Xometry Results Presentation Deck

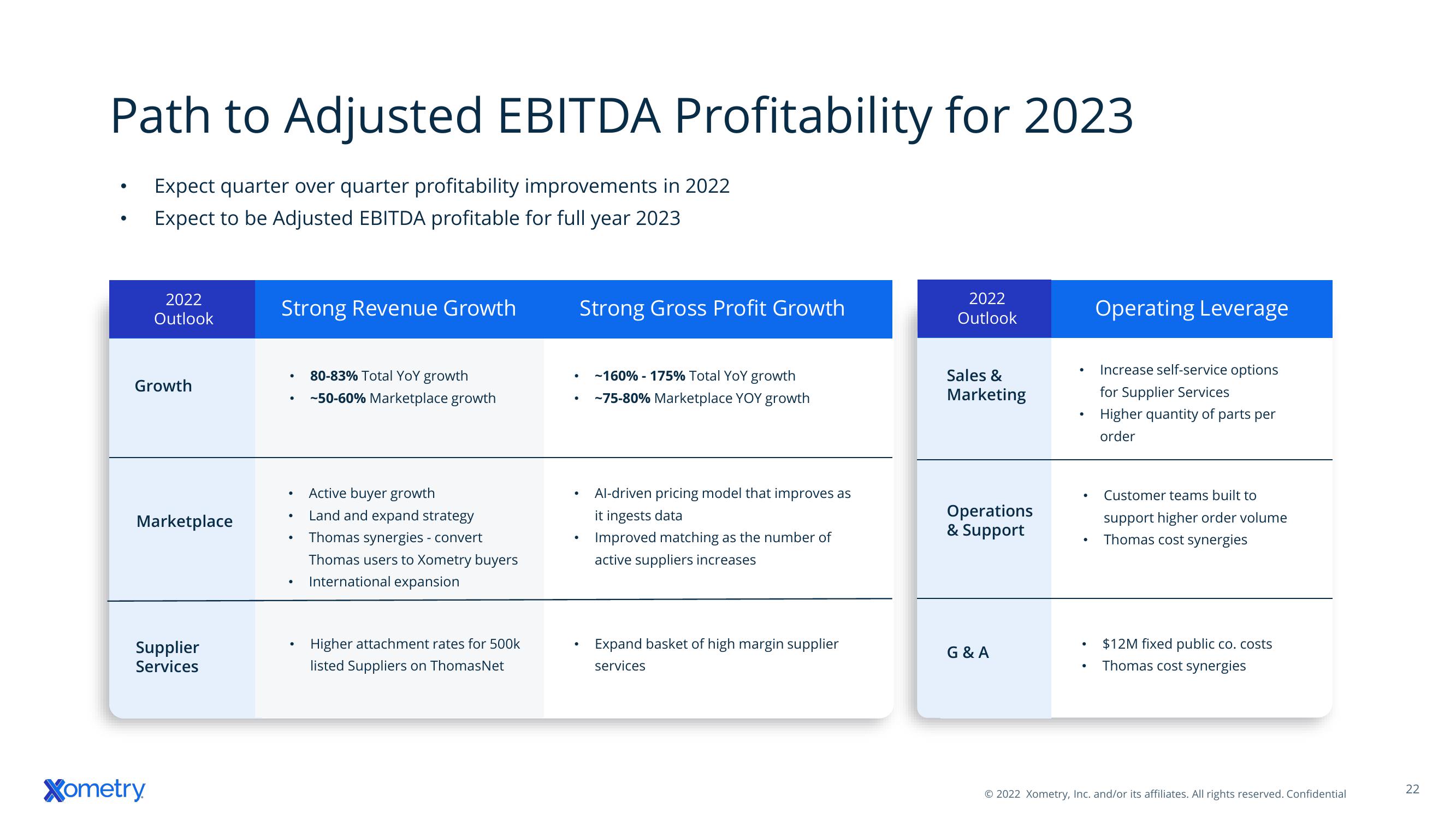

Path to Adjusted EBITDA Profitability for 2023

Expect quarter over quarter profitability improvements in 2022

Expect to be Adjusted EBITDA profitable for full year 2023

●

2022

Outlook

Growth

Marketplace

Supplier

Services

Xometry

Strong Revenue Growth

●

●

.

80-83% Total YoY growth

-50-60% Marketplace growth

Active buyer growth

Land and expand strategy

Thomas synergies - convert

Thomas users to Xometry buyers

International expansion

Higher attachment rates for 500k

listed Suppliers on ThomasNet

Strong Gross Profit Growth

●

-160% - 175% Total YoY growth

-75-80% Marketplace YOY growth

Al-driven pricing model that improves as

it ingests data

Improved matching as the number of

active suppliers increases

Expand basket of high margin supplier

services

2022

Outlook

Sales &

Marketing

Operations

& Support

G & A

●

●

●

Operating Leverage

Increase self-service options

for Supplier Services

Higher quantity of parts per

order

Customer teams built to

support higher order volume

Thomas cost synergies

$12M fixed public co. costs

Thomas cost synergies

© 2022 Xometry, Inc. and/or its affiliates. All rights reserved. Confidential

22View entire presentation