Bank of America Investment Banking Pitch Book

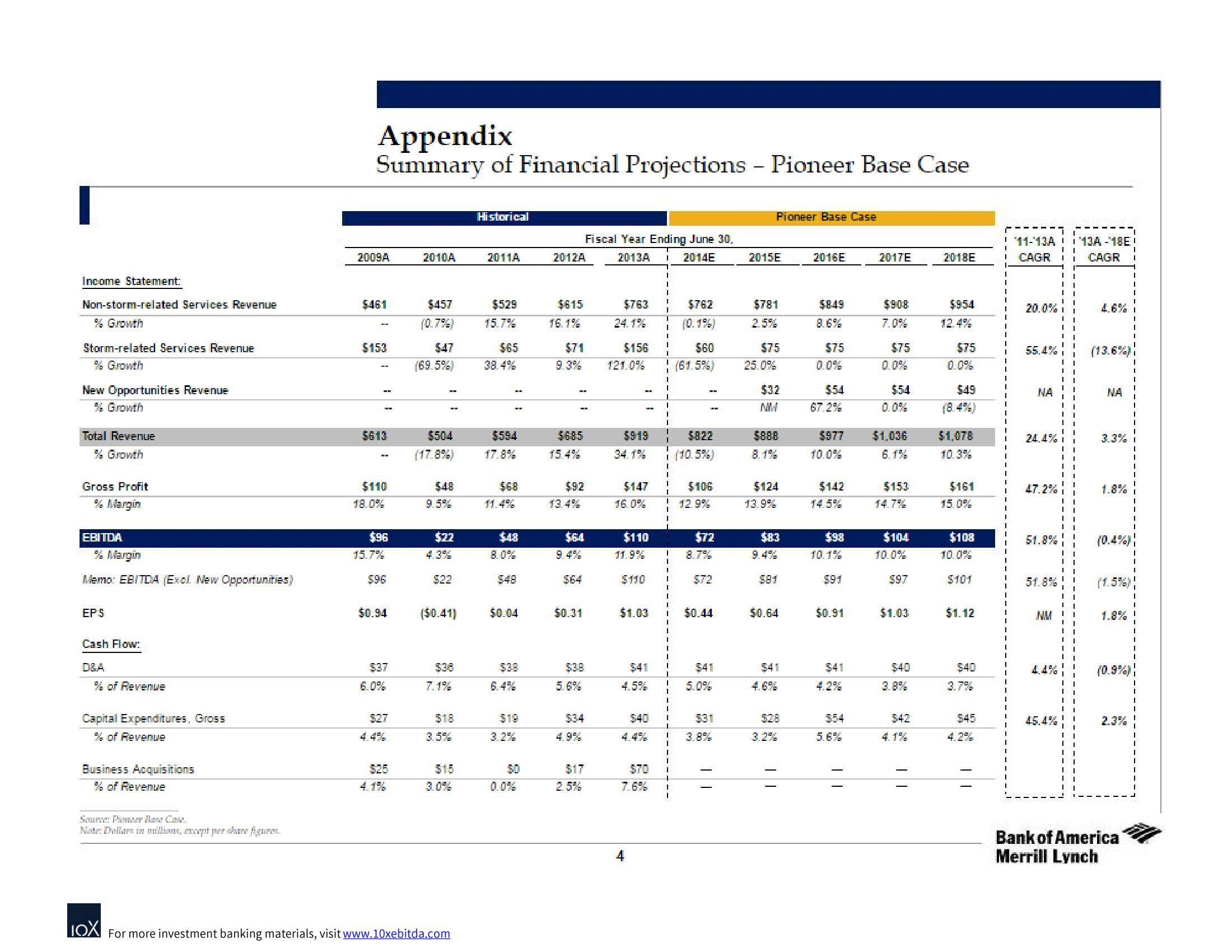

Income Statement:

Non-storm-related Services Revenue

% Growth

Storm-related Services Revenue

% Growth

New Opportunities Revenue

% Growth

Total Revenue

% Growth

Gross Profit

% Margin

EBITDA

% Margin

Memo: EBITDA (Excl New Opportunities)

EPS

Cash Flow:

D&A

% of Revenue

Capital Expenditures, Gross

% of Revenue

Business Acquisitions

% of Revenue

Source Pioneer Dase Case.

Note: Dollars in millions, except per share figures.

Appendix

Summary of Financial Projections - Pioneer Base Case

2009A

$461

$153

$613

$110

$96

15.7%

$96

$0.94

$37

$27

$25

4.1%

2010A

$457

(0.7%)

$47

(69.5%)

$504

(17.8%)

$48

9.5%

$22

4.3%

522

7.1%

$18

3.5%

$15

Historical

LOX For more investment banking materials, visit www.10xebitda.com

2011A

$529

15.7%

$65

38.4%

($0.41) $0.04

$594

17.8%

$68

11.4%

$48

$48

$38

$19

0.0%

2012A

$615

16.1%

$685

$156

$71

9.3% 121.0%

15.4%

$92

13.4%

$64

$0.31

Fiscal Year Ending June 30,

2013A

2014E

5.6%

4.9%

$17

2.5%

$763

24.1%

$147

16.0%

$110

11.9%

$919

$822

34.1% (10.5%)

$110

$1.03

$41

4.5%

I

I

$70

7.6%

4

I

I

1

I

I

1

I

I

I

$40 I

1

$762

(0.1%)

I

I

$60

(61.5%)

$106

$72

8.7%

$72

$0.44

$41

5.0%

$31

3.8%

||

2015E

$781

Pioneer Base Case

$7.5

25.0%

$32

$888

8.1%

$124

13.9%

$8:3

581

$0.64

$41

3.2%

||

2016E

$8.49

$75

$54

67.2%

10.0%

$142

$977 $1,036

6.1%

14.5%

$98

10.1%

591

$0.91

$54

5.6%

2017E

||

$908

$75

0.0%

$54

$153

14.7%

$104

$97

$1.03

4.1%

2018E

$954

12.4%

$75

0.0%

$49

(8.4%)

$1,078

10.3%

$161

15.0%

$108

10.0%

$101

$1.12

$40

3.7%

$45

4.2%

||

11-13A 13A-18E

I CAGR

CAGR

20.0%

55.4%

NA

24.4%

47.2%

51.8%

51.8%

NM

(13.6%

NA

(1.5%)

(0.9%)

2.3%

Bank of America

Merrill Lynch

IView entire presentation