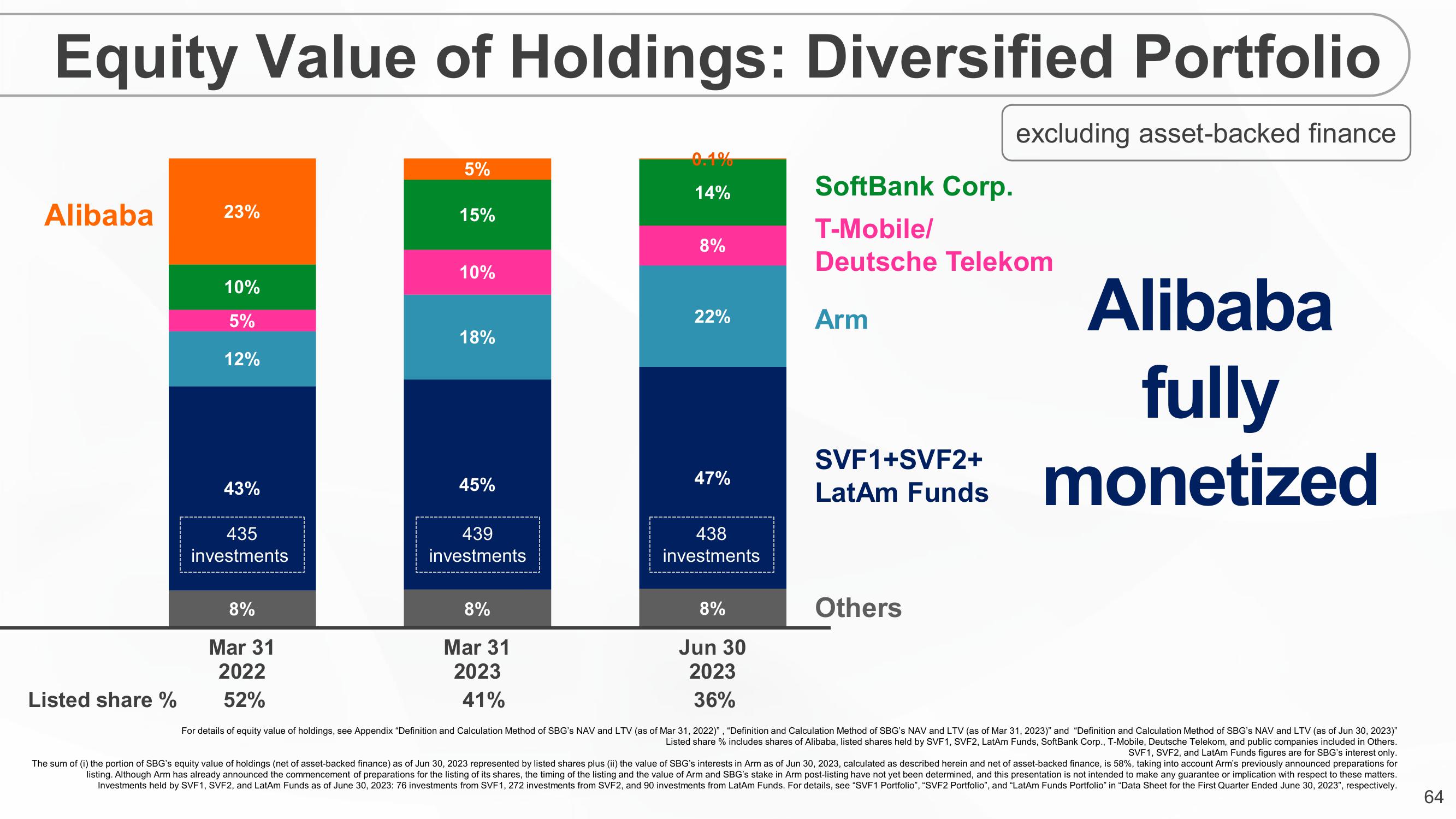

Equity Value of Holdings: Diversified Portfolio

Alibaba

23%

10%

5%

12%

43%

435

investments

8%

Mar 31

2022

52%

5%

15%

10%

18%

45%

439

investments

8%

Mar 31

2023

41%

0.1%

14%

8%

22%

47%

438

investments

8%

Jun 30

2023

36%

SoftBank Corp.

T-Mobile/

Deutsche Telekom

Arm

SVF1+SVF2+

LatAm Funds

excluding asset-backed finance

Others

Alibaba

fully

monetized

Listed share %

For details of equity value of holdings, see Appendix "Definition and Calculation Method of SBG's NAV and LTV (as of Mar 31, 2022)", "Definition and Calculation Method of SBG's NAV and LTV (as of Mar 31, 2023)" and "Definition and Calculation Method of SBG's NAV and LTV (as of Jun 30, 2023)"

Listed share % includes shares of Alibaba, listed shares held by SVF1, SVF2, LatAm Funds, SoftBank Corp., T-Mobile, Deutsche Telekom, and public companies included in Others.

SVF1, SVF2, and LatAm Funds figures are for SBG's interest only.

The sum of (i) the portion of SBG's equity value of holdings (net of asset-backed finance) as of Jun 30, 2023 represented by listed shares plus (ii) the value of SBG's interests in Arm as of Jun 30, 2023, calculated as described herein and net of asset-backed finance, is 58%, taking into account Arm's previously announced preparations for

listing. Although Arm has already announced the commencement of preparations for the listing of its shares, the timing of the listing and the value of Arm and SBG's stake in Arm post-listing have not yet been determined, and this presentation is not intended to make any guarantee or implication with respect to these matters.

Investments held by SVF1, SVF2, and LatAm Funds as of June 30, 2023: 76 investments from SVF1, 272 investments from SVF2, and 90 investments from LatAm Funds. For details, see "SVF1 Portfolio", "SVF2 Portfolio", and "LatAm Funds Portfolio" in "Data Sheet for the First Quarter Ended June 30, 2023", respectively.

64View entire presentation