Oaktree Real Estate Opportunities Fund VII, L.P.

OAKTREE REAL ESTATE OPPORTUNITIES FUND VII, L.P.

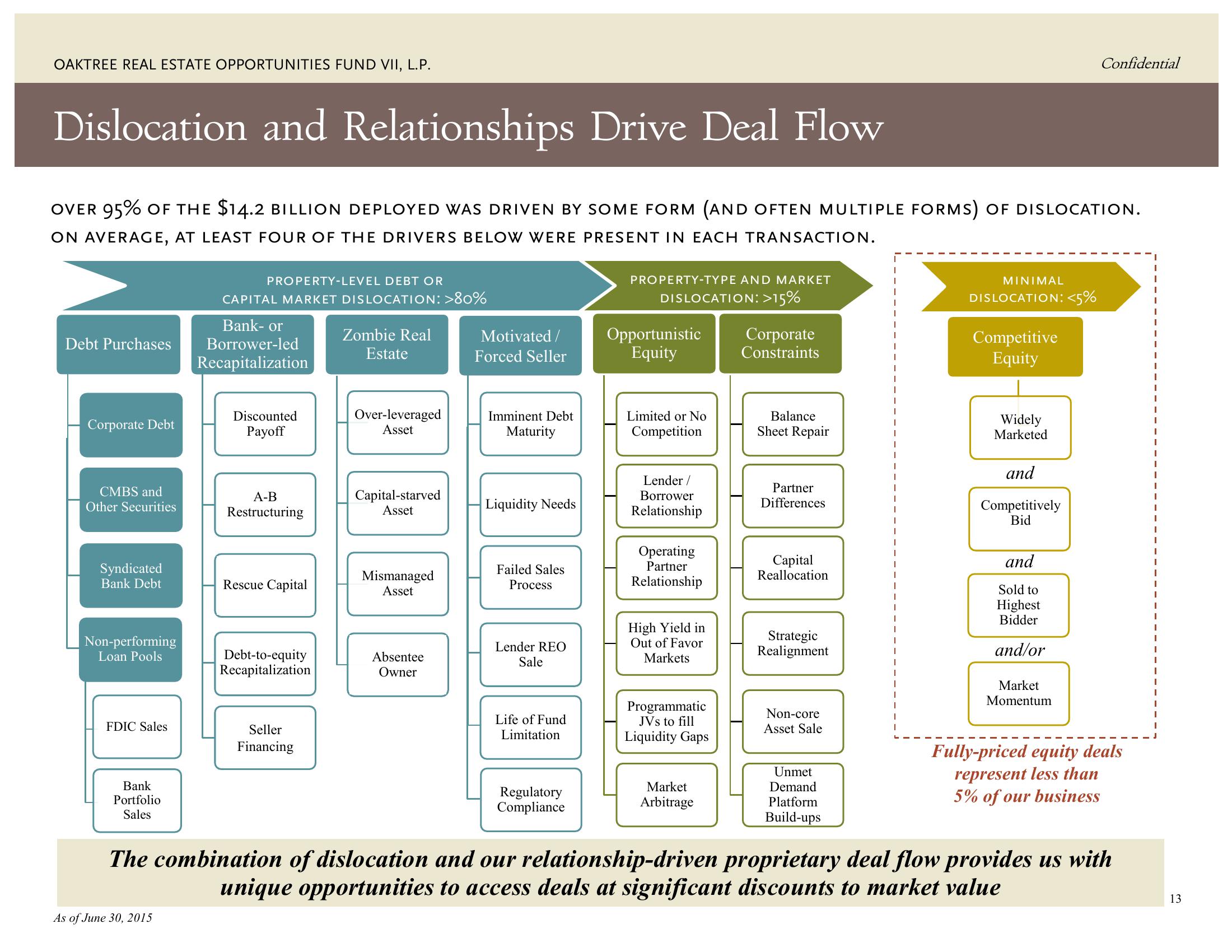

Dislocation and Relationships Drive Deal Flow

OVER 95% OF THE $14.2 BILLION DEPLOYED WAS DRIVEN BY SOME FORM (AND OFTEN MULTIPLE FORMS) OF DISLOCATION.

ON AVERAGE, AT LEAST FOUR OF THE DRIVERS BELOW WERE PRESENT IN EACH TRANSACTION.

Debt Purchases

Corporate Debt

CMBS and

Other Securities

Syndicated

Bank Debt

Non-performing

Loan Pools

FDIC Sales

Bank

Portfolio

Sales

PROPERTY-LEVEL DEBT OR

CAPITAL MARKET DISLOCATION: >80%

As of June 30, 2015

Bank- or

Borrower-led

Recapitalization

Discounted

Payoff

A-B

Restructuring

Rescue Capital

Debt-to-equity

Recapitalization

Seller

Financing

Zombie Real

Estate

Over-leveraged

Asset

Capital-starved

Asset

Mismanaged

Asset

Absentee

Owner

Motivated /

Forced Seller

Imminent Debt

Maturity

Liquidity Needs

Failed Sales

Process

Lender REO

Sale

Life of Fund

Limitation

Regulatory

Compliance

PROPERTY-TYPE AND MARKET

DISLOCATION: >15%

Opportunistic

Equity

Limited or No

Competition

Lender /

Borrower

Relationship

Operating

Partner

Relationship

High Yield in

Out of Favor

Markets

Programmatic

JVs to fill

Liquidity Gaps

Market

Arbitrage

Corporate

Constraints

Balance

Sheet Repair

Partner

Differences

Capital

Reallocation

Strategic

Realignment

Non-core

Asset Sale

Unmet

Demand

Platform

Build-ups

MINIMAL

DISLOCATION: <5%

Competitive

Equity

Widely

Marketed

and

Competitively

Bid

and

Sold to

Highest

Bidder

and/or

Confidential

Market

Momentum

Fully-priced equity deals

represent less than

5% of our business

The combination of dislocation and our relationship-driven proprietary deal flow provides us with

unique opportunities to access deals at significant discounts to market value

I

13View entire presentation