Deutsche Bank Fixed Income Presentation Deck

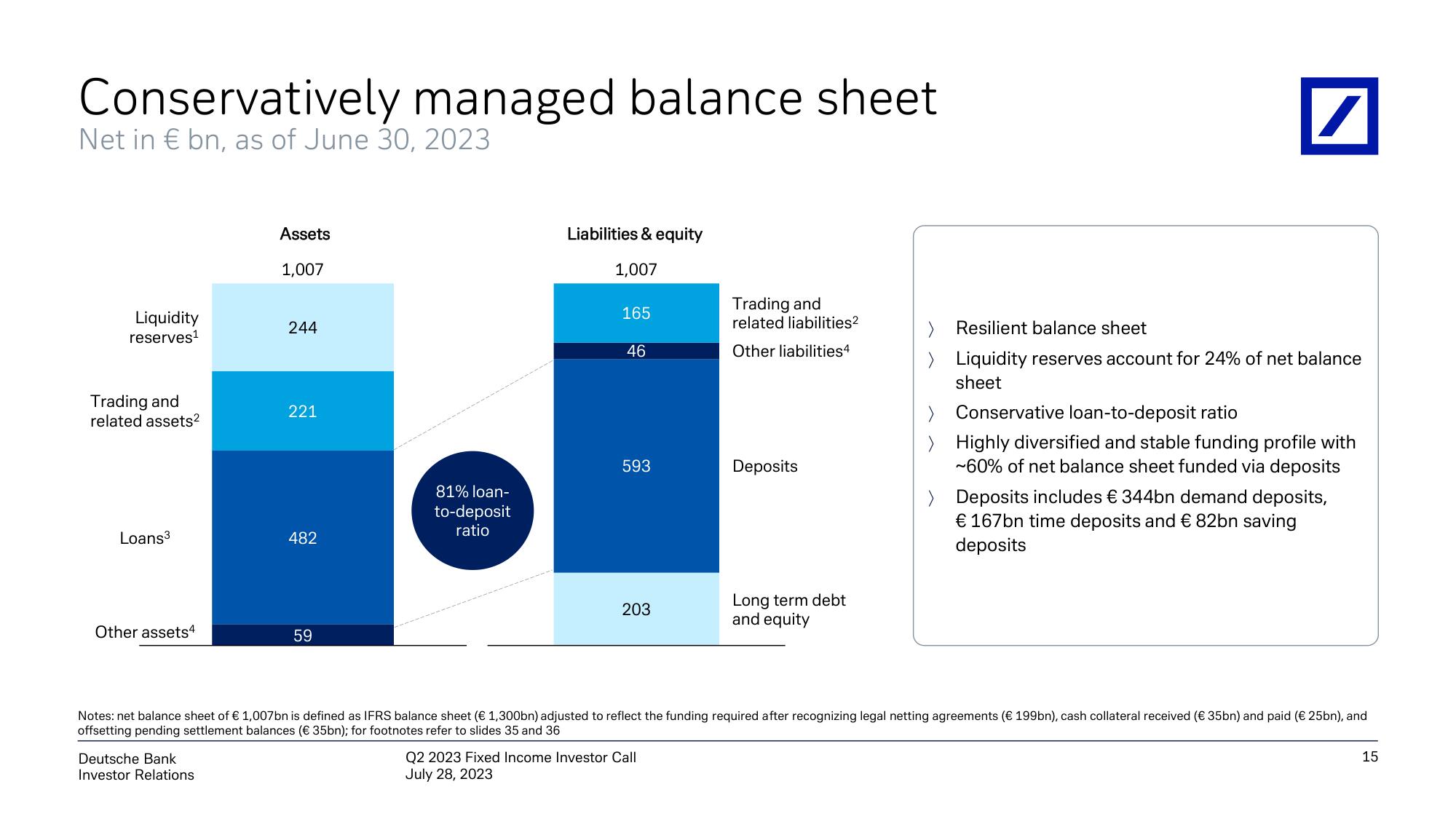

Conservatively managed balance sheet

Net in € bn, as of June 30, 2023

Liquidity

reserves¹

Trading and

related assets²

Loans³

Other assets4

Assets

1,007

Deutsche Bank

Investor Relations

244

221

482

59

81% loan-

to-deposit

ratio

Liabilities & equity

1,007

165

46

593

203

Trading and

related liabilities²

Other liabilities4

Q2 2023 Fixed Income Investor Call

July 28, 2023

Deposits

Long term debt

and equity

/

> Resilient balance sheet

> Liquidity reserves account for 24% of net balance

sheet

>

>

Conservative loan-to-deposit ratio

Highly diversified and stable funding profile with

~60% of net balance sheet funded via deposits

Notes: net balance sheet of € 1,007bn is defined as IFRS balance sheet (€ 1,300bn) adjusted to reflect the funding required after recognizing legal netting agreements (€ 199bn), cash collateral received (€ 35bn) and paid (€ 25bn), and

offsetting pending settlement balances (€ 35bn); for footnotes refer to slides 35 and 36

> Deposits includes € 344bn demand deposits,

€ 167bn time deposits and € 82bn saving

deposits

15View entire presentation