J.P.Morgan 2Q23 Investor Results

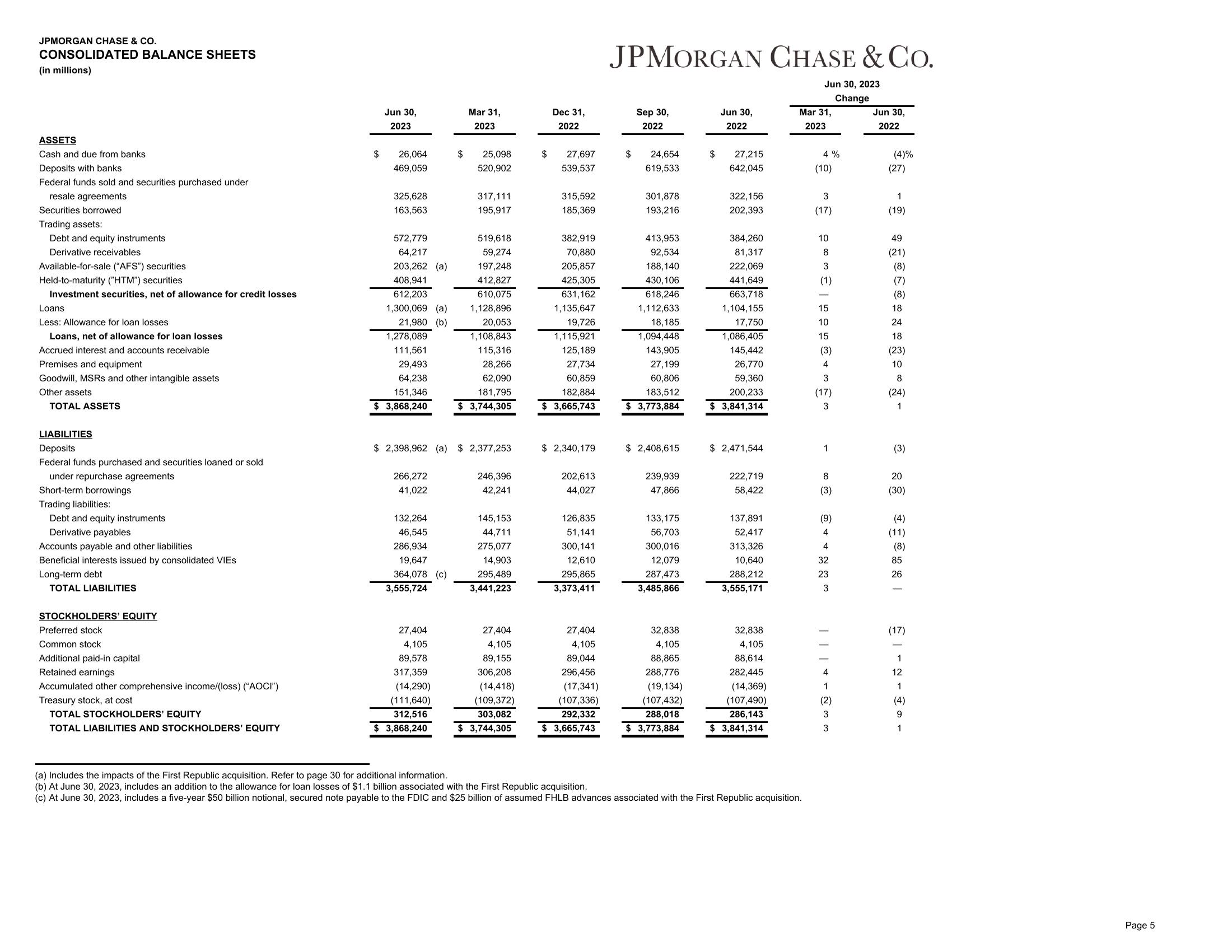

JPMORGAN CHASE & CO.

