Bakkt Results Presentation Deck

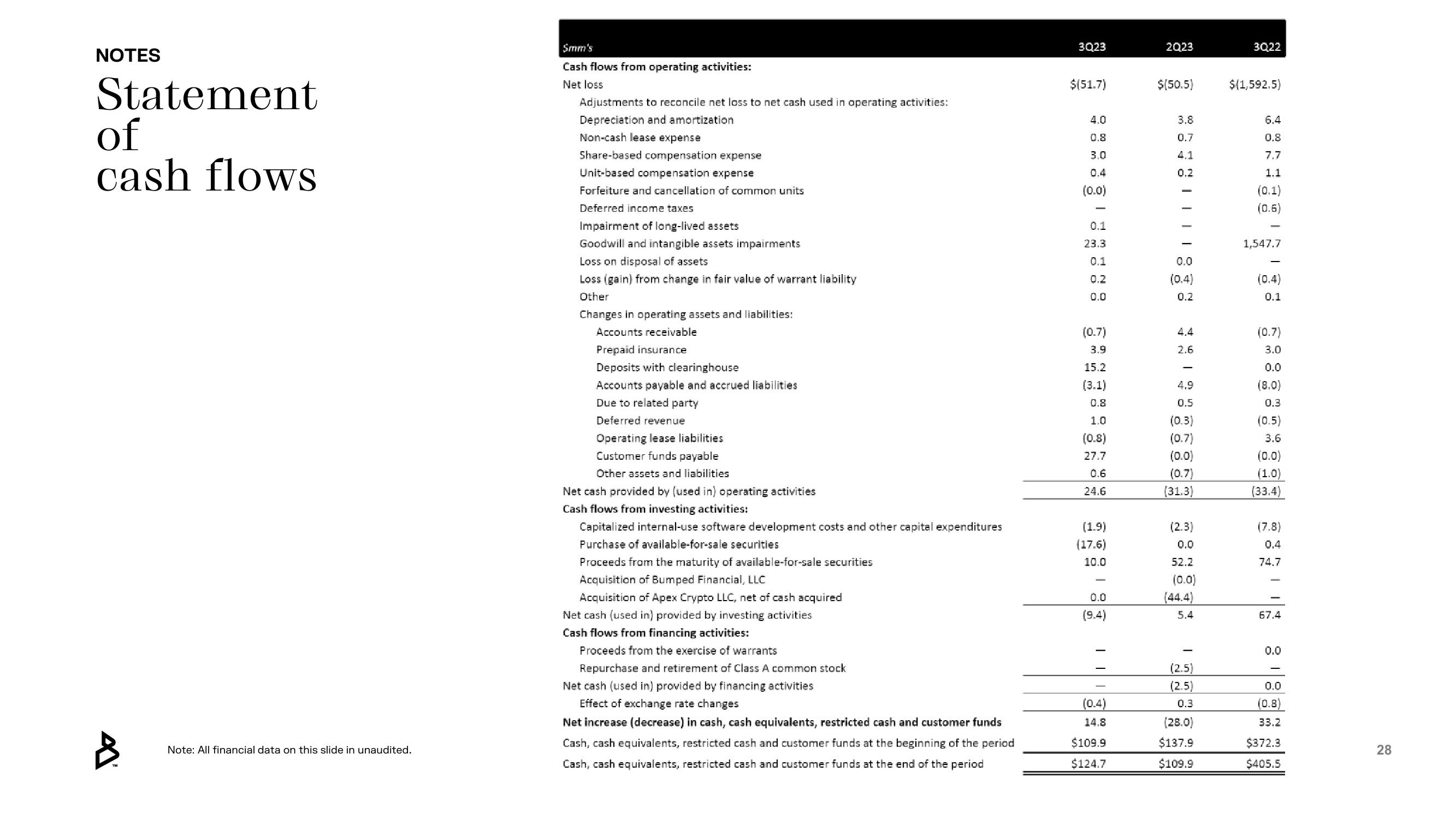

NOTES

Statement

of

cash flows

A

Note: All financial data on this slide in unaudited.

Smm's

Cash flows from operating activities:

Net loss

Adjustments to reconcile net loss to net cash used in operating activities:

Depreciation and amortization

Non-cash lease expense

Share-based compensation expense

Unit-based compensation expense

Forfeiture and cancellation of common units

Deferred income taxes

Impairment of long-lived assets

Goodwill and intangible assets impairments

Loss on disposal of assets

Loss (gain) from change in fair value of warrant liability

Other

Changes in operating assets and liabilities:

Accounts receivable

Prepaid insurance

Deposits with clearinghouse

Accounts payable and accrued liabilities

Due to related party

Deferred revenue

Operating lease liabilities

Customer funds payable

Other assets and liabilities

Net cash provided by (used in) operating activities

Cash flows from investing activities:

Capitalized internal-use software development costs and other capital expenditures

Purchase of available-for-sale securities

Proceeds from the maturity of available-for-sale securities

Acquisition of Bumped Financial, LLC

Acquisition of Apex Crypto LLC, net of cash acquired

Net cash (used in) provided by investing activities

Cash flows from financing activities:

Proceeds from the exercise of warrants

Repurchase and retirement of Class A common stock

Net cash (used in) provided by financing activities

Effect of exchange rate changes

Net increase (decrease) in cash, cash equivalents, restricted cash and customer funds

Cash, cash equivalents, restricted cash and customer funds at the beginning of the period

Cash, cash equivalents, restricted cash and customer funds at the end of the period

3Q23

$(51.7)

4.0

0.8

3.0

0.4

(0.0)

0.1

23.3

0.1

0.2

0.0

(0.7)

3.9

15.2

(3.1)

0.8

1.0

(0.8)

27.7

0.6

24.6

(1.9)

(17.6)

10.0

0.0

(9.4)

(0.4)

14.8

$109.9

$124.7

2023

$(50.5)

3.8

0.7

4.1

0.2

0.0

(0.4)

0.2

4.4

2.6

4.9

0.5

(0.3)

(0.7)

(0.0)

(0.7)

(31.3)

(2.3)

0.0

52.2

(0.0)

(44.4)

5.4

(2.5)

(2.5)

0.3

(28.0)

$137.9

$109.9

3Q22

$(1,592.5)

6.4

0.8

7.7

1.1

(0.1)

(0.6)

1,547.7

(0.4)

0.1

(0.7)

3.0

0.0

(8.0)

0.3

(0.5)

3.6

(0.0)

(1.0)

(33.4)

(7.8)

0.4

74.7

67.4

0.0

0.0

(0.8)

33.2

$372.3

$405.5

28View entire presentation