jetBlue Investor Conference Presentation Deck

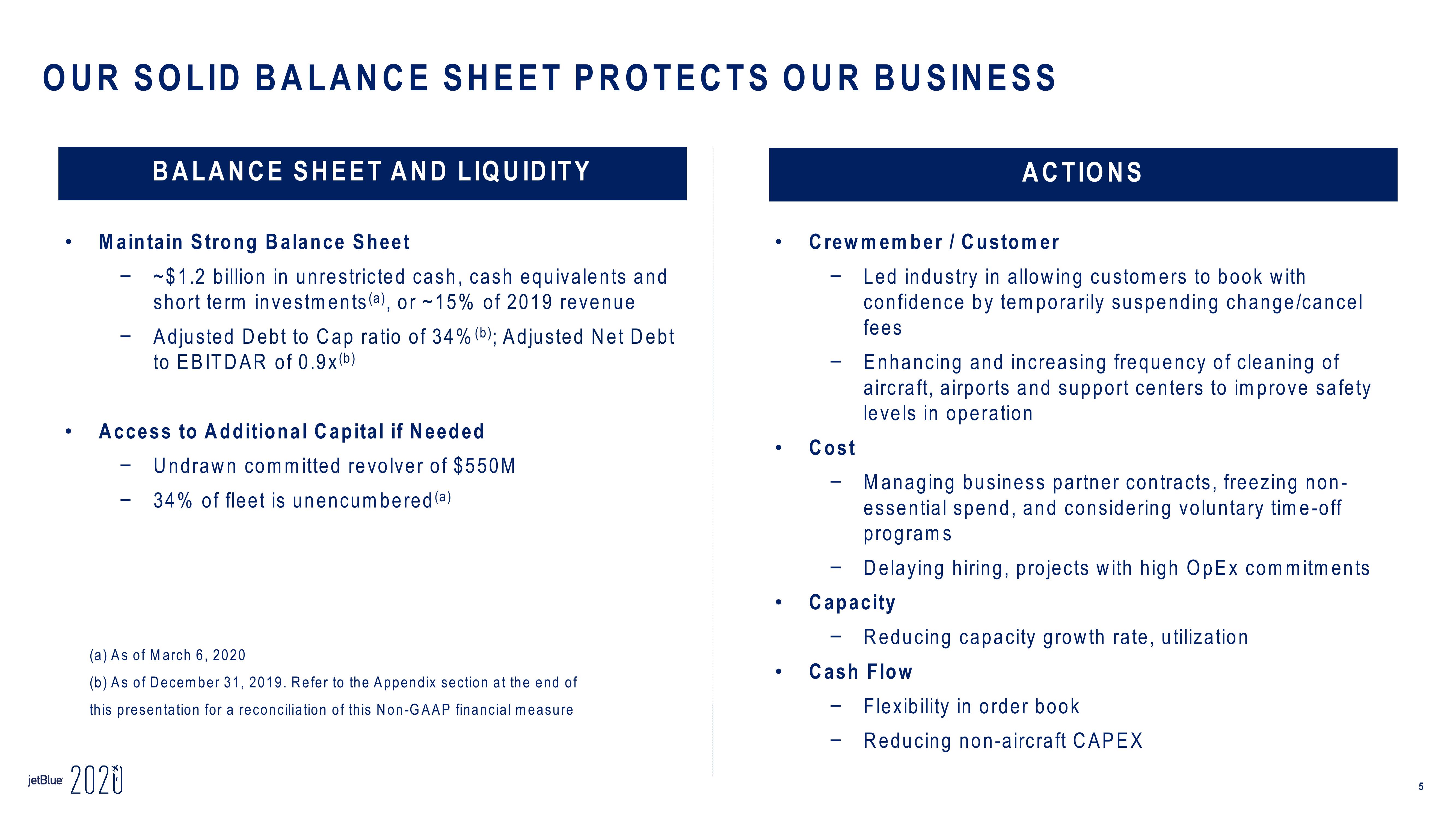

OUR SOLID BALANCE SHEET PROTECTS OUR BUSINESS

●

Maintain Strong Balance Sheet

-

-

BALANCE SHEET AND LIQUIDITY

-

-$1.2 billion in unrestricted cash, cash equivalents and

short term investments (a), or ~15% of 2019 revenue

Access to Additional Capital if Needed

Undrawn committed revolver of $550M

34% of fleet is unencumbered(a)

jetBlue 2020

Adjusted Debt to Cap ratio of 34% (b); Adjusted Net Debt

to EBITDAR of 0.9x(b)

(a) As of March 6, 2020

(b) As of December 31, 2019. Refer to the Appendix section at the end of

this presentation for a reconciliation of this Non-GAAP financial measure

●

●

Crewmember / Customer

-

Cost

ACTIONS

Led industry in allowing customers to book with

confidence by temporarily suspending change/cancel

fees

Enhancing and increasing frequency of cleaning of

aircraft, airports and support centers to improve safety

levels in operation

Capacity

-

Managing business partner contracts, freezing non-

essential spend, and considering voluntary time-off

programs

Delaying hiring, projects with high OpEx commitments

Cash Flow

Reducing capacity growth rate, utilization

Flexibility in order book

- Reducing non-aircraft CAPEX

5View entire presentation