Kinnevik Results Presentation Deck

Intro

SEK m

GROUP FINANCIAL STATEMENTS

Change in Fair Value of Financial Assets

Dividends Received

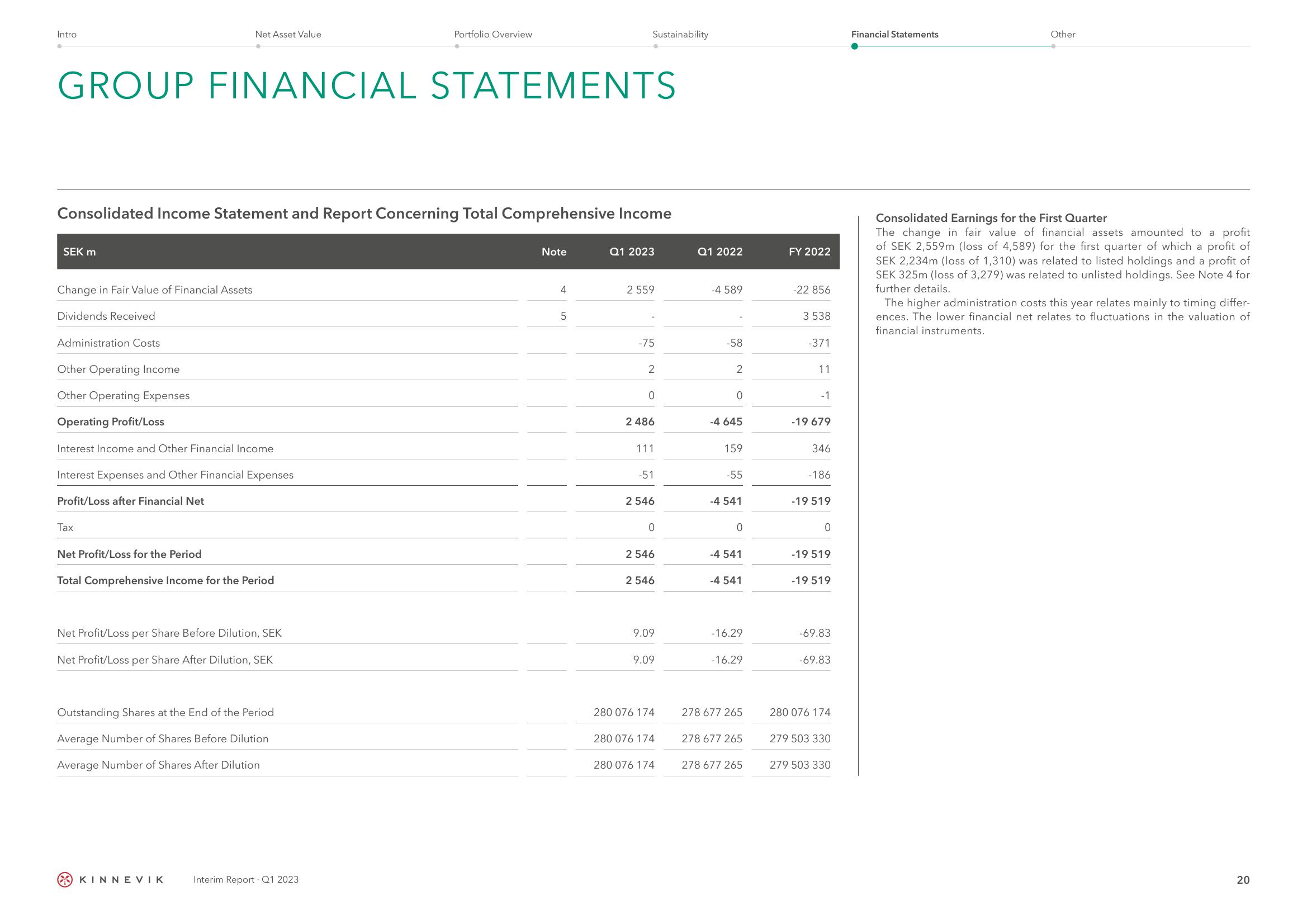

Consolidated Income Statement and Report Concerning Total Comprehensive Income

Administration Costs

Other Operating Income

Other Operating Expenses

Operating Profit/Loss

Net Asset Value

Interest Income and Other Financial Income

Interest Expenses and Other Financial Expenses

Profit/Loss after Financial Net

Tax

Net Profit/Loss for the Period

Total Comprehensive Income for the Period

Net Profit/Loss per Share Before Dilution, SEK

Net Profit/Loss per Share After Dilution, SEK

Outstanding Shares at the End of the Period

Average Number of Shares Before Dilution

Average Number of Shares After Dilution

KINNEVIK

Portfolio Overview

Interim Report Q1 2023

Note

Sustainability

4

5

Q1 2023

2 559

-75

2

0

2 486

111

-51

2 546

0

2 546

2 546

9.09

9.09

280 076 174

280 076 174

280 076 174

Q1 2022

-4 589

-58

2

0

-4 645

159

-55

-4 541

0

-4 541

-4 541

-16.29

-16.29

278 677 265

278 677 265

278 677 265

FY 2022

-22 856

3 538

-371

11

-1

-19 679

346

-186

-19 519

0

-19 519

-19 519

-69.83

-69.83

280 076 174

279 503 330

279 503 330

Financial Statements

Other

Consolidated Earnings for the First Quarter

The change in fair value of financial assets amounted to a profit

of SEK 2,559m (loss of 4,589) for the first quarter of which a profit of

SEK 2,234m (loss of 1,310) was related to listed holdings and a profit of

SEK 325m (loss of 3,279) was related to unlisted holdings. See Note 4 for

further details.

The higher administration costs this year relates mainly to timing differ-

ences. The lower financial net relates to fluctuations in the valuation of

financial instruments.

20View entire presentation