Lyft Results Presentation Deck

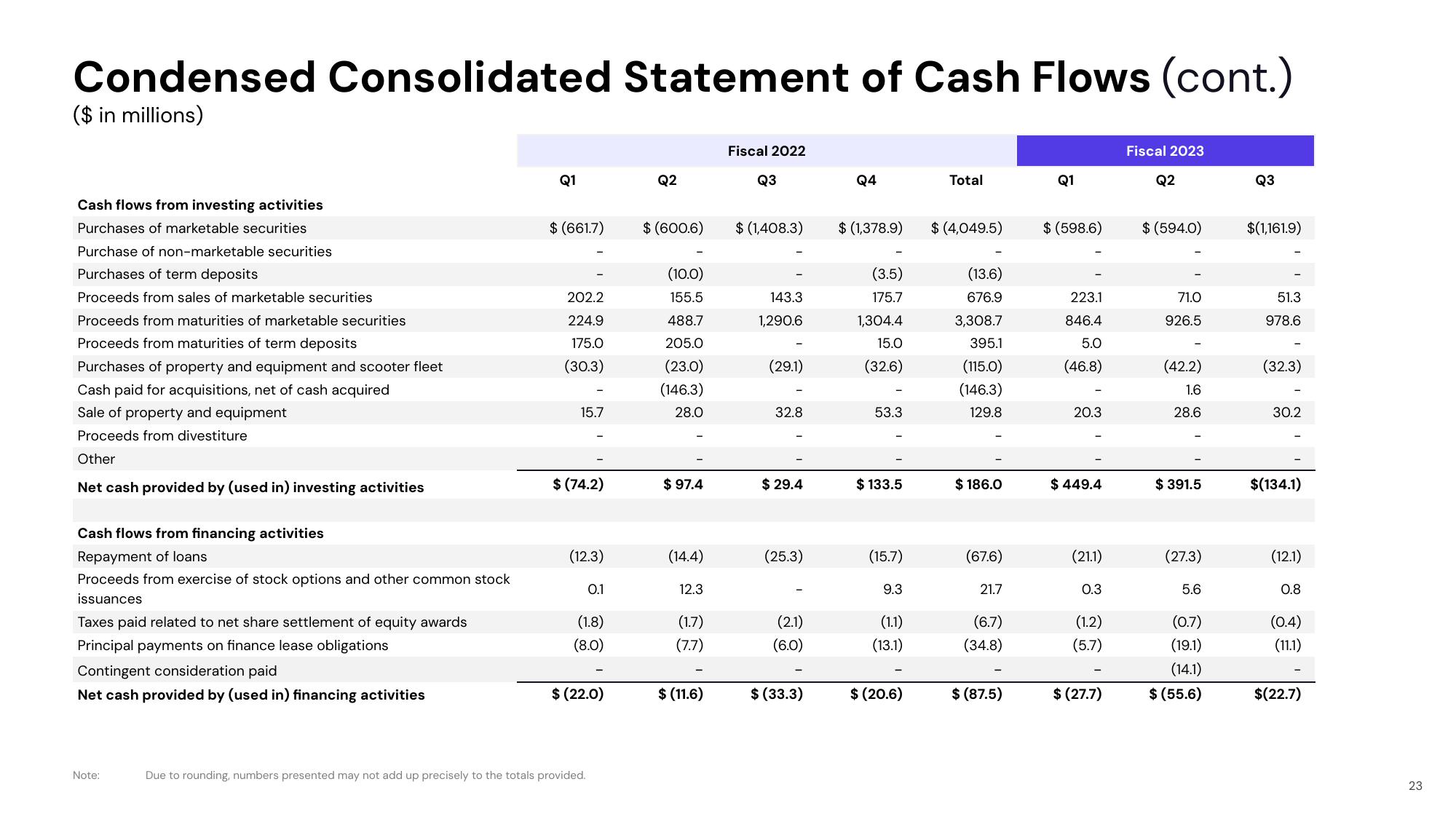

Condensed Consolidated Statement of Cash Flows (cont.)

($ in millions)

Cash flows from investing activities

Purchases of marketable securities

Purchase of non-marketable securities

Purchases of term deposits

Proceeds from sales of marketable securities

Proceeds from maturities of marketable securities

Proceeds from maturities of term deposits

Purchases of property and equipment and scooter fleet

Cash paid for acquisitions, net of cash acquired

Sale of property and equipment

Proceeds from divestiture

Other

Net cash provided by (used in) investing activities

Cash flows from financing activities

Repayment of loans

Proceeds from exercise of stock options and other common stock

issuances

Taxes paid related to net share settlement of equity awards

Principal payments on finance lease obligations

Contingent consideration paid

Net cash provided by (used in) financing activities

Note:

Q1

$ (661.7)

202.2

224.9

175.0

(30.3)

15.7

$ (74.2)

(12.3)

0.1

(1.8)

(8.0)

$ (22.0)

Due to rounding, numbers presented may not add up precisely to the totals provided.

Q2

$ (600.6)

(10.0)

155.5

488.7

205.0

(23.0)

(146.3)

28.0

$ 97.4

(14.4)

12.3

(1.7)

(7.7)

$ (11.6)

Fiscal 2022

Q3

$ (1,408.3)

143.3

1,290.6

(29.1)

32.8

$29.4

(25.3)

(2.1)

(6.0)

$ (33.3)

Q4

$ (1,378.9)

(3.5)

175.7

1,304.4

15.0

(32.6)

53.3

$ 133.5

(15.7)

9.3

(1.1)

(13.1)

$ (20.6)

Total

$ (4,049.5)

(13.6)

676.9

3,308.7

395.1

(115.0)

(146.3)

129.8

$ 186.0

(67.6)

21.7

(6.7)

(34.8)

$ (87.5)

Q1

$ (598.6)

223.1

846.4

5.0

(46.8)

20.3

$ 449.4

(21.1)

0.3

(1.2)

(5.7)

$ (27.7)

Fiscal 2023

Q2

$ (594.0)

71.0

926.5

(42.2)

1.6

28.6

$391.5

(27.3)

5.6

(0.7)

(19.1)

(14.1)

$ (55.6)

Q3

$(1,161.9)

51.3

978.6

(32.3)

30.2

$(134.1)

(12.1)

0.8

(0.4)

(11.1)

$(22.7)

23View entire presentation