Faraday Future Investor Presentation Deck

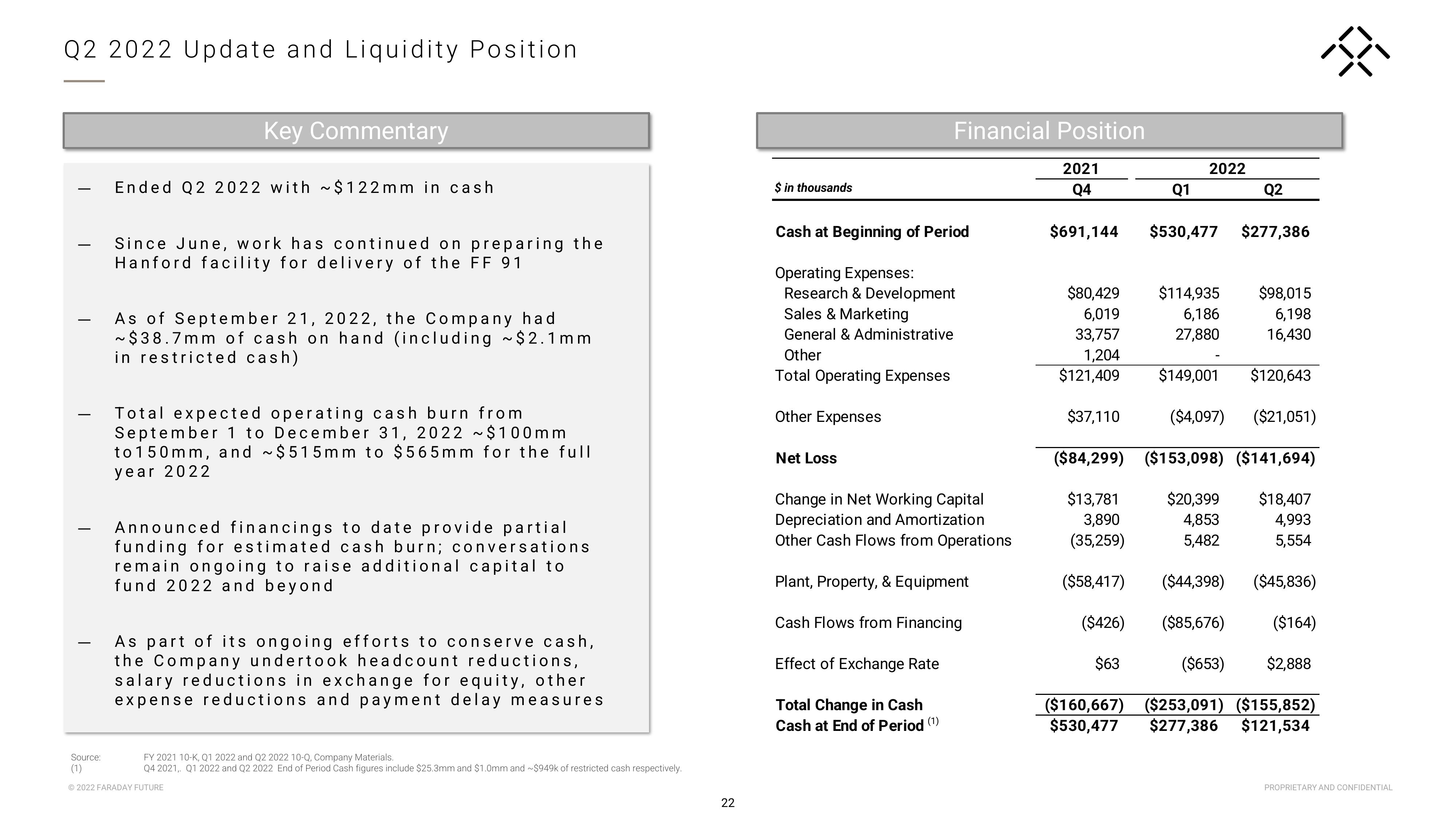

Q2 2022 Update and Liquidity Position

Source:

(1)

Key Commentary

Ended Q2 2022 with ~$122mm in cash

Since June, work has continued on preparing the

Hanford facility for delivery of the FF 91

As of September 21, 2022, the Company had

~$38.7mm of cash on hand (including ~$2.1mm

in restricted cash)

Total expected operating cash burn from

September 1 to December 31, 2022 ~$100mm

to 150mm, and ~$515mm to $565mm for the full

year 2022

Announced financings to date provide partial

funding for estimated cash burn; conversations

remain ongoing to raise additional capital to

fund 2022 and beyond

As part of its ongoing efforts to conserve cash,

the Company undertook headcount reductions,

salary reductions in exchange for equity, other

expense reductions and payment delay measures

FY 2021 10-K, Q1 2022 and Q2 2022 10-Q, Company Materials.

Q4 2021, Q1 2022 and Q2 2022 End of Period Cash figures include $25.3mm and $1.0mm and ~$949k of restricted cash respectively.

Ⓒ2022 FARADAY FUTURE

22

$ in thousands

Financial Position

2021

Q4

Cash at Beginning of Period

Operating Expenses:

Research & Development

Sales & Marketing

General & Administrative

Other

Total Operating Expenses

Other Expenses

Net Loss

Change in Net Working Capital

Depreciation and Amortization

Other Cash Flows from Operations

Plant, Property, & Equipment

Cash Flows from Financing

Effect of Exchange Rate

Total Change in Cash

Cash at End of Period (1)

$691,144

Q1

$80,429

6,019

33,757

1,204

$121,409

2022

Q2

$530,477 $277,386

$114,935 $98,015

6,186

6,198

16,430

27,880

$149,001 $120,643

$37,110

($4,097) ($21,051)

($84,299) ($153,098) ($141,694)

$13,781

$20,399 $18,407

4,853

3,890

4,993

5,554

(35,259)

5,482

($58,417)

($426)

$63

($44,398) ($45,836)

($85,676) ($164)

($653) $2,888

($160,667) ($253,091) ($155,852)

$530,477 $277,386 $121,534

8

PROPRIETARY AND CONFIDENTIALView entire presentation