3Q20 Earnings Call Presentation

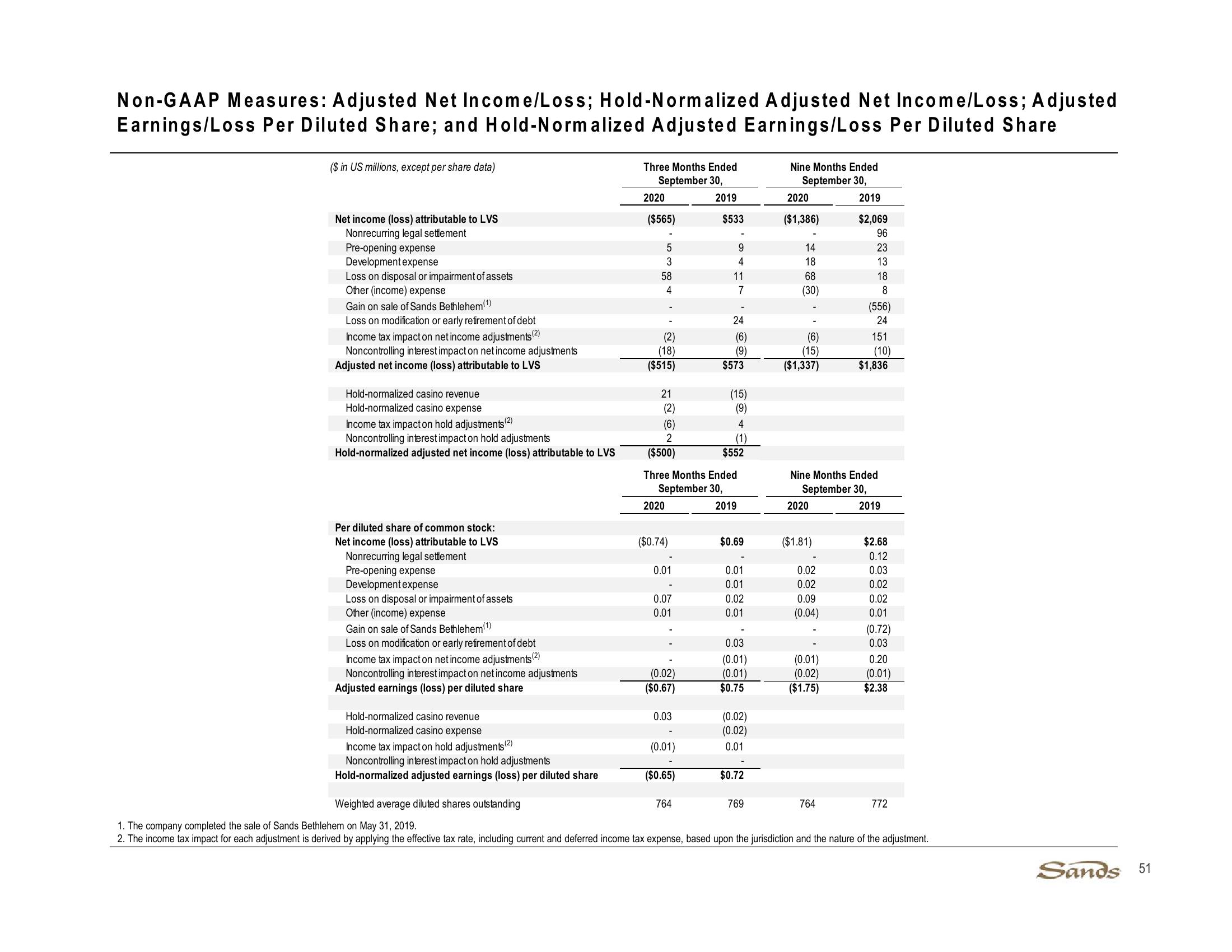

Non-GAAP Measures: Adjusted Net Income/Loss; Hold-Normalized Adjusted Net Income/Loss; Adjusted

Earnings/Loss Per Diluted Share; and Hold-Normalized Adjusted Earnings/Loss Per Diluted Share

($ in US millions, except per share data)

Nine Months Ended

Net income (loss) attributable to LVS

Nonrecurring legal settlement

Pre-opening expense

Development expense

Loss on disposal or impairment of assets

Other (income) expense

Gain on sale of Sands Bethlehem (1)

Loss on modification or early retirement of debt

Income tax impact on net income adjustments (2)

Noncontrolling interest impact on net income adjustments

Adjusted net income (loss) attributable to LVS

Hold-normalized casino revenue

Three Months Ended

September 30,

September 30,

2020

2019

2020

2019

($565)

$533

($1,386)

$2,069

96

5

9

3

4

18

58

11

100%

14

23

13

68

18

4

7

(30)

8

(556)

24

24

(2)

(6)

(6)

151

(18)

(9)

(15)

(10)

($515)

$573

($1,337)

$1,836

21

(15)

(2)

(9)

(6)

4

2

(1)

($500)

$552

Hold-normalized casino expense

Income tax impact on hold adjustments(2)

Noncontrolling interest impact on hold adjustments

Hold-normalized adjusted net income (loss) attributable to LVS

Three Months Ended

Nine Months Ended

September 30,

September 30,

2020

2019

2020

2019

Per diluted share of common stock:

Net income (loss) attributable to LVS

Nonrecurring legal settlement

($0.74)

$0.69

($1.81)

$2.68

0.12

Pre-opening expense

0.01

0.01

0.02

0.03

Development expense

0.01

0.02

0.02

Loss on disposal or impairment of assets

0.07

0.02

0.09

0.02

Other (income) expense

0.01

0.01

(0.04)

0.01

Gain on sale of Sands Bethlehem (1)

(0.72)

Loss on modification or early retirement of debt

0.03

0.03

Income tax impact on net income adjustments (2)

(0.01)

(0.01)

0.20

Noncontrolling interest impact on net income adjustments

(0.02)

(0.01)

(0.02)

(0.01)

Adjusted earnings (loss) per diluted share

($0.67)

$0.75

($1.75)

$2.38

Hold-normalized casino revenue

0.03

(0.02)

Hold-normalized casino expense

(0.02)

Income tax impact on hold adjustments (2)

(0.01)

0.01

Noncontrolling interest impact on hold adjustments

Hold-normalized adjusted earnings (loss) per diluted share

($0.65)

$0.72

Weighted average diluted shares outstanding

764

769

764

772

12

1. The company completed the sale of Sands Bethlehem on May 31, 2019.

2. The income tax impact for each adjustment is derived by applying the effective tax rate, including current and deferred income tax expense, based upon the jurisdiction and the nature of the adjustment.

Sands 51View entire presentation