Kin SPAC Presentation Deck

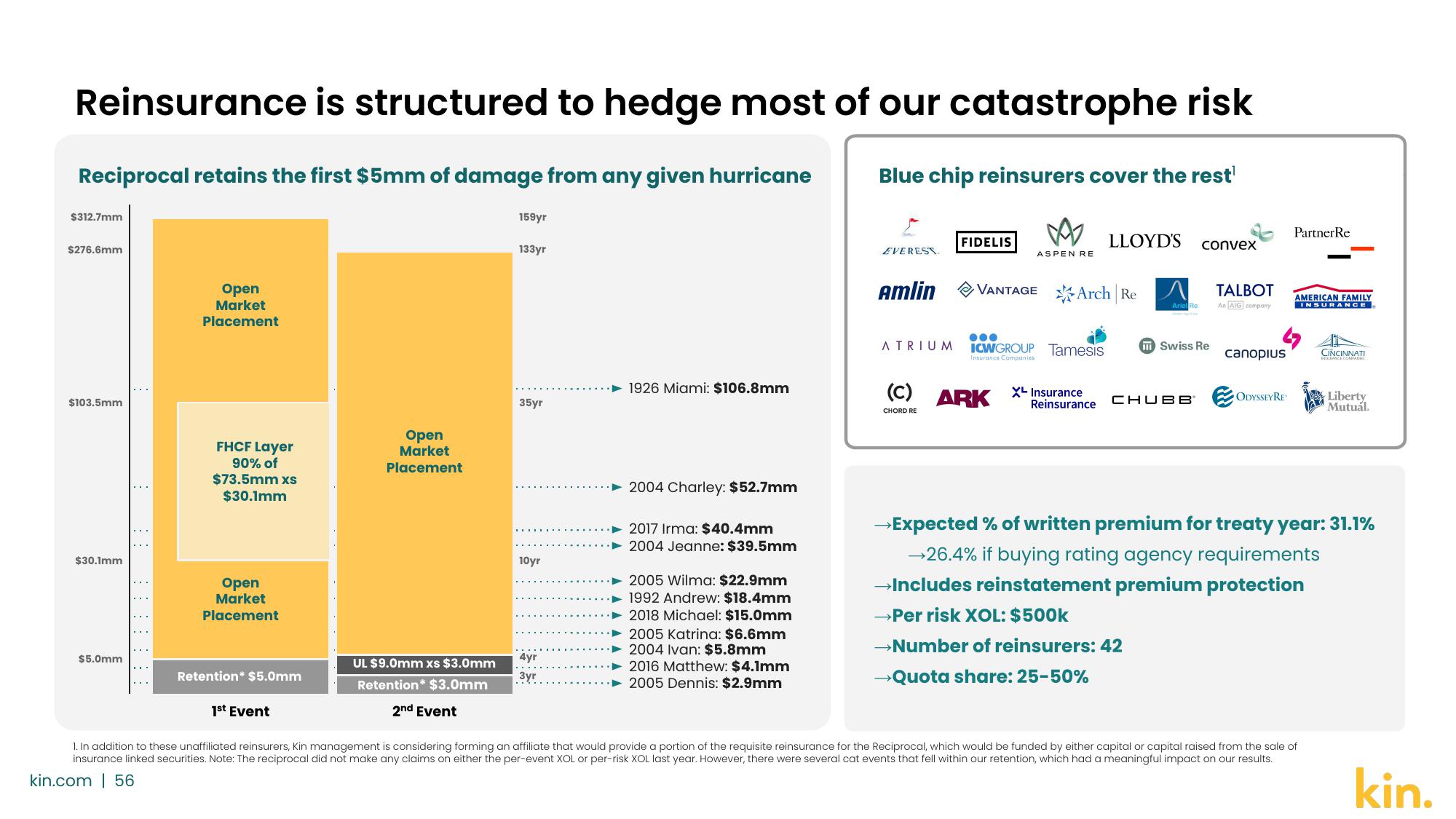

Reinsurance is structured to hedge most of our catastrophe risk

Reciprocal retains the first $5mm of damage from any given hurricane

$312.7mm

$276.6mm

$103.5mm

$30.1mm

$5.0mm

Open

Market

Placement

FHCF Layer

90% of

$73.5mm xs

$30.1mm

Open

Market

Placement

Retention* $5.0mm

1st Event

Open

Market

Placement

UL $9.0mm xs $3.0mm

Retention* $3.0mm

2nd Event

159yr

133yr

35yr

10yr

4yr

3yr

1926 Miami: $106.8mm

2004 Charley: $52.7mm

2017 Irma: $40.4mm

2004 Jeanne: $39.5mm

2005 Wilma: $22.9mm

1992 Andrew: $18.4mm

2018 Michael: $15.0mm

2005 Katrina: $6.6mm

2004 Ivan: $5.8mm

2016 Matthew: $4.1mm

2005 Dennis: $2.9mm

Blue chip reinsurers cover the rest¹

EVEREST.

Amlin

FIDELIS

☆₂

ASPEN RE

VANTAGE Arch Re

ATRIUM ICWGROUP Tamesis

Insurance Companies

(C) ARK

CHORD RE

LLOYD'S

XL Insurance

Ariel Re

convex

Swiss Re

Reinsurance CHUBв

TALBOT

An AIG company

canopius

PartnerRe

4

ODYSSEY RE

AMERICAN FAMILY

INSURANCE

1. In addition to these unaffiliated reinsurers, Kin management is considering forming an affiliate that would provide a portion of the requisite reinsurance for the Reciprocal, which would be funded by either capital or capital raised from the sale of

insurance linked securities. Note: The reciprocal did not make any claims on either the per-event XOL or per-risk XOL last year. However, there were several cat events that fell within our retention, which had a meaningful impact on our results.

kin.com | 56

CINCINNATI

Liberty

Mutual.

→Expected % of written premium for treaty year: 31.1%

→26.4% if buying rating agency requirements

→Includes reinstatement premium protection

→Per risk XOL: $500K

>Number of reinsurers: 42

→Quota share: 25-50%

kin.View entire presentation