Melrose Results Presentation Deck

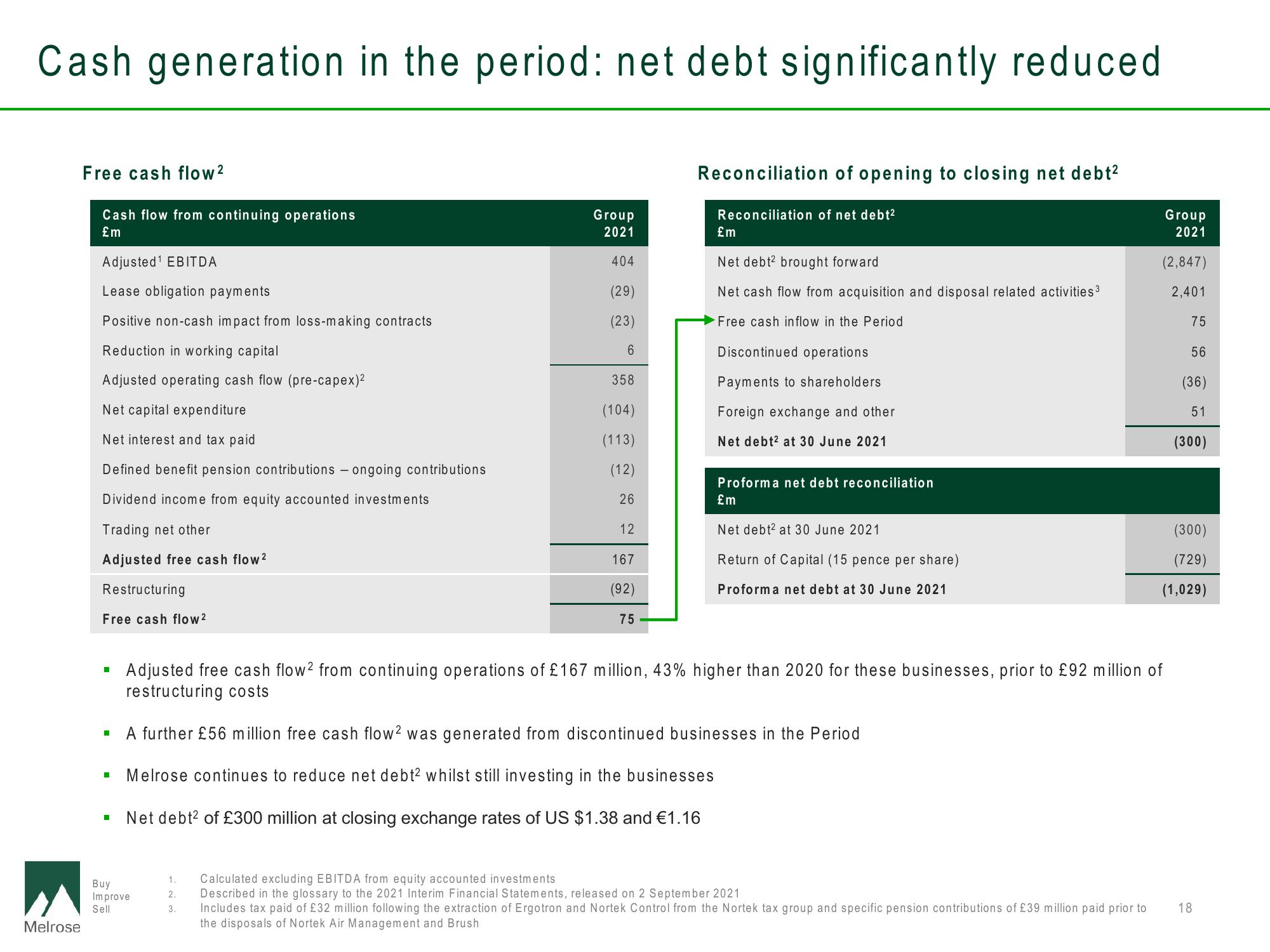

Cash generation in the period: net debt significantly reduced

Melrose

Free cash flow ²

Cash flow from continuing operations

£m

Adjusted¹ EBITDA

Lease obligation payments

Positive non-cash impact from loss-making contracts

Reduction in working capital

Adjusted operating cash flow (pre-capex)²

Net capital expenditure

Net interest and tax paid

Defined benefit pension contributions - ongoing contributions

Dividend income from equity accounted investments

Trading net other

Adjusted free cash flow ²

Restructuring

Free cash flow 2

■

I

I

I

Group

2021

404

(29)

(23)

6

Buy

Improve

Sell

358

(104)

(113)

(12)

26

1.

2.

3.

12

167

(92)

75

Reconciliation of opening to closing net debt²

Reconciliation of net debt²

£m

Net debt² brought forward

Net cash flow from acquisition and disposal related activities ³

Free cash inflow in the Period

Discontinued operations

Payments to shareholders

Foreign exchange and other

Net debt² at 30 June 2021

Proforma net debt reconciliation

£m

Net debt2 at 30 June 2021

Return of Capital (15 pence per share)

Proforma net debt at 30 June 2021

A further £56 million free cash flow2 was generated from discontinued businesses in the Period

Melrose continues to reduce net debt² whilst still investing in the businesses

Net debt² of £300 million at closing exchange rates of US $1.38 and €1.16

Adjusted free cash flow2 from continuing operations of £167 million, 43% higher than 2020 for these businesses, prior to £92 million of

restructuring costs

Group

2021

(2,847)

2,401

75

56

(36)

51

(300)

(300)

(729)

(1,029)

Calculated excluding EBITDA from equity accounted investments

Described in the glossary to the 2021 Interim Financial Statements, released on 2 September 2021

Includes tax paid of £32 million following the extraction of Ergotron and Nortek Control from the Nortek tax group and specific pension contributions of £39 million paid prior to 18

the disposals of Nortek Air Management and BrushView entire presentation