PJT Partners Investment Banking Pitch Book

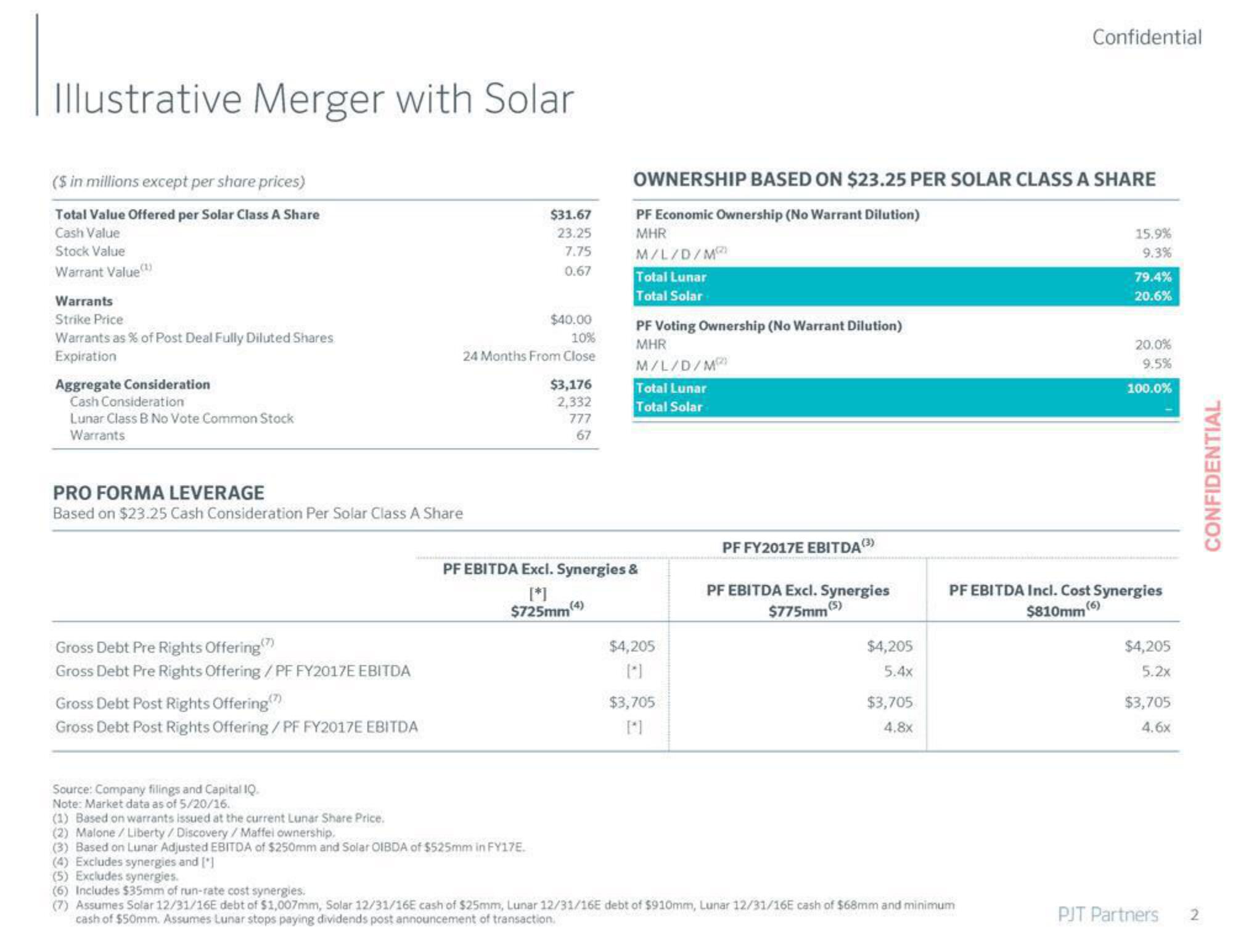

Illustrative Merger with Solar

($ in millions except per share prices)

Total Value Offered per Solar Class A Share

Cash Value

Stock Value

Warrant Value

Warrants

Strike Price

Warrants as % of Post Deal Fully Diluted Shares

Expiration

Aggregate Consideration

Cash Consideration

Lunar Class B No Vote Common Stock

Warrants

PRO FORMA LEVERAGE

Based on $23.25 Cash Consideration Per Solar Class A Share

Gross Debt Pre Rights Offering)

Gross Debt Pre Rights Offering / PF FY2017E EBITDA

Gross Debt Post Rights Offering

Gross Debt Post Rights Offering / PF FY2017E EBITDA

Source: Company filings and Capital IQ

Note: Market data as of 5/20/16.

$40.00

10%

24 Months From Close

$31.67

23.25

7.75

0.67

(1) Based on warrants issued at the current Lunar Share Price.

(2) Malone/Liberty / Discovery/Maffei ownership,

(3) Based on Lunar Adjusted EBITDA of $250mm and Solar OIBDA of $525mm in FY17E.

(4) Excludes synergies and [*]

(5) Excludes synergies.

$3,176

2,332

777

67

OWNERSHIP BASED ON $23.25 PER SOLAR CLASS A SHARE

PF Economic Ownership (No Warrant Dilution)

MHR

M/L/D/M

Total Lunar

Total Solar

PF Voting Ownership (No Warrant Dilution)

MHR

M/L/D/M

Total Lunar

Total Solar

PF EBITDA Excl. Synergies &

[*]

$725mm(4)

$4,205

$3,705

PF FY2017E EBITDA (3)

PF EBITDA Excl. Synergies

$775mm (5)

$4,205

5.4x

$3,705

4.8x

Confidential

(6) Includes $35mm of run-rate cost synergies.

(7) Assumes Solar 12/31/16E debt of $1,007mm, Solar 12/31/16E cash of $25mm, Lunar 12/31/16E debt of $910mm, Lunar 12/31/16E cash of $68mm and minimum

cash of $50mm. Assumes Lunar stops paying dividends post announcement of transaction.

15.9%

9.3%

79.4%

20.6%

20.0%

9.5%

100.0%

PF EBITDA Incl. Cost Synergies

$810mm (6)

$4,205

5.2x

$3,705

4.6x

PJT Partners

2

CONFIDENTIALView entire presentation