CONSOLIDATED BALANCE SHEETS

(in millions)

ASSETS

Cash and due from banks

Deposits with banks

Federal funds sold and securities purchased under

resale agreements

Securities borrowed

Trading assets:

Debt and equity instruments

Derivative receivables

Available-for-sale ("AFS") securities

Held-to-maturity ("HTM") securities

Investment securities, net of allowance for credit losses

Loans

Less: Allowance for loan losses

Loans, net of allowance for loan losses

Accrued interest and accounts receivable

Premises and equipment

Goodwill, MSRs and other intangible assets

Other assets

TOTAL ASSETS

LIABILITIES

Deposits

Federal funds purchased and securities loaned or sold

under repurchase agreements

Short-term borrowings

Trading liabilities:

Debt and equity instruments

Derivative payables

Accounts payable and other liabilities

Beneficial interests issued by consolidated VIES

Long-term debt

TOTAL LIABILITIES

STOCKHOLDERS' EQUITY

Preferred stock

Common stock

Additional paid-in capital

Retained earnings

Accumulated other comprehensive income/(loss) ("AOCI")

Treasury stock, at cost

TOTAL STOCKHOLDERS' EQUITY

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

$

Jun 30,

2023

26,064

469,059

325,628

163,563

572,779

64,217

203,262 (a)

408,941

612,203

1,300,069 (a)

21,980 (b)

1,278,089

111,561

29,493

64,238

151,346

$ 3,868,240

266,272

41,022

132,264

46,545

286,934

19,647

364,078 (c)

3,555,724

$

27,404

4,105

89,578

317,359

(14,290)

(111,640)

312,516

$ 3,868,240

Mar 31,

2023

$ 2,398,962 (a) $ 2,377,253

25,098

520,902

317,111

195,917

519,618

59,274

197,248

412,827

610,075

1,128,896

20,053

1,108,843

115,316

28,266

62,090

181,795

$ 3,744,305

246,396

42,241

145,153

44,711

275,077

14,903

295,489

3,441,223

27,404

4,105

89,155

306,208

(14,418)

(109,372)

303,082

$ 3,744,305

$

Dec 31,

2022

27,697

539,537

315,592

185,369

382,919

70,880

205,857

425,305

631,162

1,135,647

19,726

1,115,921

125,189

27,734

60,859

182,884

$ 3,665,743

$ 2,340,179

202,613

44,027

126,835

51,141

300,141

12,610

295,865

3,373,411

27,404

4,105

89,044

296,456

(17,341)

(107,336)

292,332

$ 3,665,743

JPMORGAN CHASE & CO.

Jun 30, 2023

Change

$

Sep 30,

2022

24,654

619,533

301,878

193,216

413,953

92,534

188,140

430,106

618,246

1,112,633

18,185

1,094,448

143,905

27,199

60,806

183,512

$ 3,773,884

$ 2,408,615

239,939

47,866

133,175

56,703

300,016

12,079

287,473

3,485,866

32,838

4,105

88,865

288,776

(19,134)

(107,432)

288,018

$ 3,773,884

$

Jun 30,

2022

27,215

642,045

322,156

202,393

384,260

81,317

222,069

441,649

663,718

1,104,155

17,750

1,086,405

145,442

26,770

59,360

200,233

$ 3,841,314

$ 2,471,544

222,719

58,422

137,891

52,417

313,326

10,640

288,212

3,555,171

32,838

4,105

88,614

282,445

(14,369)

(107,490)

286,143

$ 3,841,314

Mar 31,

2023

(a) Includes the impacts of the First Republic acquisition. Refer to page 30 for additional information.

(b) At June 30, 2023, includes an addition to the allowance for loan losses of $1.1 billion associated with the First Republic acquisition.

(c) At June 30, 2023, includes a five-year $50 billion notional, secured note payable to the FDIC and $25 billion of assumed FHLB advances associated with the First Republic acquisition.

4%

(10)

3

(17)

W WA @JO

(17)

1

8

(3)

(9)

4

4

32

23

3

w w ÑAT

(2)

Jun 30,

2022

(4)%

(27)

1

(19)

49

(21)

(8)

(7)

(8)

18

24

18

(23)

10

8

(24)

1

(3)

20

(30)

(4)

(11)

(8)

85

26

(17)

1

12

1

(4)

9

1

Page 5View entire presentation