Third Quarter 2022 Earnings Conference Call

Digital care for Truist clients

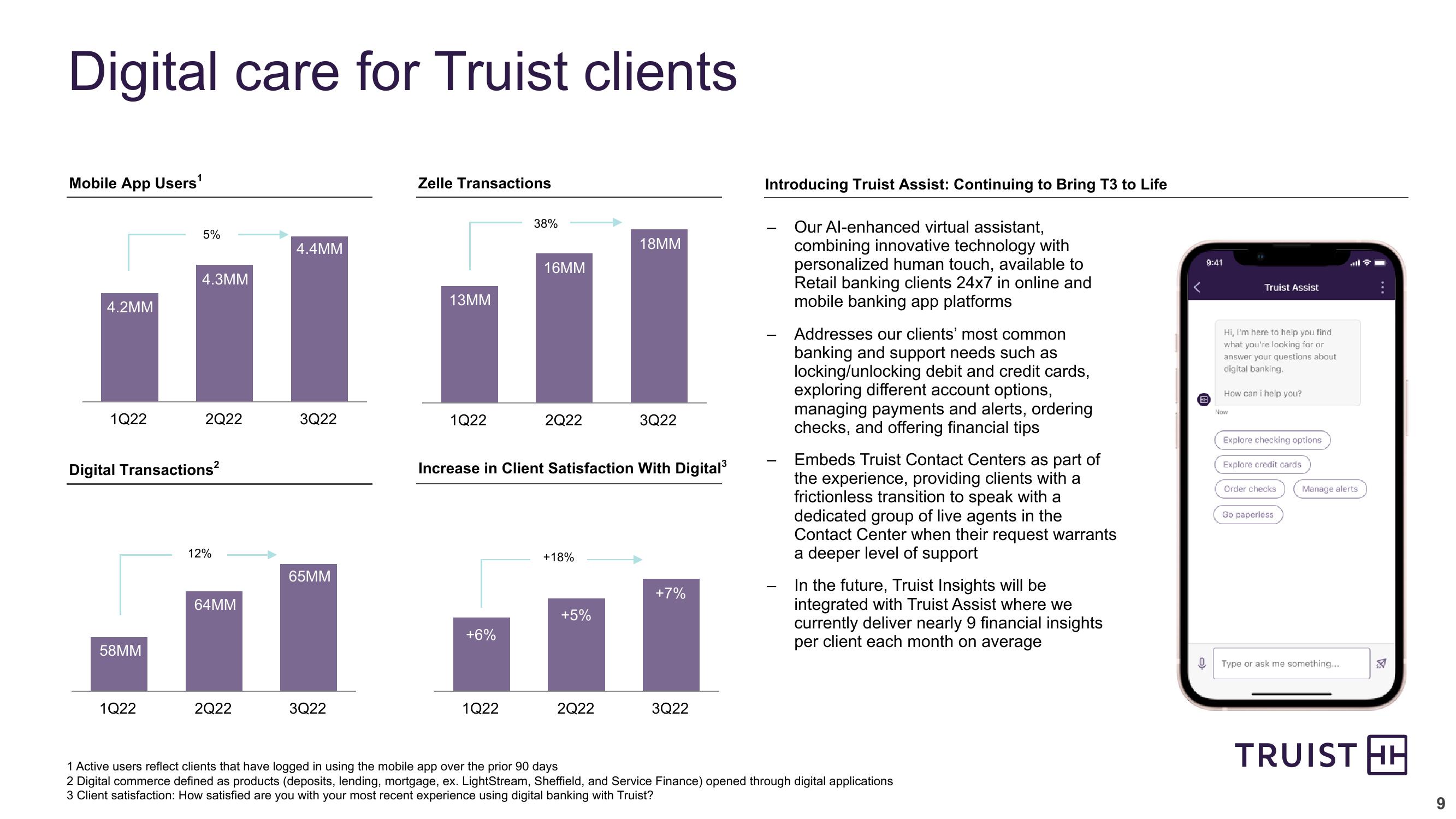

Mobile App Users¹

5%

4.4MM

4.3MM

4.2MM

1Q22

2Q22

3Q22

Digital Transactions²

58MM

12%

65MM

64MM

1Q22

2Q22

3Q22

Zelle Transactions

38%

18MM

16MM

13MM

1Q22

2Q22

3Q22

Increase in Client Satisfaction With Digital³

+18%

+7%

+5%

+6%

Introducing Truist Assist: Continuing to Bring T3 to Life

Our Al-enhanced virtual assistant,

combining innovative technology with

personalized human touch, available to

Retail banking clients 24x7 in online and

mobile banking app platforms

Addresses our clients' most common

banking and support needs such as

locking/unlocking debit and credit cards,

exploring different account options,

managing payments and alerts, ordering

checks, and offering financial tips

Embeds Truist Contact Centers as part of

the experience, providing clients with a

frictionless transition to speak with a

dedicated group of live agents in the

Contact Center when their request warrants

a deeper level of support

In the future, Truist Insights will be

integrated with Truist Assist where we

currently deliver nearly 9 financial insights

per client each month on average

H

9:41

Truist Assist

Hi, I'm here to help you find

what you're looking for or

answer your questions about

digital banking.

How can i help you?

Now!

Explore checking options

Explore credit cards

Order checks

Go paperless

Manage alerts

1Q22

2Q22

3Q22

1 Active users reflect clients that have logged in using the mobile app over the prior 90 days

2 Digital commerce defined as products (deposits, lending, mortgage, ex. LightStream, Sheffield, and Service Finance) opened through digital applications

3 Client satisfaction: How satisfied are you with your most recent experience using digital banking with Truist?

Type or ask me something...

TRUIST HH

9View entire presentation