Weber Results Presentation Deck

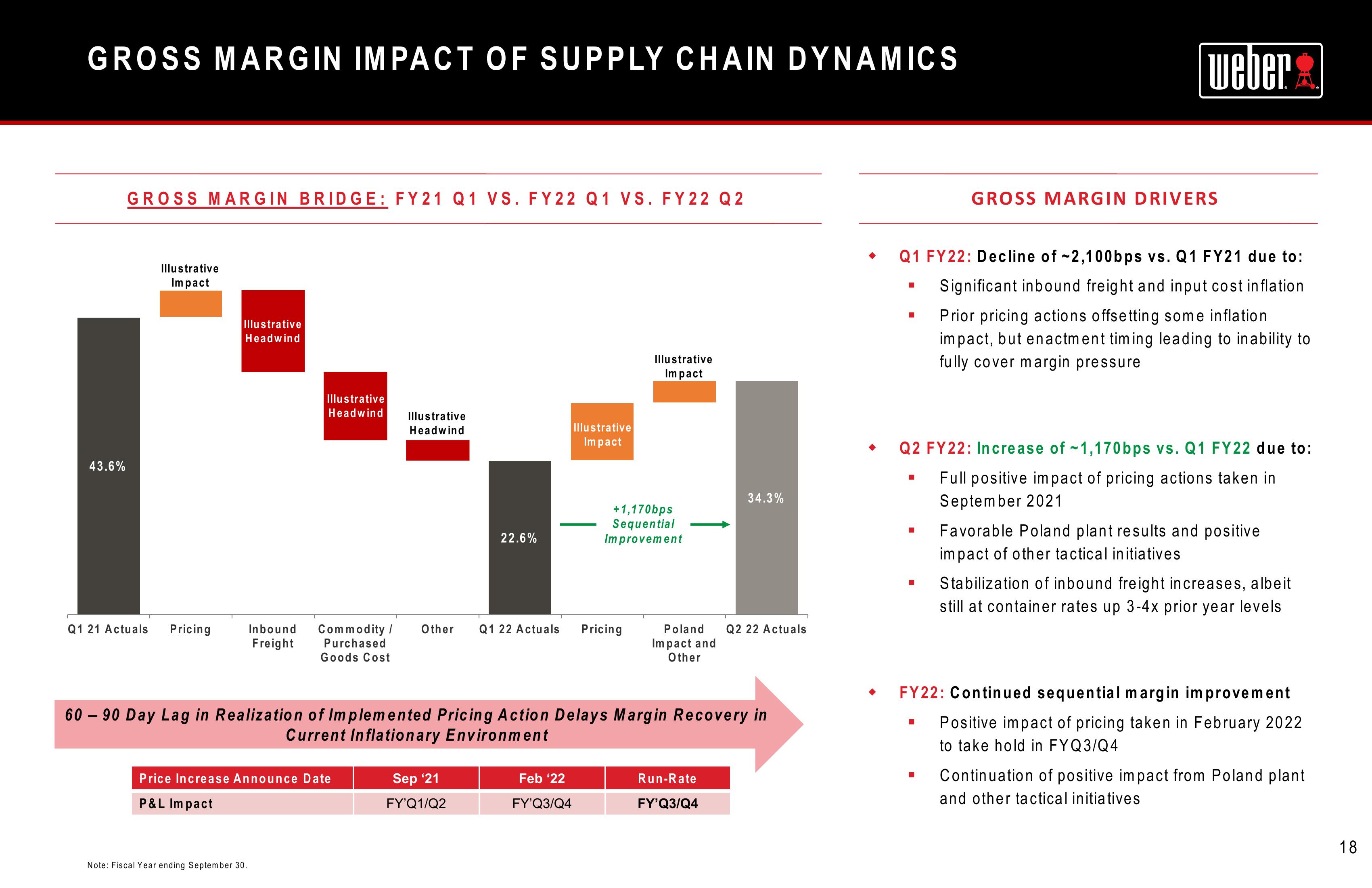

GROSS MARGIN IMPACT OF SUPPLY CHAIN DYNAMICS

43.6%

GROSS MARGIN BRIDGE: FY21 Q1 VS. FY22 Q1 VS. FY 22 Q2

Illustrative

Impact

Q1 21 Actuals Pricing

Illustrative

Headwind

Inbound

Freight

Illustrative

Headwind Illustrative

Headwind

Note: Fiscal Year ending September 30.

Price Increase Announce Date

P&L Impact

22.6%

Commodity / Other Q1 22 Actuals Pricing

Purchased

Goods Cost

Sep ¹21

FY'Q1/Q2

Illustrative

Impact

Feb '22

FY'Q3/Q4

Illustrative

Impact

+1,170bps

Sequential

Improvement

60-90 Day Lag in Realization of Implemented Pricing Action Delays Margin Recovery in

Current Inflationary Environment

34.3%

Poland Q2 22 Actuals

Impact and

Other

Run-Rate

FY'Q3/Q4

I

♦ Q1 FY22: Decline of -2,100bps vs. Q1 FY21 due to:

Significant inbound freight and input cost inflation

Prior pricing actions offsetting some inflation

impact, but enactment timing leading to inability to

fully cover margin pressure

■

I

weber

Q2 FY22: Increase of -1,170bps vs. Q1 FY22 due to:

Full positive impact of pricing actions taken in

September 2021

I

GROSS MARGIN DRIVERS

■

Favorable Poland plant results and positive

impact of other tactical initiatives

■ Stabilization of inbound freight increases, albeit

still at container rates up 3-4x prior year levels

FY22: Continued sequential margin improvement

Positive impact of pricing taken in February 2022

to take hold in FYQ3/Q4

Continuation of positive impact from Poland plant

and other tactical initiatives

18View entire presentation