Credit Suisse Results Presentation Deck

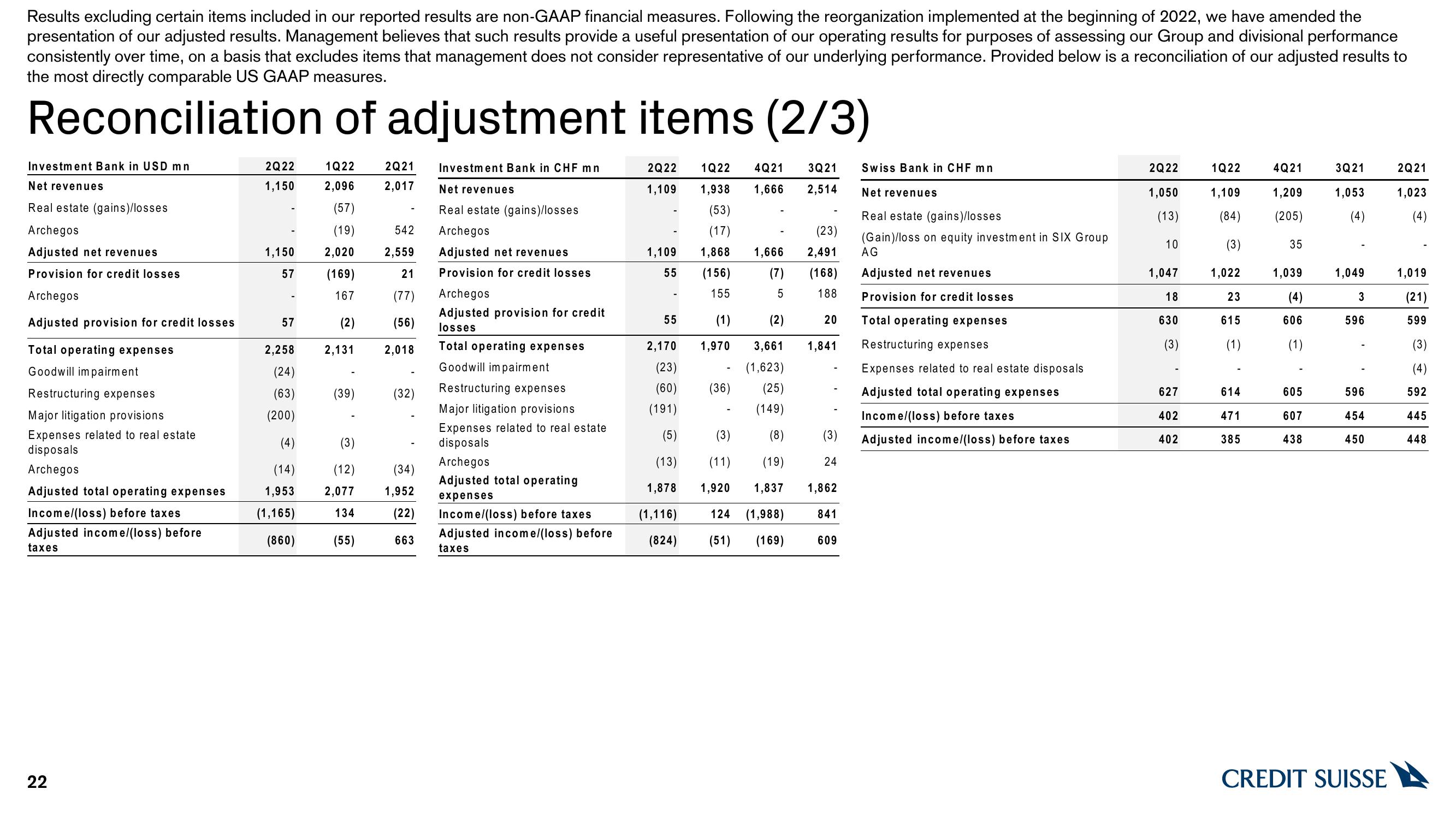

Results excluding certain items included in our reported results are non-GAAP financial measures. Following the reorganization implemented at the beginning of 2022, we have amended the

presentation of our adjusted results. Management believes that such results provide a useful presentation of our operating results for purposes of assessing our Group and divisional performance

consistently over time, on a basis that excludes items that management does not consider representative of our underlying performance. Provided below is a reconciliation of our adjusted results to

the most directly comparable US GAAP measures.

Reconciliation of adjustment items (2/3)

Investment Bank in USD mn

Net revenues

Real estate (gains)/losses

Archegos

Adjusted net revenues

Provision for credit losses

Archegos

Adjusted provision for credit losses

Total operating expenses

Goodwill impairment

Restructuring expenses

Major litigation provisions

Expenses related to real estate

disposals

Archegos

Adjusted total operating expenses

Income/(loss) before taxes

Adjusted income/(loss) before

taxes

22

2Q22

1,150

1,150

57

57

2,258

(24)

(63)

(200)

(4)

(14)

1,953

(1,165)

(860)

1Q22

2,096

(57)

(19)

2,020

(169)

167

(2)

2,131

(39)

(3)

(12)

2,077

134

(55)

2Q21

2,017

542

2,559

21

(77)

(56)

2,018

(32)

(34)

1,952

Investment Bank in CHF mn

Net revenues

Real estate (gains)/losses

Archegos

Adjusted net revenues

Provision for credit losses

Archegos

Adjusted provision for credit

losses

Total operating expenses

Goodwill impairment

Restructuring expenses

Major litigation provisions

Expenses related to real estate

disposals

Archegos

Adjusted total operating

expenses

(22) Income/(loss) before taxes

663

Adjusted income/(loss) before

taxes

3Q21

2Q22 1Q22 4Q21

1,109 1,938 1,666 2,514

(53)

(17)

1,868

(156)

155

(1)

1,970

1,109

55

55

2,170

(23)

(60)

(191)

(5)

(13)

1,878

(1,116)

(824)

(23)

1,666 2,491

(7)

(168)

5 188

(2)

3,661 1,841

(1,623)

(25)

(149)

(8)

(11) (19)

1,920 1,837 1,862

(36)

20

(3)

24

841

124 (1,988)

(51) (169) 609

Swiss Bank in CHF mn

Net revenues

Real estate (gains)/losses

(Gain)/loss on equity investment in SIX Group

AG

Adjusted net revenues

Provision for credit losses

Total operating expenses

Restructuring expenses

Expenses related to real estate disposals

Adjusted total operating expenses

Income/(loss) before taxes

Adjusted income/(loss) before taxes

2Q22

1,050

(13)

10

1,047

18

630

(3)

627

402

402

1Q22

1,109

(84)

(3)

1,022

23

615

(1)

614

471

385

4Q21

1,209

(205)

35

1,039

(4)

606

605

607

438

3Q21

1,053

(4)

1,049

3

596

596

454

450

CREDIT SUISSE

2Q21

1,023

(4)

1,019

(21)

599

(3)

(4)

592

445

448View entire presentation