AT&T Results Presentation Deck

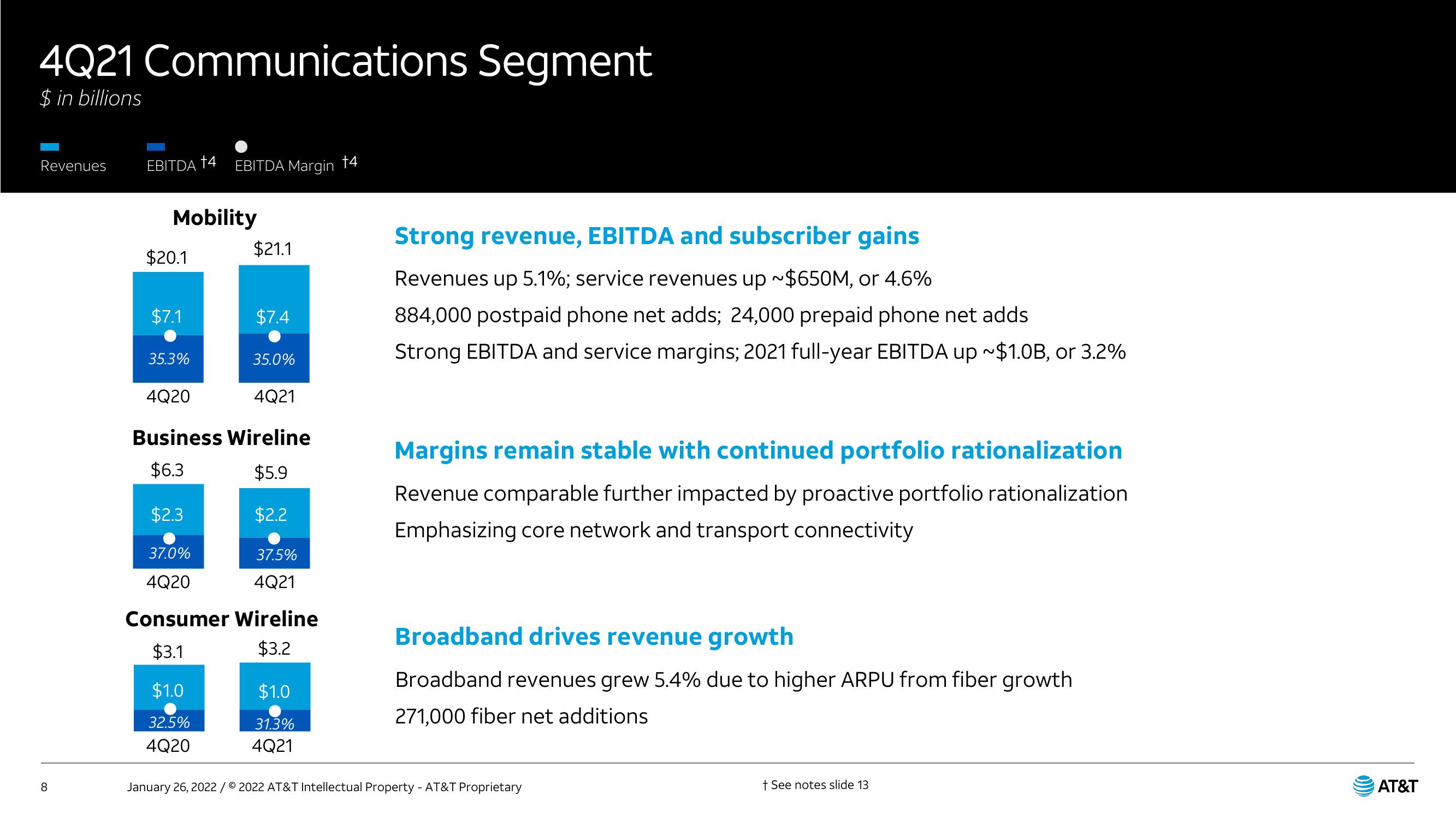

4Q21 Communications Segment

$ in billions

Revenues

8

EBITDA †4

Mobility

$20.1

$7.1

35.3%

$2.3

EBITDA Margin +4

37.0%

4Q20

$21.1

4Q20

4Q21

Business Wireline

$6.3

$5.9

$2.2

$1.0

32.5%

4Q20

$7.4

35.0%

37.5%

4Q21

Consumer Wireline

$3.1

$3.2

$1.0

31.3%

4Q21

Strong revenue, EBITDA and subscriber gains

Revenues up 5.1%; service revenues up ~$650M, or 4.6%

884,000 postpaid phone net adds; 24,000 prepaid phone net adds

Strong EBITDA and service margins; 2021 full-year EBITDA up ~$1.0B, or 3.2%

Margins remain stable with continued portfolio rationalization

Revenue comparable further impacted by proactive portfolio rationalization

Emphasizing core network and transport connectivity

Broadband drives revenue growth

Broadband revenues grew 5.4% due to higher ARPU from fiber growth

271,000 fiber net additions

January 26, 2022 / © 2022 AT&T Intellectual Property - AT&T Proprietary

+ See notes slide 13

AT&TView entire presentation