Moelis & Company Investment Banking Pitch Book

Situation Overview (cont'd)

STRICTLY CONFIDENTIAL

MOELIS & COMPANY

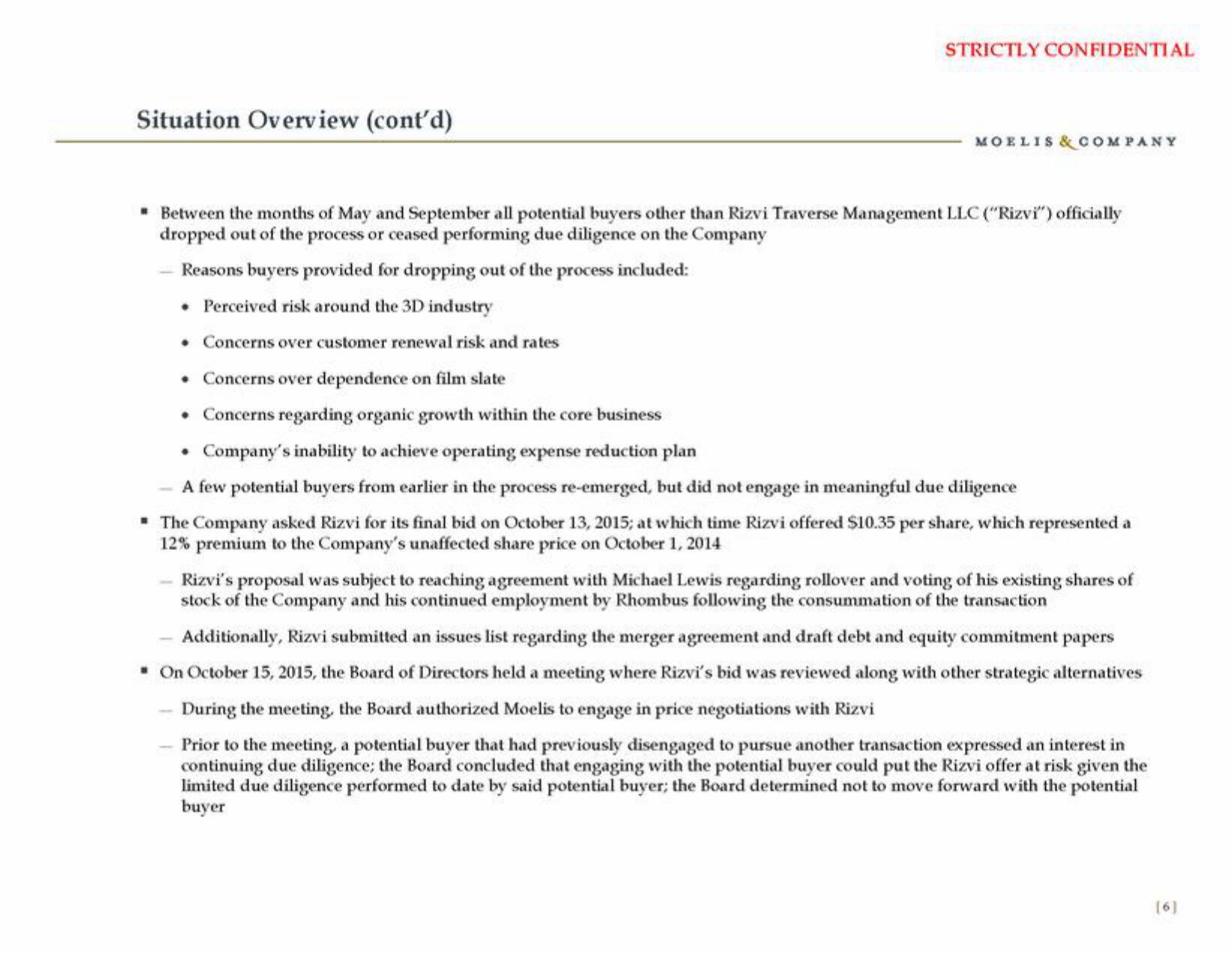

▪ Between the months of May and September all potential buyers other than Rizvi Traverse Management LLC ("Rizvi") officially

dropped out of the process or ceased performing due diligence on the Company

Reasons buyers provided for dropping out of the process included:

• Perceived risk around the 3D industry

• Concerns over customer renewal risk and rates

. Concerns over dependence on film slate

. Concerns regarding organic growth within the core business

• Company's inability to achieve operating expense reduction plan

- A few potential buyers from earlier in the process re-emerged, but did not engage in meaningful due diligence

* The Company asked Rizvi for its final bid on October 13, 2015; at which time Rizvi offered $10.35 per share, which represented a

12% premium to the Company's unaffected share price on October 1, 2014

Rizvi's proposal was subject to reaching agreement with Michael Lewis regarding rollover and voting of his existing shares of

stock of the Company and his continued employment by Rhombus following the consummation of the transaction

- Additionally, Rizvi submitted an issues list regarding the merger agreement and draft debt and equity commitment papers

▪ On October 15, 2015, the Board of Directors held a meeting where Rizvi's bid was reviewed along with other strategic alternatives

During the meeting, the Board authorized Moelis to engage in price negotiations with Rizvi

Prior to the meeting, a potential buyer that had previously disengaged to pursue another transaction expressed an interest in

continuing due diligence; the Board concluded that engaging with the potential buyer could put the Rizvi offer at risk given the

limited due diligence performed to date by said potential buyer; the Board determined not to move forward with the potential

buyer

[6]View entire presentation