Melrose Mergers and Acquisitions Presentation Deck

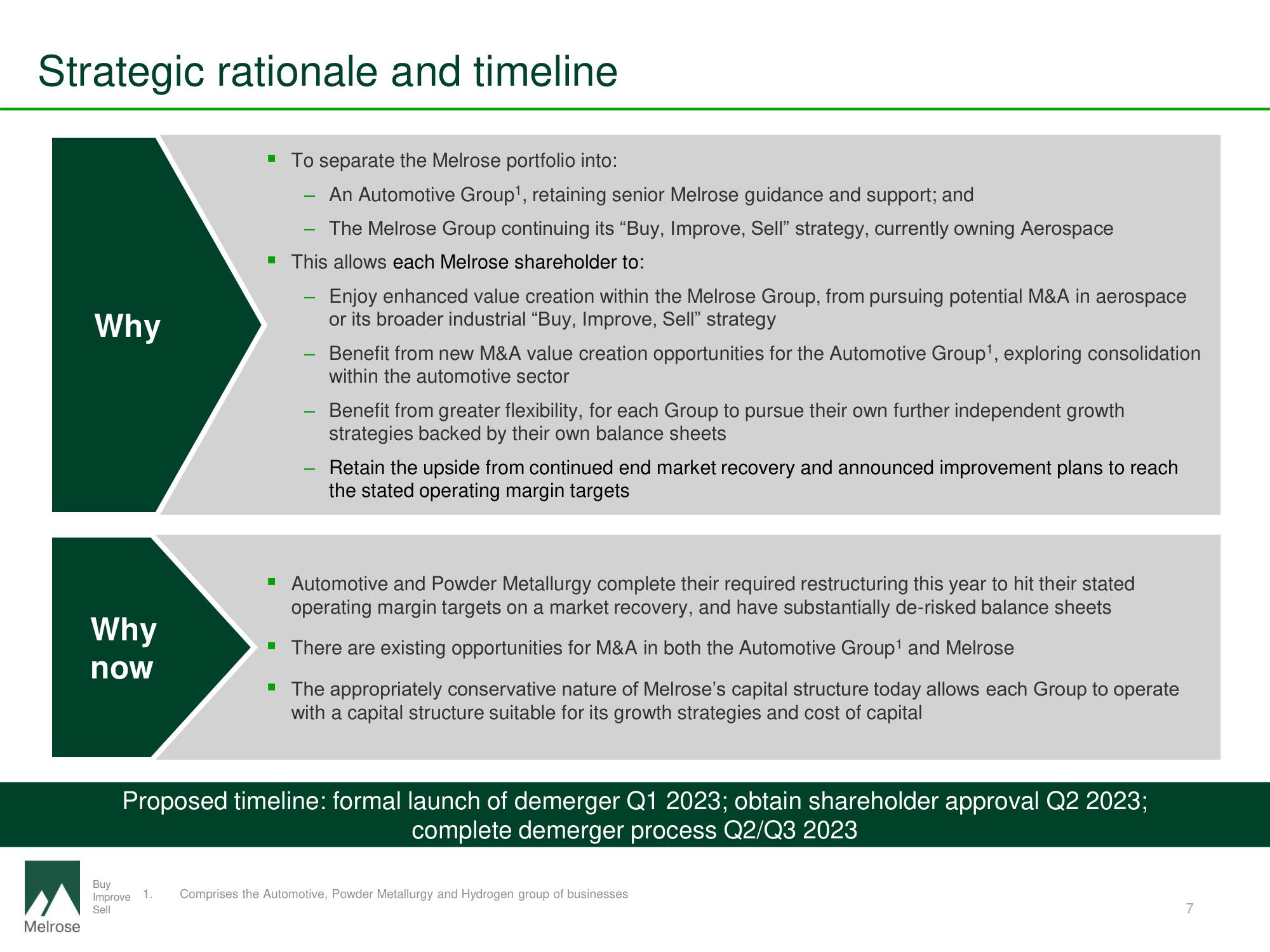

Strategic rationale and timeline

Melrose

Why

Why

now

▪ To separate the Melrose portfolio into:

An Automotive Group¹, retaining senior Melrose guidance and support; and

The Melrose Group continuing its "Buy, Improve, Sell" strategy, currently owning Aerospace

▪ This allows each Melrose shareholder to:

-

Enjoy enhanced value creation within the Melrose Group, from pursuing potential M&A in aerospace

or its broader industrial "Buy, Improve, Sell" strategy

Benefit from new M&A value creation opportunities for the Automotive Group¹, exploring consolidation

within the automotive sector

Benefit from greater flexibility, for each Group to pursue their own further independent growth

strategies backed by their own balance sheets

Retain the upside from continued end market recovery and announced improvement plans to reach

the stated operating margin targets

▪ Automotive and Powder Metallurgy complete their required restructuring this year to hit their stated

operating margin targets on a market recovery, and have substantially de-risked balance sheets

▪ There are existing opportunities for M&A in both the Automotive Group¹ and Melrose

▪ The appropriately conservative nature of Melrose's capital structure today allows each Group to operate

with a capital structure suitable for its growth strategies and cost of capital

Proposed timeline: formal launch of demerger Q1 2023; obtain shareholder approval Q2 2023;

complete demerger process Q2/Q3 2023

Buy

Improve 1. Comprises the Automotive, Powder Metallurgy and Hydrogen group of businesses

Sell

7View entire presentation