HSBC Results Presentation Deck

Commercial Banking

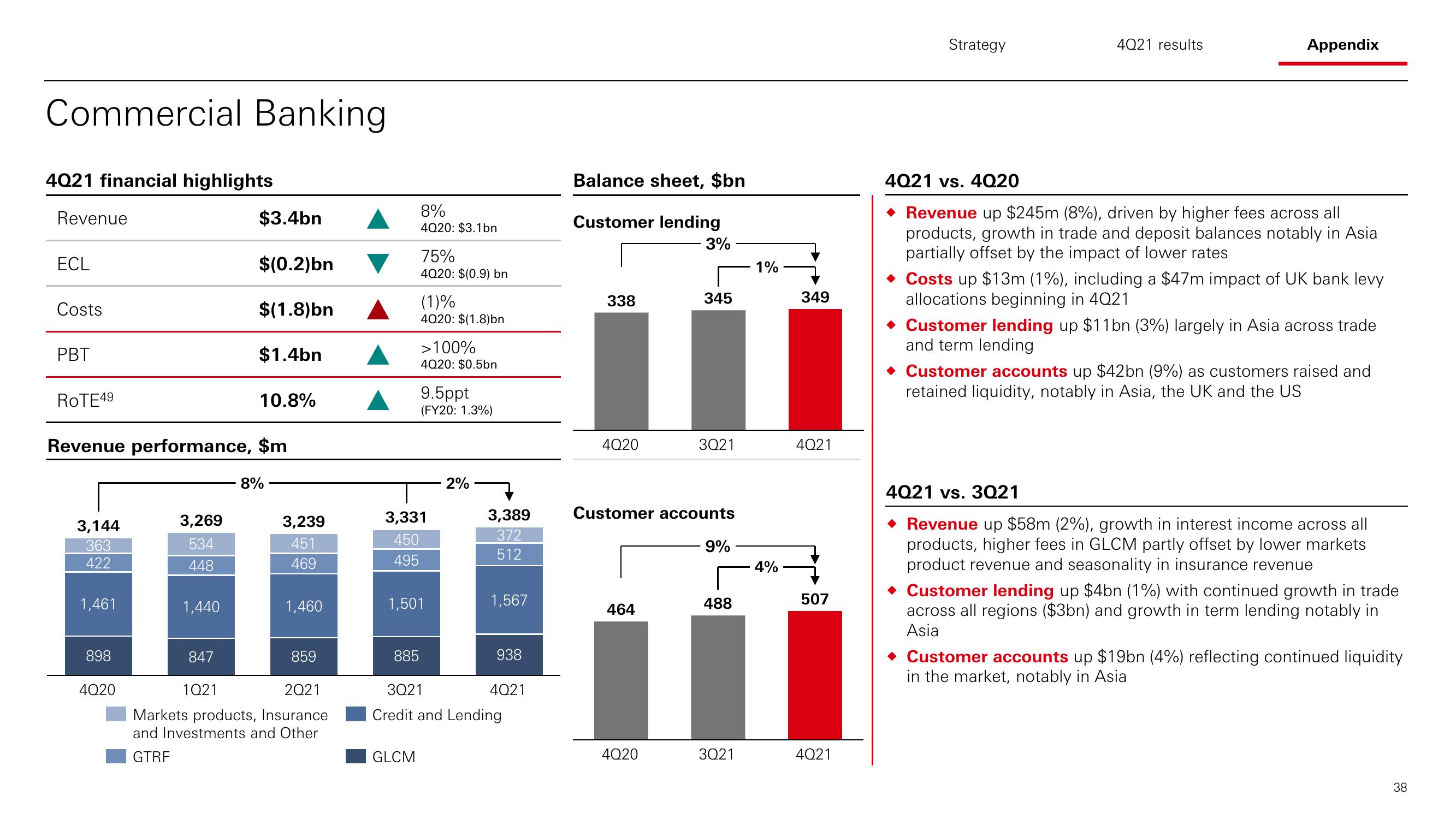

4021 financial highlights

Revenue

ECL

Costs

PBT

3,144

363

422

ROTE4⁹

Revenue performance, $m

1,461

898

4Q20

3,269

534

448

1,440

$3.4bn

$(0.2)bn

$(1.8)bn

$1.4bn

847

1Q21

10.8%

8%

3,239

451

469

1,460

859

2021

Markets products, Insurance

and Investments and Other

GTRF

8%

4020: $3.1bn

75%

4020: $(0.9) bn

(1)%

4020: $(1.8)bn

GLCM

>100%

4020: $0.5bn

9.5ppt

(FY20: 1.3%)

3,331

450

495

1,501

2%

3,389

372

512

1,567

885

3Q21

Credit and Lending

938

4Q21

Balance sheet, $bn

Customer lending

- 3%

338

4Q20

464

345

Customer accounts

4020

3Q21

9%

488

3Q21

1%

4%

349

4Q21

507

4Q21

Strategy

4021 results

Appendix

4Q21 vs. 4Q20

Revenue up $245m (8%), driven by higher fees across all

products, growth in trade and deposit balances notably in Asia

partially offset by the impact of lower rates

◆ Costs up $13m (1%), including a $47m impact of UK bank levy

allocations beginning in 4021

◆ Customer lending up $11bn (3%) largely in Asia across trade

and term lending

Customer accounts up $42bn (9%) as customers raised and

retained liquidity, notably in Asia, the UK and the US

4021 vs.

3Q21

Revenue up $58m (2%), growth in interest income across all

products, higher fees in GLCM partly offset by lower markets

product revenue and seasonality in insurance revenue

◆ Customer lending up $4bn (1%) with continued growth in trade

across all regions ($3bn) and growth in term lending notably in

Asia

Customer accounts up $19bn (4%) reflecting continued liquidity

in the market, notably in Asia

38View entire presentation