Kinnevik Results Presentation Deck

Intro

FINANCIAL REVIEW

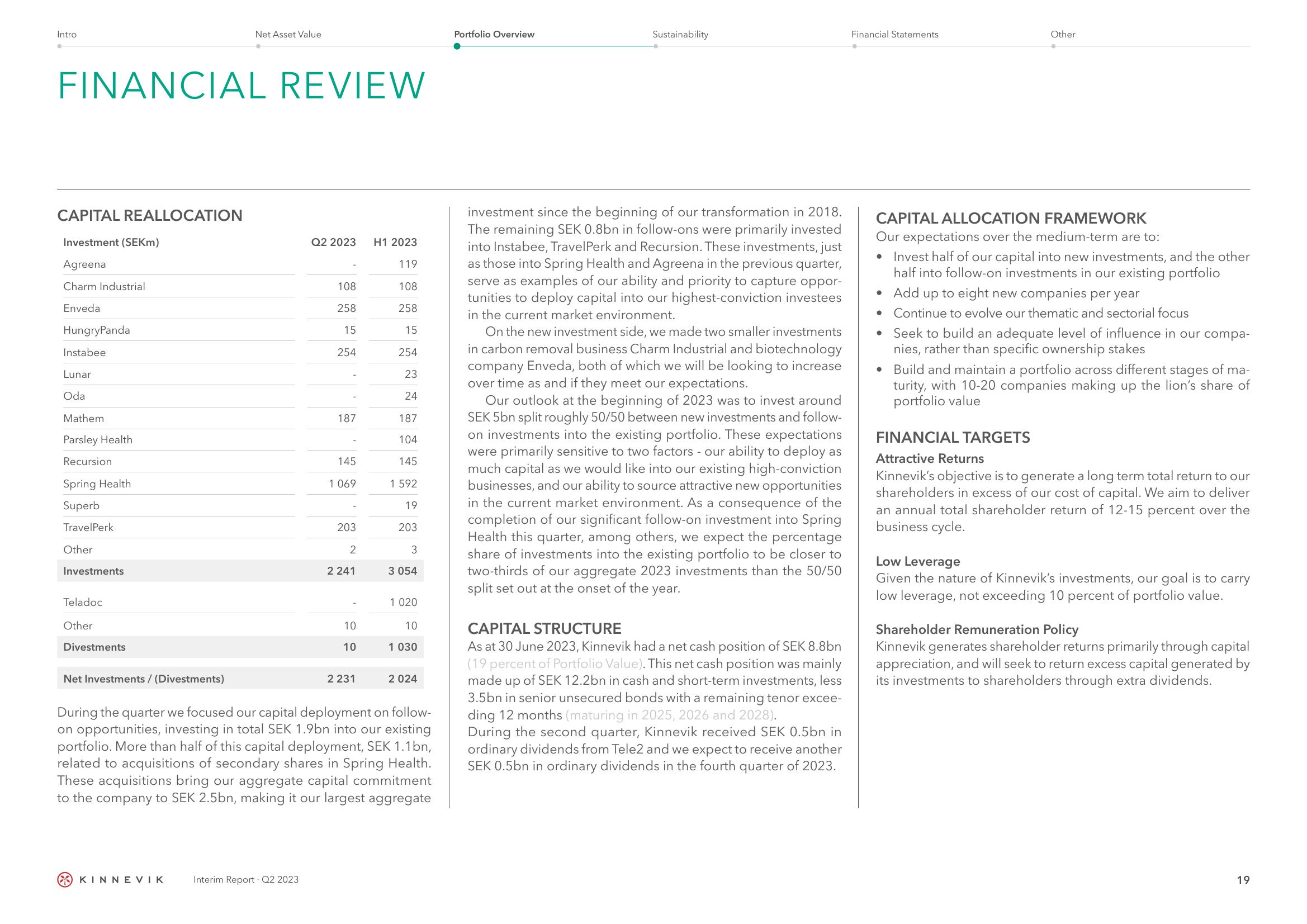

CAPITAL REALLOCATION

Investment (SEKm)

Agreena

Charm Industrial

Enveda

HungryPanda

Instabee

Lunar

Oda

Mathem

Parsley Health

Recursion

Spring Health

Superb

TravelPerk

Other

Investments

Teladoc

Other

Divestments

Net Investments / (Divestments)

Net Asset Value

KINNEVIK

Q2 2023

Interim Report Q2 2023

108

258

15

254

187

145

1 069

203

2

2 241

10

10

2 231

H1 2023

119

108

258

15

254

23

24

187

104

145

1 592

19

203

3

3 054

1 020

10

1 030

During the quarter we focused our capital deployment on follow-

on opportunities, investing in total SEK 1.9bn into our existing

portfolio. More than half of this capital deployment, SEK 1.1bn,

related to acquisitions of secondary shares in Spring Health.

These acquisitions bring our aggregate capital commitment

to the company to SEK 2.5bn, making it our largest aggregate

2 024

Portfolio Overview

Sustainability

investment since the beginning of our transformation in 2018.

The remaining SEK 0.8bn in follow-ons were primarily invested

into Instabee, TravelPerk and Recursion. These investments, just

as those into Spring Health and Agreena in the previous quarter,

serve as examples of our ability and priority to capture oppor-

tunities to deploy capital into our highest-conviction investees

in the current market environment.

On the new investment side, we made two smaller investments

in carbon removal business Charm Industrial and biotechnology

company Enveda, both of which we will be looking to increase

over time as and if they meet our expectations.

Our outlook at the beginning of 2023 was to invest around

SEK 5bn split roughly 50/50 between new investments and follow-

on investments into the existing portfolio. These expectations

were primarily sensitive to two factors - our ability to deploy as

much capital as we would like into our existing high-conviction

businesses, and our ability to source attractive new opportunities

in the current market environment. As a consequence of the

completion of our significant follow-on investment into Spring

Health this quarter, among others, we expect the percentage

share of investments into the existing portfolio to be closer to

two-thirds of our aggregate 2023 investments than the 50/50

split set out at the onset of the year.

CAPITAL STRUCTURE

As at 30 June 2023, Kinnevik had a net cash position of SEK 8.8bn

(19 percent of Portfolio Value). This net cash position was mainly

made up of SEK 12.2bn in cash and short-term investments, less

3.5bn in senior unsecured bonds with a remaining tenor excee-

ding 12 months (maturing in 2025, 2026 and 2028).

During the second quarter, Kinnevik received SEK 0.5bn in

ordinary dividends from Tele2 and we expect to receive another

SEK 0.5bn in ordinary dividends in the fourth quarter of 2023.

Financial Statements

Other

CAPITAL ALLOCATION FRAMEWORK

Our expectations over the medium-term are to:

Invest half of our capital into new investments, and the other

half into follow-on investments in our existing portfolio

• Add up to eight new companies per year

• Continue to evolve our thematic and sectorial focus

Seek to build an adequate level of influence in our compa-

nies, rather than specific ownership stakes

Build and maintain a portfolio across different stages of ma-

turity, with 10-20 companies making up the lion's share of

portfolio value

FINANCIAL TARGETS

Attractive Returns

Kinnevik's objective is to generate a long term total return to our

shareholders in excess of our cost of capital. We aim to deliver

an annual total shareholder return of 12-15 percent over the

business cycle.

Low Leverage

Given the nature of Kinnevik's investments, our goal is to carry

low leverage, not exceeding 10 percent of portfolio value.

Shareholder Remuneration Policy

Kinnevik generates shareholder returns primarily through capital

appreciation, and will seek to return excess capital generated by

its investments to shareholders through extra dividends.

19View entire presentation