Truist Financial Corp Results Presentation Deck

Net interest income & net interest margin

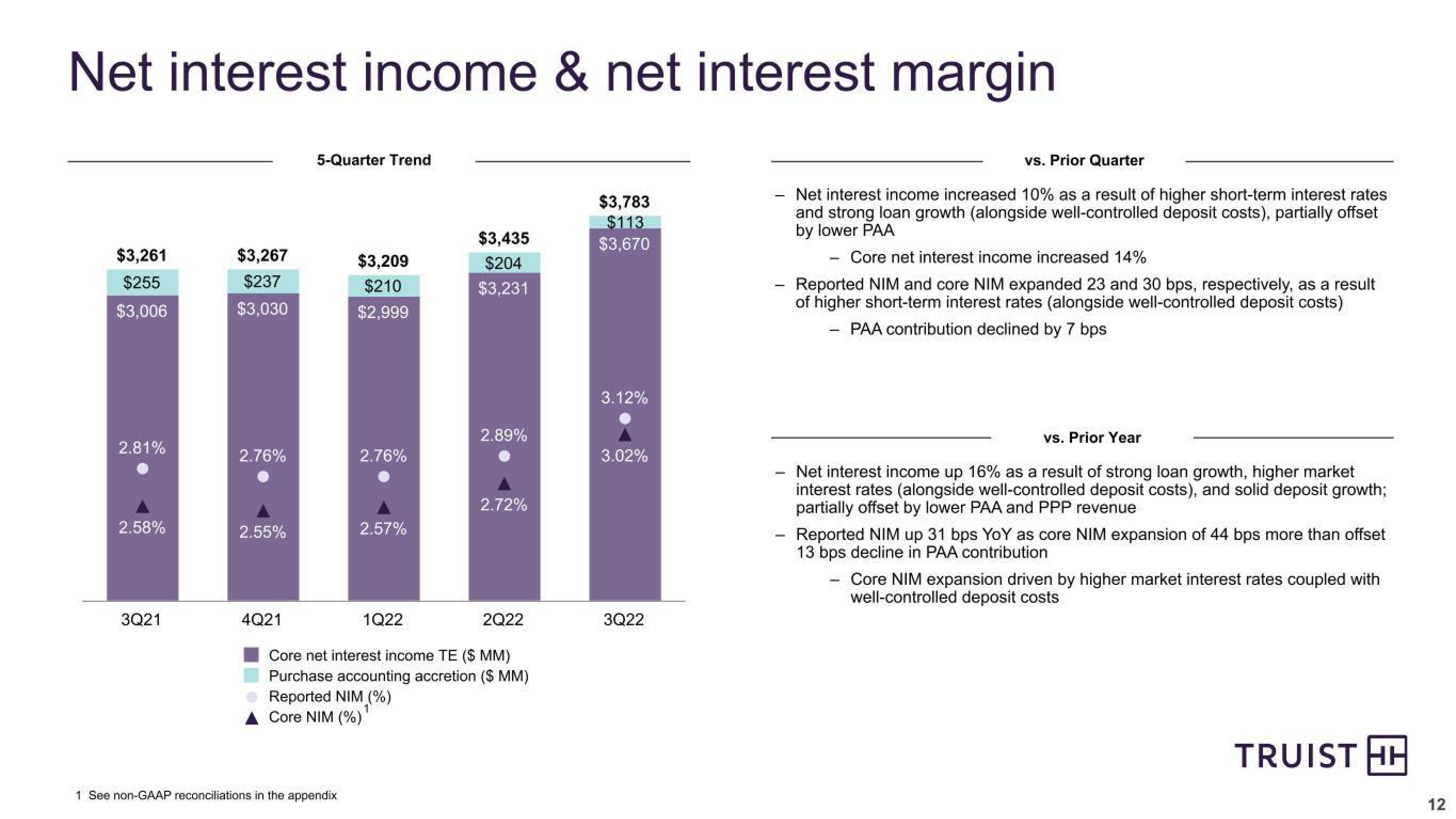

$3,261

$255

$3,006

2.81%

2.58%

3Q21

$3,267

$237

$3,030

2.76%

2.55%

4Q21

5-Quarter Trend

$3,209

$210

$2,999

1 See non-GAAP reconciliations in the appendix

2.76%

2.57%

1Q22

$3,435

$204

$3,231

2.89%

2.72%

2Q22

Core net interest income TE ($ MM)

Purchase accounting accretion ($ MM)

Reported NIM (%)

1

Core NIM (%)

$3,783

$113

$3,670

3.12%

3.02%

3Q22

-

vs. Prior Quarter

Net interest income increased 10% as a result of higher short-term interest rates

and strong loan growth (alongside well-controlled deposit costs), partially offset

by lower PAA

Core net interest income increased 14%

Reported NIM and core NIM expanded 23 and 30 bps, respectively, as a result

of higher short-term interest rates (alongside well-controlled deposit costs)

PAA contribution declined by 7 bps

-

vs. Prior Year

Net interest income up 16% as a result of strong loan growth, higher market

interest rates (alongside well-controlled deposit costs), and solid deposit growth;

partially offset by lower PAA and PPP revenue

Reported NIM up 31 bps YoY as core NIM expansion of 44 bps more than offset

13 bps decline in PAA contribution

-

Core NIM expansion driven by higher market interest rates coupled with

well-controlled deposit costs

TRUIST HH

12View entire presentation