Summit Hotel Properties Investor Presentation Deck

9

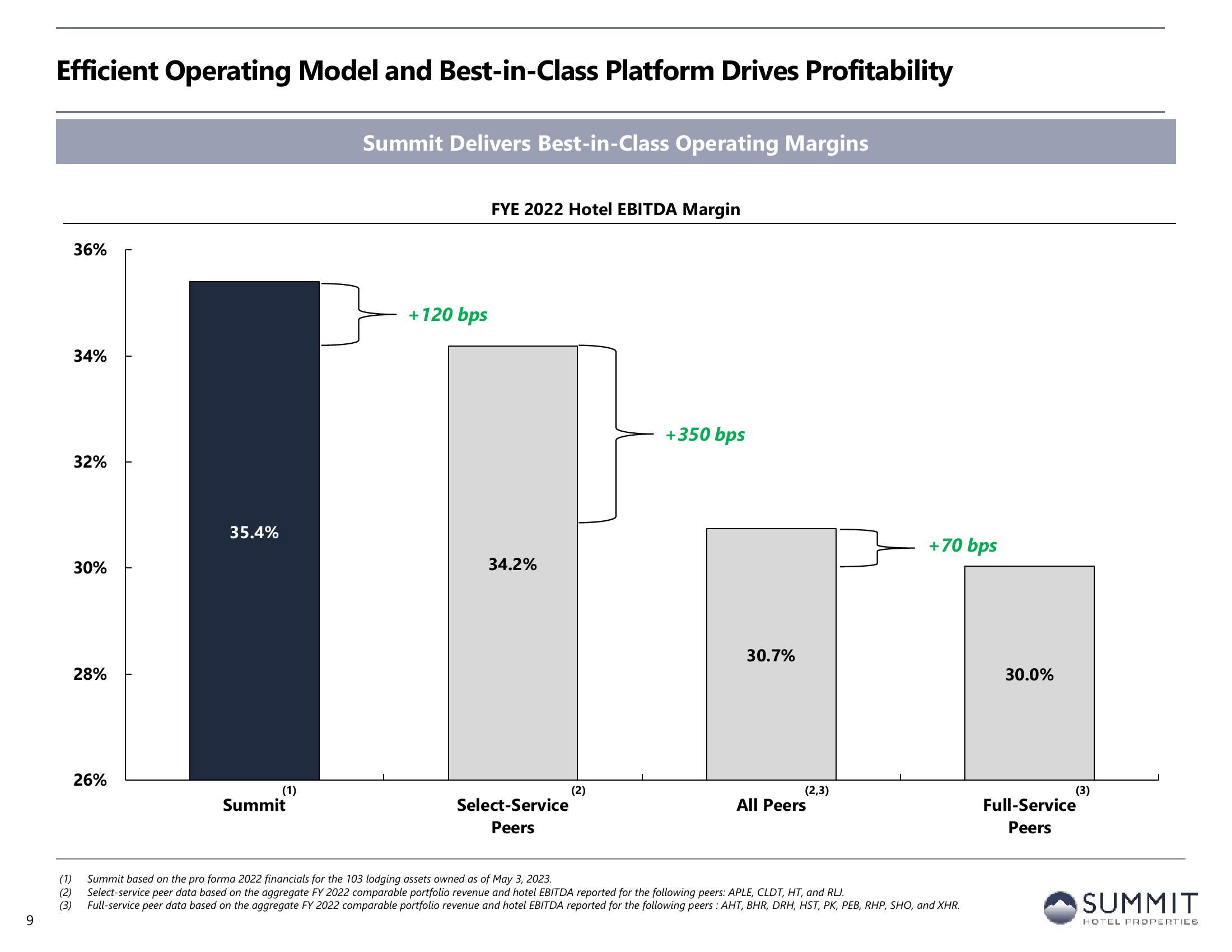

Efficient Operating Model and Best-in-Class Platform Drives Profitability

36%

34%

32%

30%

28%

26%

35.4%

(1)

Summit

Summit Delivers Best-in-Class Operating Margins

+120 bps

FYE 2022 Hotel EBITDA Margin

34.2%

Select-Service

Peers

(2)

+350 bps

30.7%

(2,3)

All Peers

+70 bps

(1) Summit based on the pro forma 2022 financials for the 103 lodging assets owned as of May 3, 2023.

(2) Select-service peer data based on the aggregate FY 2022 comparable portfolio revenue and hotel EBITDA reported for the following peers: APLE, CLDT, HT, and RLJ.

(3) Full-service peer data based on the aggregate FY 2022 comparable portfolio revenue and hotel EBITDA reported for the following peers: AHT, BHR, DRH, HST, PK, PEB, RHP, SHO, and XHR.

30.0%

(3)

Full-Service

Peers

SUMMIT

HOTEL PROPERTIESView entire presentation