Pathward Financial Results Presentation Deck

Low-cost

Deposits

HIGHLIGHTS

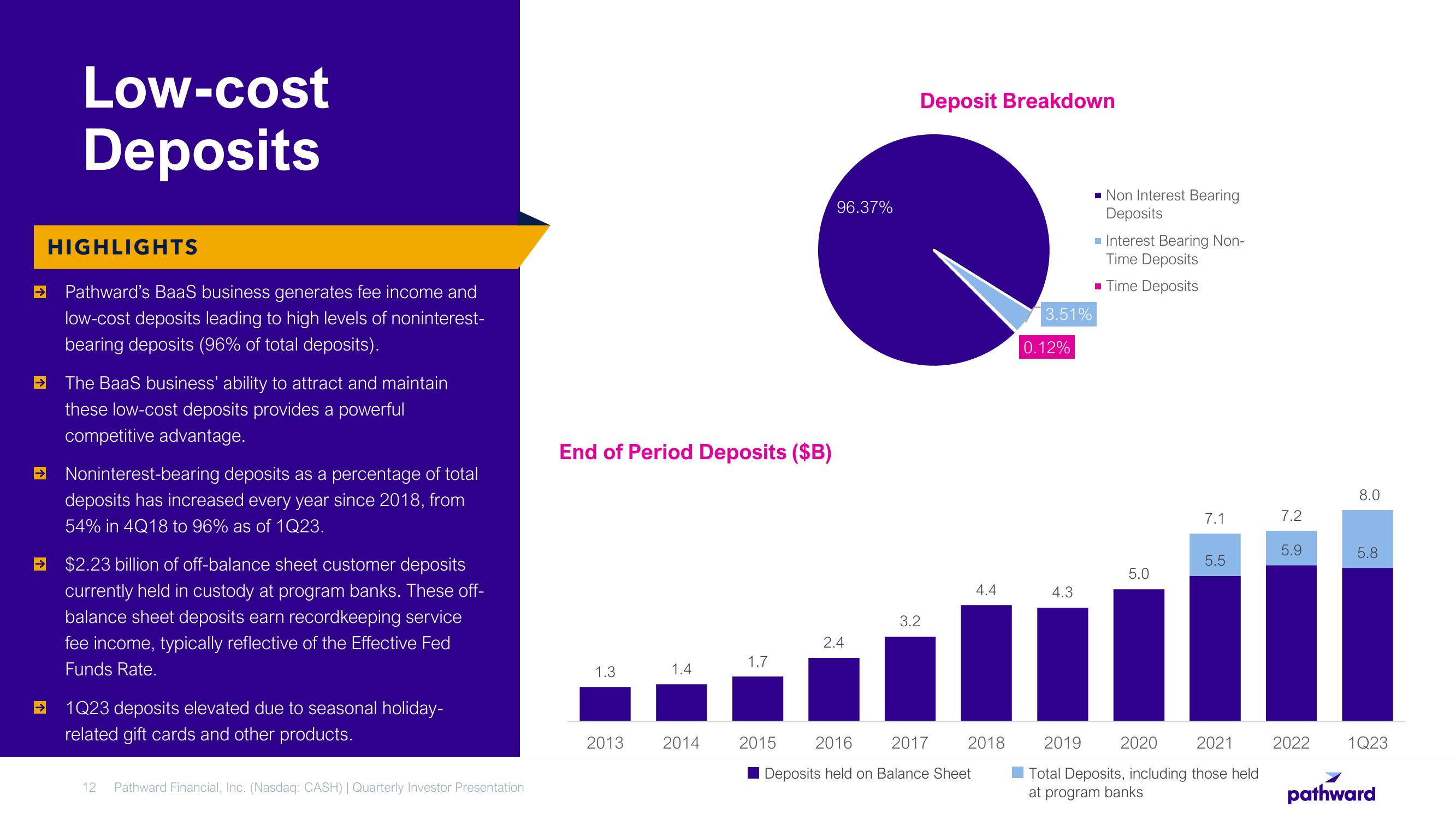

Pathward's BaaS business generates fee income and

low-cost deposits leading to high levels of noninterest-

bearing deposits (96% of total deposits).

The BaaS business' ability to attract and maintain

these low-cost deposits provides a powerful

competitive advantage.

Noninterest-bearing deposits as a percentage of total

deposits has increased every year since 2018, from

54% in 4Q18 to 96% as of 1Q23.

$2.23 billion of off-balance sheet customer deposits

currently held in custody at program banks. These off-

balance sheet deposits earn recordkeeping service

fee income, typically reflective of the Effective Fed

Funds Rate.

1Q23 deposits elevated due to seasonal holiday-

related gift cards and other products.

12 Pathward Financial, Inc. (Nasdaq: CASH) | Quarterly Investor Presentation

End of Period Deposits ($B)

1.3

2013

1.4

2014

1.7

96.37%

2015

2.4

Deposit Breakdown

3.2

2016 2017

Deposits held on Balance Sheet

4.4

2018

3.51%

0.12%

4.3

■ Non Interest Bearing

Deposits

■ Interest Bearing Non-

Time Deposits

■ Time Deposits

5.0

7.1

2020

5.5

2021

2019

Total Deposits, including those held

at program banks

7.2

5.9

2022

8.0

5.8

1Q23

pathwardView entire presentation